CEX vs DEX: How Geographic Restrictions Shape Your Crypto Access

If you’ve ever tried to trade crypto and got blocked by a message like "This service isn’t available in your country," you’ve hit one of the biggest real-world barriers in crypto: geographic restrictions. It’s not just about internet speed or language-it’s about where you live determining what you can buy, sell, or even hold. And the difference between centralized exchanges (CEX) and decentralized exchanges (DEX) when it comes to these blocks is night and day.

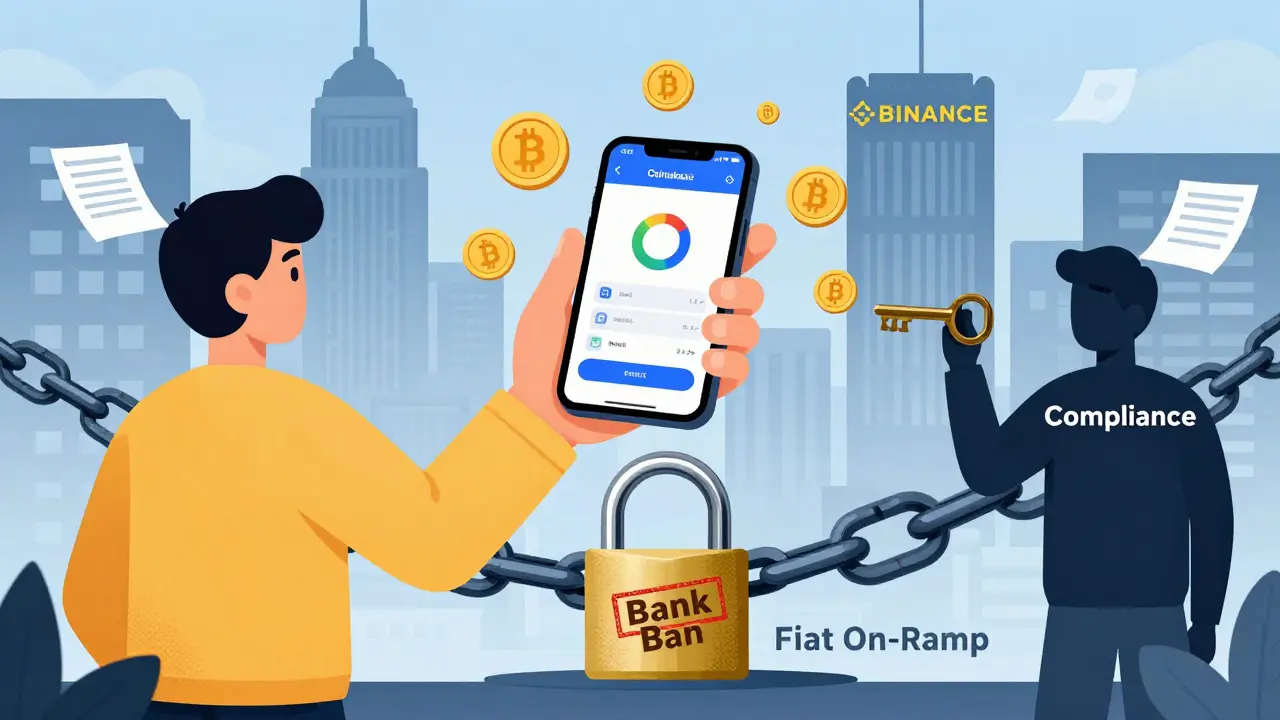

CEXs: Built to Be Restricted

Centralized exchanges like Binance, Coinbase, or Kraken don’t just operate like websites-they operate like banks. They need licenses. They need to follow local laws. And if a government says, "No derivatives trading here," or "No US citizens," they comply. No debate.That’s why you’ll find Binance.US separate from Binance.com. Why Coinbase doesn’t offer staking in New York. Why you can’t deposit euros on a CEX if the exchange doesn’t have a banking partner in the Eurozone. These aren’t technical glitches-they’re legal requirements.

Every CEX uses KYC (Know Your Customer) to verify your identity. That means uploading a passport, a selfie, sometimes even proof of address. Once they have that, they know exactly where you are. And if you’re in Iran, Russia, Cuba, or Syria? You’re locked out. Not because the tech can’t reach you, but because the company can’t risk fines, blacklisting, or criminal charges.

Even within countries that allow crypto, restrictions vary. In Germany, you can trade Bitcoin freely. In France, you need to report holdings over €10,000. In India, exchanges must collect tax details. These rules don’t just affect what you trade-they affect whether you can even open an account.

DEXs: Theoretically Open, Practically Getting Closer

Decentralized exchanges like Uniswap, SushiSwap, or PancakeSwap don’t ask for your ID. You connect your wallet-MetaMask, Phantom, Trust Wallet-and trade. No sign-up. No paperwork. No location check.That’s why someone in Nigeria can trade ETH for a token no CEX lists. Why a user in Venezuela can swap USDT for a stablecoin without a bank. DEXs don’t control your funds. They don’t hold your keys. And they don’t know where you are-unless you tell them.

But here’s the twist: regulators are catching up. In 2025, the EU’s MiCA regulation started pushing for DEXs to implement geolocation tools. The U.S. SEC has signaled that DEXs facilitating trades of unregistered securities could be held liable. Even though the code runs on blockchain, the people building and promoting these platforms are still subject to law.

Some DEXs now quietly block IP addresses from sanctioned countries. Others use wallet analytics to detect if a user is linked to a known exchange account in a restricted region. It’s not perfect-but it’s growing. You can still trade on a DEX from most places, but the door is slowly closing.

Fiat On-Ramps: The Real Gatekeepers

Here’s the hidden truth: CEXs control the front door to crypto. Most people don’t start with Bitcoin. They start with dollars, euros, or yen. And only CEXs let you deposit those directly.On a DEX, you need crypto already. So if you’re in a country where buying crypto with a bank card is banned-like Egypt, Algeria, or parts of Southeast Asia-you’re stuck. You can’t even get to the DEX unless you find a peer-to-peer seller, a crypto ATM, or a friend abroad to send you ETH.

That’s why CEXs are the gatekeepers. They’re the ones with banking licenses, payment processors, and compliance teams. If your country doesn’t have a deal with Coinbase or Kraken, you can’t get in. DEXs don’t solve that problem-they just let you trade once you’re already inside.

Security Trade-Offs: Control vs. Autonomy

CEXs promise safety. They store your coins in cold wallets. They freeze accounts if they detect fraud. They can reverse transactions (sometimes). But that same control makes them easy targets for regulators. If the government orders them to freeze accounts in Turkey, they do it. No appeal.DEXs give you total control. If you lose your private key, your coins are gone forever. If you send funds to a scam contract, there’s no customer service to call. But you also can’t be frozen. No one can shut down your wallet. No regulator can demand you stop trading.

That’s the trade-off: convenience and protection vs. freedom and risk. In countries with unstable governments or weak property rights, DEXs are a lifeline. In countries with strong legal systems, CEXs offer peace of mind.

Who Gets Left Behind?

The people most affected aren’t tech-savvy traders. They’re everyday people trying to protect their savings from inflation. In Argentina, where the peso lost 200% of its value in 2024, many turned to crypto. But CEXs like Binance blocked them from withdrawing pesos. So they used P2P platforms to buy USDT, then swapped it on DEXs.In Nigeria, where the central bank banned banks from handling crypto in 2021, DEXs became the only way to trade. But without fiat access, users had to rely on informal networks-WhatsApp groups, cash deliveries, or friends overseas. The DEX didn’t block them. The system around it did.

Even in the U.S., restrictions exist. Some states ban certain tokens. Some CEXs don’t offer margin trading in California. DEXs let you trade those tokens-but only if you already own them. So the restriction shifts from the platform to the on-ramp.

What’s Next? The Regulatory Tightrope

By 2026, we’re seeing a new trend: regulators aren’t trying to shut down DEXs anymore. They’re trying to make them comply.Projects like Uniswap are being asked to add geofencing to their front-end interfaces. Some DEX aggregators now show warnings: "Trading this token may violate your local laws." Others partner with compliance tools that scan wallet histories for links to sanctioned addresses.

It’s not about stopping crypto. It’s about controlling it. The goal isn’t to ban DEXs-it’s to make them traceable, accountable, and tied to real identities.

That means the days of "completely unregulated" DEXs are ending. The next generation of decentralized platforms will likely include optional KYC, regional token lists, and IP-based access controls-not because they want to, but because they have to.

Which One Should You Use?

If you’re in the U.S., Canada, UK, Australia, or most of Western Europe: Use a CEX. They’re safe, regulated, and easy. You can deposit fiat, trade hundreds of coins, and get help if something goes wrong.If you’re in a country with strict controls, high inflation, or unstable banking: Use a DEX-but only after you’ve gotten your first crypto through P2P, a local exchange, or a friend. DEXs won’t solve your on-ramp problem, but they’ll give you freedom once you’re in.

If you’re anywhere and care about privacy: Use a DEX with a hardware wallet. Don’t connect your exchange wallet. Don’t reuse addresses. Your freedom comes with responsibility.

There’s no perfect solution. But understanding where the walls are-and who built them-helps you navigate around them.

Can I use a DEX if my country bans crypto?

Technically, yes. DEXs don’t require registration or location checks. But if your country bans crypto entirely, using a DEX could still break the law. Enforcement varies-some governments monitor blockchain activity, others don’t. The risk isn’t technical-it’s legal.

Why can’t DEXs just block users by country like CEXs do?

The core code of a DEX runs on blockchain and can’t be easily changed. But the front-end website you use to access it (like Uniswap’s interface) can block IPs. Many DEX aggregators already do this. The protocol itself doesn’t enforce location rules-but the tools you use to interact with it can.

Do I need KYC to use a DEX?

No, DEXs themselves don’t require KYC. You only need a crypto wallet. But if you buy crypto on a CEX first-and most people do-you’ll have already gone through KYC. Some DEX interfaces now suggest or require identity checks to comply with local laws, but it’s not built into the protocol.

Can I move from a CEX to a DEX without getting blocked?

Yes. Once you withdraw crypto from a CEX to your own wallet, you’re no longer under the CEX’s control. You can then use that crypto on any DEX. The restriction only applies while your funds are on the CEX. Once they’re off, you’re free to trade-unless your country bans crypto entirely.

Are there any DEXs that are completely free from geographic restrictions?

No platform is truly free anymore. Even if the blockchain code allows global access, the websites, apps, and wallet integrations that connect you to DEXs are increasingly adding geo-blocks. The era of fully borderless DEXs is ending as regulators demand accountability. What remains is a gray zone where access depends on how hard you look-and how much risk you’re willing to take.

Tom Sheppard

bro i just tried to buy crypto on binance from canada and got blocked like wtf 😭 i mean i get the regs but why can’t i trade usdt? it’s not even a derivative lol. why does my country get treated like a criminal just because we’re not the usa? 🤦♂️