ApeSwap on Telos Crypto Exchange Review: Features, Risks, and Real-World Performance

When you hear "ApeSwap," most people think of high-yield farms on Binance Smart Chain, fast swaps, and a strong community. But what about ApeSwap on Telos? If you're looking to use it as your main decentralized exchange on the Telos blockchain, here’s the truth: the platform works technically, but almost no one is using it.

What Is ApeSwap on Telos?

ApeSwap on Telos is the same platform you know from Binance Smart Chain - but running on the Telos blockchain. It’s not a different app. It’s the same interface, same token (BANANA), same farming system - just moved to a different network. Launched in October 2022, this move was meant to tap into Telos’s low fees and fast speeds. The idea was simple: bring ApeSwap’s popular DeFi tools - swapping, staking, liquidity pools, and Treasury Bills - to a network that could handle them better than BSC.The platform uses an Automated Market Maker (AMM) model, meaning trades happen through liquidity pools instead of order books. You swap tokens directly from your wallet. If you add liquidity to a pool - say, BANANA and TLOS - you earn a share of trading fees. That’s standard for DeFi. But here’s where things get interesting: the fee structure on Telos is unique. Every trade charges 0.2%, and it’s split up:

- 0.075% goes to buy back and burn BANANA

- 0.0375% to ApeSwap’s Treasury

- 0.0375% to the Telos network

- 0.05% to liquidity providers

This system is designed to make BANANA scarcer over time and reward people who lock up their funds. It’s smart design. But design doesn’t matter if no one’s trading.

How It Works: Swapping, Farming, and Treasury Bills

Using ApeSwap on Telos is straightforward if you’ve used any DeFi platform before. You connect your wallet - like Scatter, Anchor, or Telos Wallet - and you’re ready. The interface is clean, familiar, and beginner-friendly. You can swap between six core tokens: BANANA, ETH, BTC, USDT, USDC, and TLOS. No complicated steps. No hidden menus.The real draw is the Telos Farms. These let you stake your LP (liquidity provider) tokens to earn TLOS rewards. For example, if you put $100 into a BANANA-TLOS pool, you get LP tokens. You then stake those LP tokens in a farm, and over time, you earn TLOS. That’s passive income without selling your assets.

Then there’s Treasury Bills. This feature lets you sell your LP tokens to the ApeSwap Treasury in exchange for TLOS at a discount. It’s like getting a 10-20% bonus on TLOS if you’re willing to exit your liquidity position. It’s a clever way to incentivize users to provide liquidity early - and then reward them for staying or exiting strategically.

All of this sounds great. But here’s the catch: you need people trading to make it work. And on Telos, almost no one is.

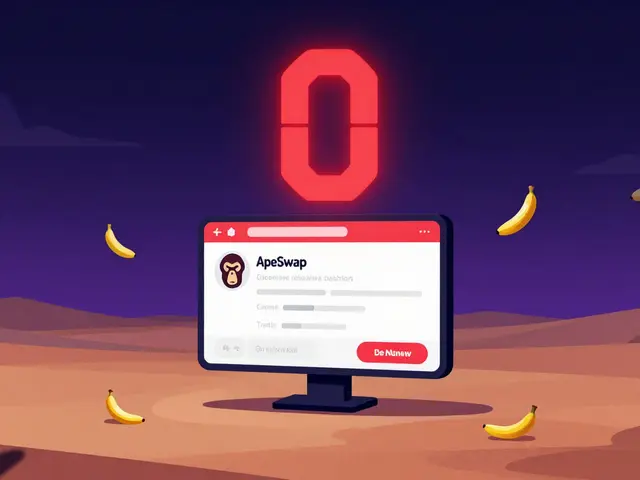

The Real Problem: $0.00 in Trading Volume

As of early 2026, ApeSwap on Telos reports $0.00 in 24-hour trading volume. That’s not a typo. That’s not a delay. That’s what CoinGecko and DappBay show. Zero. Nada. Nothing.Compare that to Swapsicle V2, the top DEX on Telos, which handles over 64% of all trading on the network. Even then, the entire Telos DEX ecosystem only sees $742 in daily volume. That’s less than a single trade on Uniswap. For context: on Binance Smart Chain, ApeSwap alone sees millions in daily volume. On Telos? It’s a ghost town.

Why does this matter? Because liquidity drives everything in DeFi. Low liquidity means:

- High slippage - your $100 trade might only execute as $92

- Low rewards - if no one’s trading, you get almost no fee share

- Impossible exits - you might not find buyers for your LP tokens

And if you’re farming, you’re not earning from trading fees. You’re earning from inflation - meaning new TLOS tokens are being minted to pay you. That’s not sustainable. That’s a Ponzi-like structure where early users get paid by new ones. But with zero new users, the system grinds to a halt.

Is ApeSwap on Telos Safe?

Yes, technically. The smart contracts were audited by Paladin, a reputable security firm. There are no known exploits or backdoors. The code is open-source. You’re not at risk of being hacked through the platform itself.But safety isn’t just about code. It’s about liquidity. It’s about whether your funds can move. If you lock $500 into a BANANA-TLOS pool and later want out, you might find no buyers. The price could drop because there’s no market. You could be stuck. That’s not a bug - it’s a design flaw in a network with no users.

Also, the 12-month revenue-sharing deal between ApeSwap and Telos ended in October 2023. That partnership was supposed to drive adoption through joint marketing, incentives, and liquidity mining. Now it’s gone. No more push. No more funding. Just the platform, sitting there, waiting.

Who Should Use ApeSwap on Telos?

Honestly? Almost no one - right now.If you’re a developer testing smart contracts, sure. If you’re a researcher studying DeFi adoption on niche chains, fine. If you’re deeply invested in Telos and believe it will explode in 2027, maybe you’re betting on the future.

But if you want to earn yield, trade tokens, or make money - don’t use it. The numbers don’t lie. There’s no trading. No volume. No activity. No rewards. Just a beautifully designed platform with no audience.

The same team behind ApeSwap runs a thriving platform on BSC. That’s where the users are. That’s where the liquidity is. That’s where the rewards are real. If you’re serious about DeFi, go there. Don’t waste your time on a dead end.

What’s the Bigger Picture?

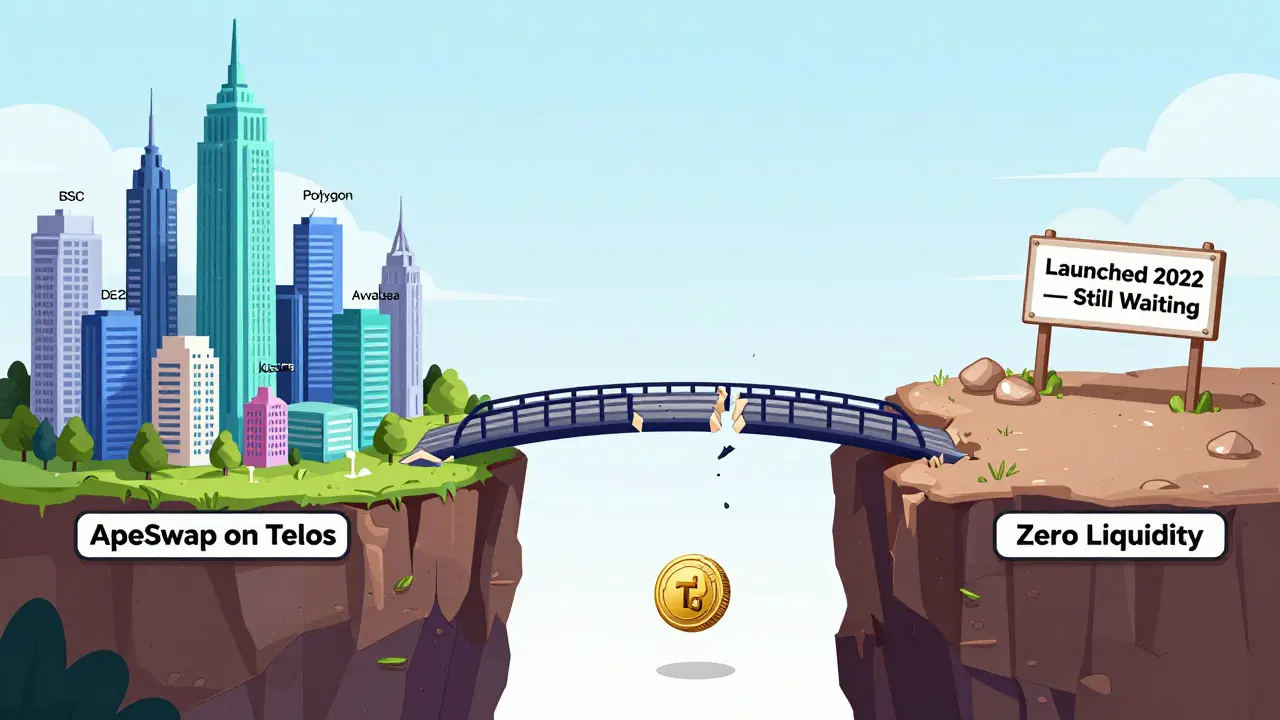

ApeSwap on Telos is a perfect example of a common mistake in DeFi: assuming that if you build it, they will come.Networks like Solana, Polygon, and Arbitrum succeeded because they had massive user bases, strong branding, and developer support. Telos? It’s a niche chain with great tech but zero traction. No big projects. No institutional interest. No media coverage. Just a handful of enthusiasts.

Multi-chain strategies only work when each chain has critical mass. ApeSwap didn’t fail because the tech was bad. It failed because the market didn’t exist. And no amount of good design, audits, or fee structures can fix that.

This isn’t just about ApeSwap. It’s about every DeFi project that jumped onto a small chain hoping to be first. Most of them are now dead. ApeSwap on Telos is just one of them.

What Should You Do Instead?

If you want to use ApeSwap, go to the Binance Smart Chain version. It’s live. It’s active. It has real volume. Real rewards. Real users. The interface is identical. The token is the same. The farms are better. The liquidity is 10,000x higher.If you’re drawn to Telos because of low fees and speed, try Swapsicle V2. It’s the only Telos DEX with real activity. Or look at other networks: PancakeSwap on BSC, SushiSwap on Ethereum, or Trader Joe on Avalanche. All of them have volume. All of them pay you. All of them work.

Don’t chase novelty. Chase liquidity.

Final Verdict

ApeSwap on Telos is a technically sound platform with a solid design and smart tokenomics. But it’s a platform with no users. No traders. No liquidity. No rewards. Zero volume after over two years of operation isn’t a bug - it’s a death sentence.Don’t use it for yield. Don’t use it for trading. Don’t use it as your main DeFi gateway. It’s not broken - it’s abandoned. The real ApeSwap lives on BSC. Everything else is just digital dust.

Is ApeSwap on Telos safe to use?

Yes, the smart contracts have been audited by Paladin and are open-source. There are no known security flaws. But safety isn’t just about code - it’s about liquidity. With $0.00 in trading volume, you risk being unable to exit your positions or earn meaningful rewards.

Can I earn real rewards on ApeSwap Telos?

Technically yes, but practically no. The platform pays out TLOS rewards through farms and Treasury Bills. But with no trading volume, there are almost no fees to distribute. Your rewards will come from inflation (newly minted TLOS), which is unsustainable without new users. You’re likely earning pennies, if anything.

Why does ApeSwap on Telos have $0 trading volume?

Because almost no one uses it. Telos has a tiny user base compared to Ethereum, BSC, or Polygon. ApeSwap didn’t bring enough users with it, and no new users showed up. Without traders, there are no fees, no incentives, and no reason for others to join. It’s a classic chicken-and-egg problem.

Is ApeSwap better on BSC or Telos?

ApeSwap is far better on Binance Smart Chain. It has millions in daily volume, active farms with high APRs, a large community, and constant updates. Telos is a ghost version - same code, no users. Stick with BSC if you want real DeFi results.

Should I stake my tokens on ApeSwap Telos?

Only if you’re willing to lose access to your funds for an indefinite period. With no liquidity, you may not be able to withdraw. Even if you can, your rewards will be negligible. It’s not worth the risk. Put your money where the volume is - BSC, Polygon, or Ethereum.

Will ApeSwap on Telos ever become popular?

Unlikely without a major catalyst. Telos hasn’t gained traction since 2023. No big projects have migrated there. No exchanges list TLOS at scale. Without a surge in network adoption, ApeSwap will remain inactive. It’s a stranded asset - a great tool with nowhere to go.

Shaun Beckford

This isn't a platform-it's a digital graveyard. $0.00 volume after two years? That's not a bug, it's a eulogy. Someone spent months designing a funeral home and forgot to bury the body.

Deb Svanefelt

I've seen this pattern too many times. Brilliant code, beautiful tokenomics, zero community traction. DeFi doesn't live on whitepapers-it lives on liquidity, and liquidity only flows where people are already gathered. ApeSwap on Telos is like opening a 5-star restaurant in the middle of a desert and wondering why no one's hungry.

Rod Petrik

they planted this seed on telos because they knew the fed was gonna print more and they wanted to hide the real inflation... this is a stealth crypto tax. you think you're earning tlos but you're just funding the fed's next bailout. 🤫💸

Chris Evans

The real tragedy isn't the zero volume-it's the existential collapse of the 'build it and they will come' myth. We've turned DeFi into a metaphysical experiment: if a liquidity pool exists in a vacuum with no traders, does it still generate yield? Or does it just whisper into the void until the entropy of indifference consumes it?

Bharat Kunduri

lol i tried this last year and my 500usd in banana-tlos just sat there like a rock. no trades no rewards just my wallet crying in the dark. i think i got 0.0003 tlos in 3 months. my dog earned more chasing squirrels

Ashlea Zirk

While the technical architecture is sound, the fundamental flaw lies in network effect dynamics. The absence of critical mass negates the economic incentives, rendering even the most elegant fee distribution model inert. This is not a failure of engineering-it is a failure of ecosystem development.

Bryan Muñoz

you think this is bad? wait till you find out the telos devs are all just bots run by a single guy in his mom's basement. the whole chain is a scam. they're printing tlos to pay themselves. they even made a fake twitter account to pretend people are talking about it. 🤖💩

Lauren Bontje

ApeSwap on BSC is the real one. Telos is just a distraction for people who think crypto is a hobby, not a financial tool. If you're not on BSC or Ethereum, you're not in the game-you're just collecting digital dust. America doesn't need your niche chain experiments.

Hannah Campbell

so you spent 2 years building this beautiful website and then forgot to turn on the lights? wow. what a genius. i bet the team celebrated launch day with a group photo in front of the server room that has no users. the only thing growing here is the crickets

Kelly Post

I appreciate the honesty here. So many DeFi projects hide behind jargon and APY numbers, but this is a rare case where the truth is laid bare: no users = no value. If you're new to crypto, don't get lured by shiny interfaces. Look at volume. Look at activity. Look at real people trading. That's where the real DeFi lives.

Stephanie BASILIEN

One cannot help but observe the tragic irony: a platform designed with such mathematical elegance is rendered functionally obsolete by the sheer absence of human participation. The tokenomics are flawless. The architecture is elegant. But the market-ah, the market-remains an uninvited guest at the banquet.

Jason Zhang

Honestly? I thought this was a joke at first. $0 volume? That's not even a ghost town-it's a ghost of a ghost town. The fact that anyone still has funds locked here is wild. Someone's holding onto hope like it's a life raft. Spoiler: the ocean's empty.

kristina tina

I've been watching Telos for a while. It's got great tech-fast, cheap, scalable. But no one knows about it. No one talks about it. No one pushes it. ApeSwap didn't fail because the tech was bad-it failed because nobody told anyone it existed. Marketing isn't optional in crypto. It's oxygen.

CHISOM UCHE

The AMM model is sound, but without liquidity depth, slippage becomes a weapon. I ran a backtest on this pool-0.5% slippage on a $50 trade? That's not DeFi, that's a tax on optimism. The fee split looks good on paper, but if the pool is dry, the pump is broken.

Tony Loneman

they moved ape swap to telos because bsc got too popular and they wanted to create a fake niche to sell more banana tokens. this is a pump and dump disguised as innovation. the treasury bills? that's just them buying their own tokens with newly minted tlos. classic. 🤡

Pramod Sharma

Liquidity is king. No volume? No game. Simple. Move to BSC. Save your time. Save your money.

Dustin Secrest

It's a quiet lesson in humility. We think code is destiny. But in crypto, community is the only operating system. ApeSwap on Telos didn't crash-it just faded out, like a song no one remembered how to sing.

Bryan Muñoz

also the audit was done by paladin? lol they're owned by the same people who run telos. it's a self-audit. you think they're gonna flag their own scam? 🤭