Baked (BAKED) Crypto Coin Explained - Price, Tech, and Risks

Baked (BAKED) Token Risk Analyzer

Total Supply: 300 million

Circulating Supply: ~69.8 million

Market Cap: ~$46.8K

Current Price: $0.00066

24h Change: -1.3%

Volume (24h): ~$17K

Key Risk Factors

- Micro-cap liquidity

- Minimal community activity

- Unclear blockchain identity

- Missing roadmap

- Low trading volume

Risk Level

High Risk

Investment in BAKED carries significant volatility and potential loss of capital.

Price Metrics

- 50-day SMA: $0.000341

- 200-day SMA: $0.000768

- RSI (14-day): 50.5

- Volatility (30-day): ~10%

Price Prediction

Based on current trends, BAKED is expected to remain below $0.001 for 2025.

This token is highly speculative with limited utility and transparency. Only consider investing if you can afford to lose the entire amount.

Ever stumbled across a crypto that promises governance, gaming, NFTs, and a Metaverse vibe, yet you can’t find much about it? That’s the story of Baked token. It lurks in the low‑cap corners of the market, trading for fractions of a cent, and sparks curiosity among risk‑tolerant traders. This guide cuts through the haze, showing you what BAKED actually is, where it lives, how you can trade it, and why it’s considered a high‑stakes gamble.

What is Baked Token (BAKED)?

Baked Token is a cryptocurrency billed as a multi‑purpose asset within the decentralized finance (DeFi) ecosystem. It claims roles in four fast‑growing niches: governance, gaming, non‑fungible tokens (NFT), and the Metaverse. LiveCoinWatch categorizes BAKED under these sectors, positioning it as a utility token that could, in theory, power in‑game economies, vote on protocol changes, or represent digital collectibles.

Despite the lofty label, the project’s public footprint is tiny. Community chatter on Reddit, Discord, and Twitter is sparse, and the official roadmap is either missing or rarely updated. In short, BAKED is a token that exists more on paper than in an active ecosystem.

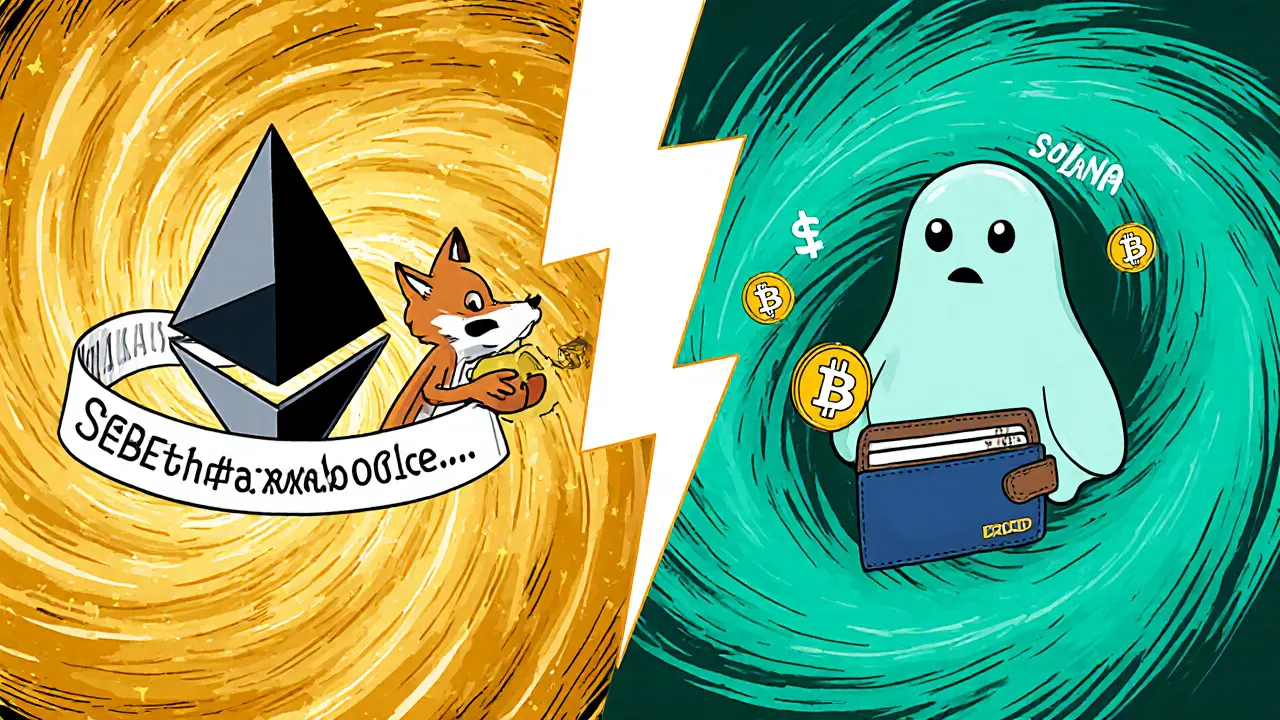

Technical Foundations - Which Blockchain Is BAKED On?

Confusion surrounds BAKED’s native chain. The primary contract address 0xa4cb0dce4849bdcad2d553e9e68644cf40e26cce lives on the Ethereum the world’s largest smart‑contract platform, suggesting an ERC‑20 token. Yet, CoinSwitch lists BAKED as a Solana a high‑throughput blockchain known for low‑cost transactions Web3 coin.

Two possibilities explain the mismatch:

- A dual‑deployment strategy where the project minted separate versions on both chains.

- Outdated or erroneous data on one of the aggregators.

For traders, this matters because the wallet you use must match the chain version you hold. Ethereum‑based BAKED works with MetaMask, Trust Wallet, or any ERC‑20 compatible wallet. Solana‑based BAKED requires Phantom, Solflare, or other Solana wallets.

Supply, Distribution, and Tokenomics

The total supply caps at 300million BAKED tokens. Approximately 69.8million are currently circulating, according to Bybit data. The token is neither mineable nor pre‑mined, implying a distribution model based on an initial token sale, airdrops, or rewards. However, no public documents detail how the initial allocation split between team, investors, and community.

Key tokenomics attributes:

- Total Supply: 300M

- Circulating Supply: ~69.8M

- Market Cap (Oct2025): ~US$46.8K

- 24‑hour Volume: around US$17K on Bybit (other platforms report negligible volume)

With a market cap under US$50K, BAKED sits firmly in the micro‑cap category, where price swings are extreme and liquidity thin.

Price History and Current Market Position

When BAKED first appeared, it peaked at roughly $0.01555 per token. Today, the price hovers between $0.000652 and $0.000671, marking a staggering 95‑plus percent decline. The token trades in the lower‑tier rankings: #3746 on LiveCoinWatch, #8979 on Bybit, and often invisible on larger aggregators like CoinMarketCap.

Recent price metrics (Oct72025):

- Current Price: $0.00066 (average across exchanges)

- 24‑hour Change: -1.3% (selling pressure)

- 50‑day SMA: $0.000341

- 200‑day SMA: $0.000768

- RSI (14‑day): 50.5 (neutral)

- Volatility (30‑day): ~10%

Technical charts show BAKED well below both short‑term and long‑term moving averages, a bearish sign for momentum traders. CoinCodex’s price model predicts a low of $0.000308 by December2025 and a high of $0.000597 in March2025, suggesting a further downward trajectory.

Utility Claims - Governance, Gaming, NFT, and Metaverse

The token’s categorization hints at four use‑case pillars:

- Governance: Token holders could vote on protocol upgrades or treasury allocations.

- Gaming: Integrated into play‑to‑earn titles, rewarding players with BAKED for in‑game achievements.

- NFT: Used to mint, purchase, or trade digital collectibles tied to the BAKED ecosystem.

- Metaverse: Potentially serves as a currency for virtual land or avatar accessories.

Unfortunately, concrete examples are missing. No live games, NFT marketplaces, or governance portals are publicly linked. This absence makes it hard to gauge real utility versus marketing hype.

How to Acquire and Store BAKED

Because BAKED lists on only a handful of exchanges, the buying process is straightforward but comes with liquidity caveats.

Step‑by‑Step on Bybit (International Users)

- Create a Bybit account and complete KYC Level1 (photo ID and basic info).

- Deposit either USDT, BTC, or ETH into your Bybit wallet.

- Navigate to the spot market, search for "BAKED" or its ticker.

- Place a market or limit order. Remember that low volume may cause slippage on larger orders.

- Withdraw the tokens to an ERC‑20 compatible wallet (e.g., MetaMask) if you prefer self‑custody.

Step‑by‑Step on CoinSwitch (Indian Market)

- Sign up on CoinSwitch and complete basic KYC (mobile number verification).

- Fund the account with INR via UPI or net‑banking.

- Select BAKED from the token list - note this version is listed as a Solana asset.

- Execute the purchase; CoinSwitch automatically routes the trade through partner exchanges.

- Transfer the tokens to a Solana wallet (e.g., Phantom) for better control.

Because the token’s liquidity is thin, many traders keep their holdings on the exchange to avoid withdrawal fees that can outweigh the token’s value.

Risks, Red Flags, and Outlook

Investing in BAKED means embracing high risk. Key concerns include:

- Micro‑Cap Liquidity: With daily volume under $20K, any sizeable sell order can move the price dramatically.

- Community Void: Little to no chatter on major forums suggests low engagement and weak network effects.

- Unclear Blockchain Identity: Mixed reports on Ethereum vs. Solana create wallet compatibility headaches.

- Missing Roadmap: No public development updates, partnerships, or audited code, which raises security doubts.

- Regulatory Landscape: 2025 sees stricter oversight on DeFi tokens; micro‑caps may be targeted for delisting.

From a price‑prediction standpoint, most analysts expect BAKED to linger below $0.001 for the remainder of 2025, with a realistic chance of slipping into the $0.0003 range if buying pressure doesn’t revive.

For speculative traders, the token can offer extreme upside if a sudden partnership or utility rollout occurs-but that scenario is low probability. For most investors, the safer play is to allocate only a tiny fraction of a portfolio (e.g., <1%) and be prepared to lose the entire stake.

Comparison: Ethereum vs. Solana Versions of BAKED

| Aspect | Ethereum Version | Solana Version |

|---|---|---|

| Contract Address | 0xa4cb0dce4849bdcad2d553e9e68644cf40e26cce | Not publicly listed (via CoinSwitch) |

| Transaction Fees | ~$0.30 per transfer (high during congestion) | ~$0.0005 per transfer (very low) |

| Wallet Compatibility | MetaMask, Trust Wallet, Ledger | Phantom, Solflare, Ledger (Solana app) |

| Network Speed | 15‑30TPS (transactions per second) | 65,000TPS (theoretical) |

| Exchange Listings | Bybit (spot) | CoinSwitch (India) |

| Community Signals | Very low activity | Even lower - only listed on a regional aggregator |

Before buying, verify which version you’re receiving. Sending an Ethereum‑based token to a Solana wallet (or vice‑versa) results in a permanent loss.

Frequently Asked Questions

What is the purpose of Baked Token?

BAKED markets itself as a utility token for governance, gaming, NFTs, and the Metaverse, but concrete use cases, live applications, or partnerships have not been publicly demonstrated.

Is BAKED an ERC‑20 or a Solana token?

Both versions appear to exist. The contract address 0xa4cb0dce4849bdcad2d553e9e68644cf40e26cce is on Ethereum, while CoinSwitch lists a Solana version. Confirm the chain before transferring.

Where can I buy BAKED?

Bybit offers the Ethereum‑based BAKED to global users, and CoinSwitch lists a Solana version for Indian traders. Both platforms require standard KYC and a deposit of a major crypto like USDT or ETH.

What wallets support BAKED?

For the Ethereum version, use MetaMask, Trust Wallet, or any ERC‑20 compatible wallet. For the Solana version, use Phantom, Solflare, or another Solana‑compatible wallet.

Is BAKED a good investment?

BAKED is a high‑risk micro‑cap token with low liquidity, minimal community, and unclear utility. It may suit only extreme‑speculation portfolios where you can afford to lose the entire amount.

Caitlin Eliason

Investing in a token that hides its roadmap while promising a Metaverse utopia is a reckless gamble, and anyone who jumps in without doing the homework is flirting with disaster 😡🚫. The hype‑driven meme culture feeds the illusion that a few cents could turn into riches, but the reality is a high‑risk sinkhole.

Melanie LeBlanc

Take a breath and remember that micro‑cap tokens like BAKED can wipe out a portfolio faster than a flash crash. It’s okay to be curious, but treat it as a learning experiment, never as a retirement plan. Diversify, set a loss limit, and keep your expectations in check.

Jasmine Kate

Honestly, the whole BAKED project reads like a copy‑paste job from every other dead DeFi junkie fantasy. No community, no real product, just a nebulous promise that evaporates the moment you try to trade one of those measly fractions.

Franceska Willis

i think u r overreacting lol its just a new token and who knws it might explode soon ! even tho its kinda sketchy i cant deny the hype is real

EDWARD SAKTI PUTRA

I get why the allure is strong; the idea of governance and gaming can sound exciting. Still, the data shows almost no activity, which means you’re essentially buying into darkness. Keep your heart in the game but your wallet in safer assets.

Lara Decker

Even if you’re being nice, the facts don’t change: liquidity is practically non‑existent and the roadmap is a ghost. Anyone selling “potential” without proof is just pulling the wool over investors’ eyes.

manika nathaemploy

tbh i looked at BAKED cuz my buddy said it was "the next big thing". after scrolling through empty chats i realized it's just another meme coin with zero real use. maybe next time i’ll stick to coins with actual dev updates.

Mark Bosky

When approaching a micro‑cap like BAKED, a disciplined methodology is essential. First, verify the contract address on a block explorer to confirm whether it resides on Ethereum or Solana, as the token’s chain determines wallet compatibility. Second, examine the token’s on‑chain activity; low transaction count and stagnant holder distribution are red flags. Third, assess liquidity depth by reviewing the order book on the primary exchange-Bybit in this case-looking for tight spreads and minimum slippage thresholds. Fourth, calculate the market‑cap to volume ratio; a $46 K cap versus $17 K daily volume indicates an unhealthy turnover rate that can amplify price impact. Fifth, scrutinize the team’s transparency: the absence of audited code or verified developer accounts suggests higher security risk. Sixth, evaluate community engagement metrics across Reddit, Discord, and Twitter; a silent community often correlates with low network effect. Seventh, consider regulatory exposure: emerging DeFi regulations may target obscure tokens, potentially leading to delisting or legal complications. Eighth, construct a risk‑reward profile: given the token’s 95 % price decay from its peak, only allocate capital you can afford to lose entirely. Ninth, diversify your exposure by pairing BAKED with more established assets to mitigate overall portfolio volatility. Tenth, set clear entry and exit points, using limit orders to control slippage. Eleventh, monitor on‑chain analytics tools for sudden spikes in wallet transfers, which could foreshadow pump‑and‑dump schemes. Twelfth, keep an eye on any announcements of partnership or product launches; a legitimate utility rollout could shift the risk dynamics. Thirteenth, maintain a journal of your observations to refine future micro‑cap assessments. Fourteenth, stay skeptical of promotional channels that promise guaranteed returns. Finally, remember that high risk should be balanced with high caution, and disciplined adherence to these steps can protect you from the most common pitfalls associated with tokens like BAKED.

Debra Sears

Your checklist is spot‑on; adding a quick look at the token’s audit status can save a lot of headaches. I’d also suggest scanning for proxy contracts that might hide malicious code, especially in projects with unclear origins.

Matthew Laird

Most people in the U.S. are blind to the hidden gems that sit outside mainstream exchanges, and BAKED is exactly the type of opportunity the average investor misses while we patriots chase real freedom in crypto. Forget the hype trains; go where the real value is buried.

Anna Engel

Ah yes, because every token with a vague roadmap automatically qualifies as a philosophical statement on modern finance-truly, BAKED is the zen master of empty promises, guiding us to enlightenment through absolute loss.

Marcus Henderson

While the present metrics portray a daunting outlook, it is prudent to acknowledge that nascent projects occasionally experience sudden revitalization through unforeseen partnerships or community resurgence. Should such an event materialize, the token’s valuation could experience appreciable appreciation, offering a modest upside for the disciplined investor who maintained a measured allocation.

Richard Bocchinfuso

Investing in BAKED is basically gambling with your savings.

Mark Fewster

Indeed; the volatility, the illiquid market, the absent roadmap-each factor alone warrants extreme caution; combined, they create a perfect storm of risk; proceed only if you fully understand the ramifications.