Bibox Crypto Exchange Review: Features, Fees, and Trust Risks in 2026

When you're looking for a crypto exchange that offers hundreds of coins, high leverage, and low fees, Bibox sounds like a strong contender. But beneath the surface of its flashy interface and AI claims lies a platform with serious trust problems that could cost you more than just trading fees.

What Bibox Actually Offers

Bibox launched in 2017 and markets itself as an AI-powered cryptocurrency exchange. It supports over 500 digital assets, including spot trading, futures contracts with up to 1:150 leverage, margin trading, options, and even NFTs. For beginners, the signup process is simple: just an email, a password, and email verification. No phone number, no ID-just a few minutes to get started.

But here’s the catch: while you can deposit crypto instantly, Bibox doesn’t accept fiat currency deposits. That means no bank transfers, no credit cards, no PayPal. If you want to buy Bitcoin with USD or EUR, you’ll need to get it from another exchange first. This alone rules out most casual traders who aren’t already deep into crypto.

The platform uses a tiered fee system based entirely on your BIX token holdings. Spot trading fees start at 0.1% and drop as low as 0.01% if you hold enough BIX. Futures trading fees are lower, ranging from 0.04% to 0.06%. Compare that to Binance or Kraken, where fees are often lower even without token discounts, and you start to see the trade-off: you’re not just paying for trades-you’re paying to own a token that gives you a discount.

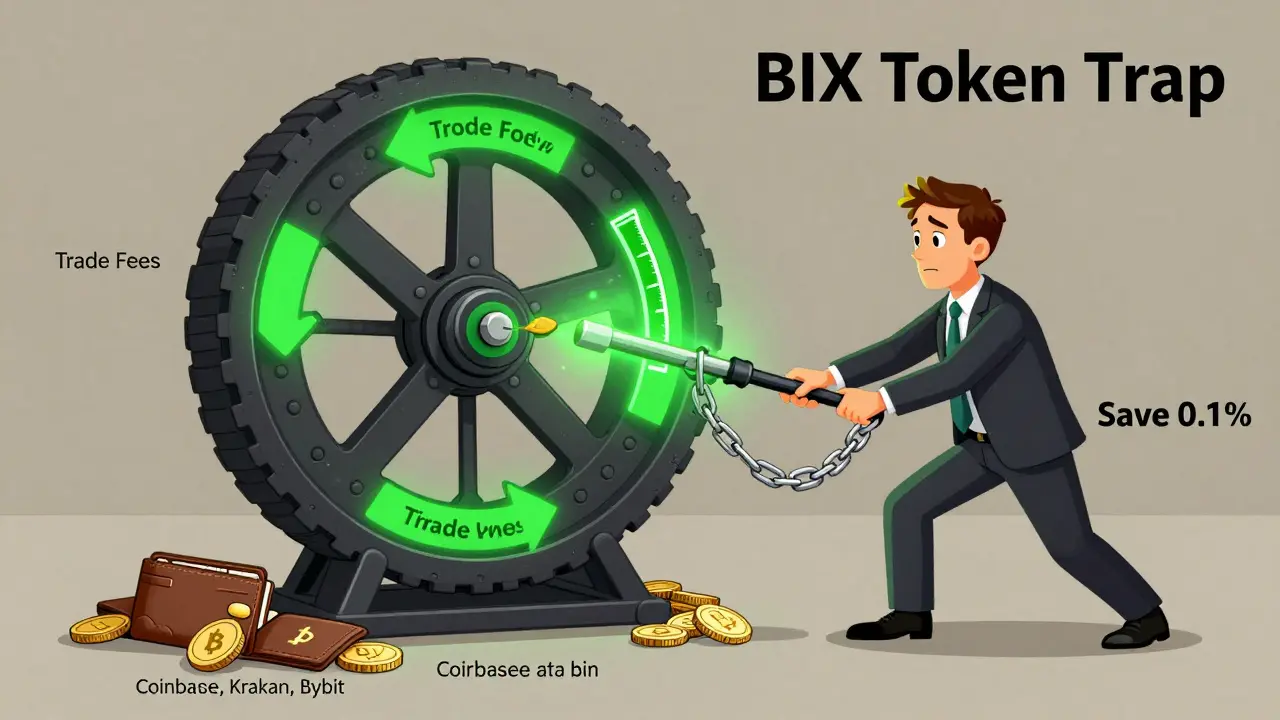

The BIX Token Trap

BIX is Bibox’s native token, and it’s central to everything. Want lower fees? Buy BIX. Want to stake? You need BIX. Want to vote on new listings? You need BIX. It’s a closed loop designed to keep you locked in.

But here’s the problem: BIX has no real utility outside Bibox. It’s not listed on major exchanges like Coinbase or KuCoin. Its market cap is tiny compared to ETH or SOL. And if Bibox ever shuts down or gets hacked, BIX becomes worthless. Holding BIX isn’t an investment-it’s a gamble on Bibox surviving.

Traders who rely on fee discounts end up buying BIX just to save a fraction of a percent on trades. For someone making $10,000 in trades a month, that might save $10. But if the price of BIX drops 30%? You’ve lost $300 on your "savings."

Trust Issues You Can’t Ignore

Let’s talk about trust. Because Bibox doesn’t have any.

On Trustpilot, Bibox has a 1.1 out of 5 stars rating from over 170 reviews. That’s not a glitch. That’s a pattern. The top complaints? Withdrawal delays, frozen accounts, and customer support that doesn’t respond.

Reddit threads and crypto forums are full of users who deposited funds, made trades, and then couldn’t withdraw for weeks. Some reported waiting 18 days just to get their ETH out. When they contacted support? Silence. No phone number. No live chat. Just an email ticket that vanished into a black hole.

ScamAdviser gives Bibox a 70/100 trust score-"moderate risk." Traders Union rates it 3.37 out of 10, calling it "higher-than-average risk." These aren’t random opinions. These are professional financial reviewers who’ve analyzed thousands of platforms. And they all say the same thing: avoid Bibox.

Compare that to Coinbase, which has a 4.7 on Trustpilot, or Kraken with a 4.5. Both are regulated in the U.S. and EU. Bibox? No clear licensing anywhere. No SEC registration. No FCA approval. No MAS license. Just a website with a lot of trading pairs.

Mobile App and Features: Functional But Unreliable

The Bibox mobile app works. It’s clean. It has TradingView charts. You can place orders, check balances, and view your portfolio. For experienced traders, that’s enough to get by.

But here’s what users don’t tell you: the app mirrors the website’s problems. If withdrawals freeze on the web, they freeze on mobile too. If support ignores your email, they ignore your in-app ticket. The app doesn’t fix the core issues-it just makes them more convenient.

There’s no educational content. No webinars. No blog with market analysis. No community forum. Just a trading terminal with no guidance. If you’re new to crypto, you’re on your own.

Who Should Use Bibox?

There’s one type of trader who might still consider Bibox: someone who already holds a large amount of crypto, knows exactly what they’re doing, and is willing to accept serious risk for slightly lower fees.

If you’re trading high volumes and already have BIX tokens stashed away, the fee discounts might make sense. If you’re comfortable with the idea that your funds might get stuck for weeks, and you’ve accepted that customer support won’t help you, then Bibox technically works.

But for 99% of users? It’s not worth it.

Alternatives That Actually Work

Instead of risking your funds on Bibox, consider these alternatives:

- Binance: Lowest fees, 1000+ coins, regulated in multiple regions, 24/7 support.

- Kraken: Strong security, U.S.-based, licensed, excellent customer service.

- Coinbase: Simple for beginners, insured assets, FDIC-backed fiat on-ramps.

- Bybit: Best for futures trading, 1:100 leverage, transparent fee structure.

All of these have real customer support, regulatory oversight, and proven track records. Bibox doesn’t.

The Bottom Line

Bibox has the features. It has the coins. It has the leverage. But it doesn’t have the trust.

Every time you deposit funds into Bibox, you’re betting that they’ll still be there when you want them out. And based on hundreds of user reports, that bet is losing.

There’s no reason to use Bibox in 2026. The market has moved on. Better, safer, and more reliable exchanges exist. You don’t need to risk your crypto on a platform with a 1.1-star rating and no clear path to accountability.

If you’re looking for a crypto exchange, choose one that protects your money-not one that just takes your fees.

Is Bibox a legitimate crypto exchange?

Bibox operates as a crypto exchange, but its legitimacy is heavily disputed. It lacks regulatory licensing in major markets like the U.S. and EU. Multiple review platforms, including Traders Union and ScamAdviser, rate it as high-risk due to withdrawal delays, unresponsive support, and low user trust scores. While it functions technically, it doesn’t meet the safety standards of established exchanges.

Can I deposit fiat currency on Bibox?

No, Bibox does not accept fiat deposits. You cannot deposit USD, EUR, JPY, or any other government-issued currency directly. You must first buy crypto on another exchange that supports fiat, then transfer it to Bibox. This makes it inaccessible for most new traders.

Why are withdrawal times so slow on Bibox?

Users report withdrawal delays ranging from days to weeks, often with no explanation. This is linked to poor operational practices and likely insufficient liquidity reserves. Customer support is email-only and frequently unresponsive. Many users describe frozen withdrawals during market volatility, suggesting internal processing bottlenecks or deliberate holds.

Is the BIX token worth holding?

Holding BIX only makes sense if you’re a high-volume trader on Bibox and fully understand the risk. BIX has no value outside Bibox, isn’t listed on major exchanges, and its price is entirely dependent on Bibox’s survival. For most users, the fee discounts don’t offset the risk of holding a token that could become worthless if Bibox shuts down or gets hacked.

Does Bibox have customer support?

Bibox offers email-only support with no live chat, phone line, or ticket system. Users consistently report long response times or no replies at all. Even during critical issues like frozen withdrawals, many users received automated replies or silence. This is one of the biggest red flags for any exchange.

Is Bibox safe for long-term holdings?

No. Bibox lacks insurance, regulatory oversight, and proven security practices. With no clear licensing and a history of withdrawal issues, storing significant amounts of crypto on Bibox is extremely risky. Reputable exchanges like Kraken and Coinbase offer cold storage, insurance, and multi-sig security-features Bibox doesn’t match.

What’s the best alternative to Bibox?

For most users, Kraken or Binance are the best alternatives. Kraken offers strong regulation, fiat on-ramps, and 24/7 support. Binance has the widest coin selection, lowest fees, and global reach. If you want futures trading, Bybit is a safer, more transparent option. All of these have proven track records-unlike Bibox.

James Breithaupt

Bibox is the crypto equivalent of a shady used car lot with a shiny paint job. You got 500 coins, 1:150 leverage, and a UI that looks like it was designed by a SpaceX intern-until you try to withdraw and realize your ETH is stuck in a digital black hole. The BIX token isn’t a utility, it’s a hostage situation. Buy it to save 0.02% on fees? Cool. Lose 30% of your ‘savings’ when the token crashes? Even cooler. This isn’t DeFi, it’s a pyramid scheme with better charts.

And don’t get me started on the ‘AI-powered’ nonsense. AI doesn’t fix liquidity issues. AI doesn’t answer emails. AI definitely doesn’t make your withdrawals go through faster. It’s just marketing fluff wrapped around a shell company with a .com domain and zero regulatory backbone.

Alex Williams

Look, if you’re a degens trading 50 BTC a day and already holding 10K BIX, maybe the fee discounts make sense. But for 99% of people? This is like using a chainsaw to cut butter-overkill and dangerous. Kraken and Binance give you lower fees, real support, and actual insurance. Why risk your life savings on a platform with a 1.1 Trustpilot rating?

Also, fiat on-ramps? No. That’s not a feature gap-it’s a dealbreaker. If you can’t deposit USD, you’re not a trader, you’re a crypto tourist. And tourists don’t belong in places like Bibox. Stick to Coinbase if you’re not ready to play Russian roulette with your portfolio.