DeFi Swap Crypto Exchange Review: Best Platforms for 2025

DeFi Swap Fee Calculator

What Is a DeFi Swap Exchange?

A DeFi swap exchange lets you trade cryptocurrencies directly from your wallet-no middleman, no account signup, no bank approval. Unlike traditional crypto exchanges like Binance or Coinbase, DeFi swaps run on smart contracts. You keep control of your keys. Your money never leaves your wallet. That’s the whole point.

These platforms use automated market makers (AMMs), not order books. Instead of matching buyers and sellers, they use pools of tokens. If you want to swap ETH for USDC, you’re trading against a pool that already has both tokens in it. The price changes based on supply and demand inside the pool. Simple, but powerful.

As of September 2025, over $800 billion in crypto has been swapped across DeFi platforms. That’s not speculation anymore-it’s infrastructure. People use it for everything: moving assets between chains, earning yield, hedging, or just swapping tokens they found on Twitter.

Top DeFi Swap Platforms in 2025

Not all DeFi swaps are the same. Some are built for speed. Others for low fees. Some specialize in stablecoins. Here are the four platforms dominating the space right now.

Uniswap V4

Uniswap still leads on Ethereum. Its V4 update, launched in March 2025, introduced concentrated liquidity. That means liquidity providers can set price ranges instead of covering the whole market. This cuts capital needs by up to 90%. If you’re swapping ETH, BTC, or major tokens on Ethereum, Uniswap is still the go-to.

It has $4.2 billion locked in liquidity as of September 2025. But here’s the catch: Ethereum gas fees. During peak hours, a single swap can cost $3.20. That’s fine for big trades, but not for small ones. If you’re swapping $50 worth of tokens, you’re paying more in fees than the trade is worth.

PancakeSwap

If you want low fees and high volume, PancakeSwap on BNB Chain is your best bet. It’s the most popular DEX on BNB Chain, with $2.1 billion in total value locked. Its average fee? Just 0.17%. That’s less than half of Uniswap’s 0.3% fee.

It’s also the easiest to use for beginners. The interface is clean, and you don’t need to worry about Ethereum’s high gas. BNB Chain transactions cost around $0.02. If you’re trading tokens native to BNB Chain-like CAKE, SHIB, or DOGE-PancakeSwap is faster and cheaper than anything on Ethereum.

Curve Finance

Curve isn’t for swapping random tokens. It’s built for stablecoins. If you’re moving between USDC, USDT, DAI, or FRAX, Curve is the most efficient tool out there. Its fees are just 0.04%. Slippage? Often under 0.001%. That’s nearly invisible.

It has $4.1 billion locked, mostly in stablecoin pools. But if you try to swap ETH for USDC on Curve, you’ll get an error. It doesn’t support volatile pairs. It’s a specialist, not a generalist. Use it only for stablecoin swaps.

Symbiosis Finance

Symbiosis is the only platform built for cross-chain swaps. It connects 25 blockchains-Ethereum, Solana, Polygon, Arbitrum, BNB Chain, and more-without wrapping tokens. Most platforms lock your ETH on Ethereum and mint fake ETH on Solana. Symbiosis moves the real asset directly.

Swaps take about 12.7 seconds on average. Its latest update in August 2025, called "No-Loss Cross-Chain," refunds your gas if the swap fails. That’s huge. Before, a failed swap still cost you $5 in gas. Now, you pay nothing.

But it’s not perfect. On low-volume chains, slippage can hit 2.3%. And the interface? Clunky. Most users say it feels like a beta app.

How Do DeFi Swaps Compare?

| Platform | Best For | TVL | Avg Fee | Slippage (Avg) | Chains Supported | Interface Ease |

|---|---|---|---|---|---|---|

| Uniswap V4 | Ethereum swaps | $4.2B | 0.3% | 1.1% | 1 (Ethereum) | 4.3/5 |

| PancakeSwap | BNB Chain swaps | $2.1B | 0.17% | 0.9% | 1 (BNB Chain) | 4.1/5 |

| Curve Finance | Stablecoin swaps | $4.1B | 0.04% | 0.001% | 1 (Ethereum) | 3.9/5 |

| Symbiosis | Cross-chain swaps | $1.8B | 0.45% | 1.5% | 25 | 3.1/5 |

| 1inch | Aggregated swaps | $5.3M | 0.3% | 0.87% | 150+ sources | 2.7/5 |

1inch doesn’t have its own liquidity. Instead, it scans 150+ sources-including Uniswap, Symbiosis, and Curve-to find the best rate. It’s like a price comparison engine for crypto. Slippage is the lowest among major platforms. But its interface is overwhelming. Only experienced users should use it without help.

What You Need to Know Before Swapping

Swapping crypto on DeFi sounds simple. But beginners lose money all the time. Here’s what you need to avoid the common traps.

Gas Fees Are Not Optional

You can’t avoid them. They’re paid to miners or validators to process your transaction. On Ethereum, gas averages $1.75. On Polygon? $0.02. On Solana? $0.00025. If you’re swapping on Ethereum, check Etherscan’s Gas Tracker before you hit confirm. Avoid peak hours (9 AM-2 PM UTC). That’s when fees spike 2.3x.

Slippage Tolerance Matters

Slippage is the difference between the price you see and the price you get. For stablecoins, 0.1% is fine. For volatile tokens like SOL or SHIB, set it to 0.8-1.2%. If you leave it at 0.5%, your swap might fail. If you set it to 5%, you could get ripped off.

Wallet Setup Is Critical

You need a Web3 wallet: MetaMask, Phantom, or Rabby. MetaMask supports 89 blockchains as of October 2025. Never use a centralized exchange wallet to swap. That defeats the whole purpose. And never share your seed phrase. Ever.

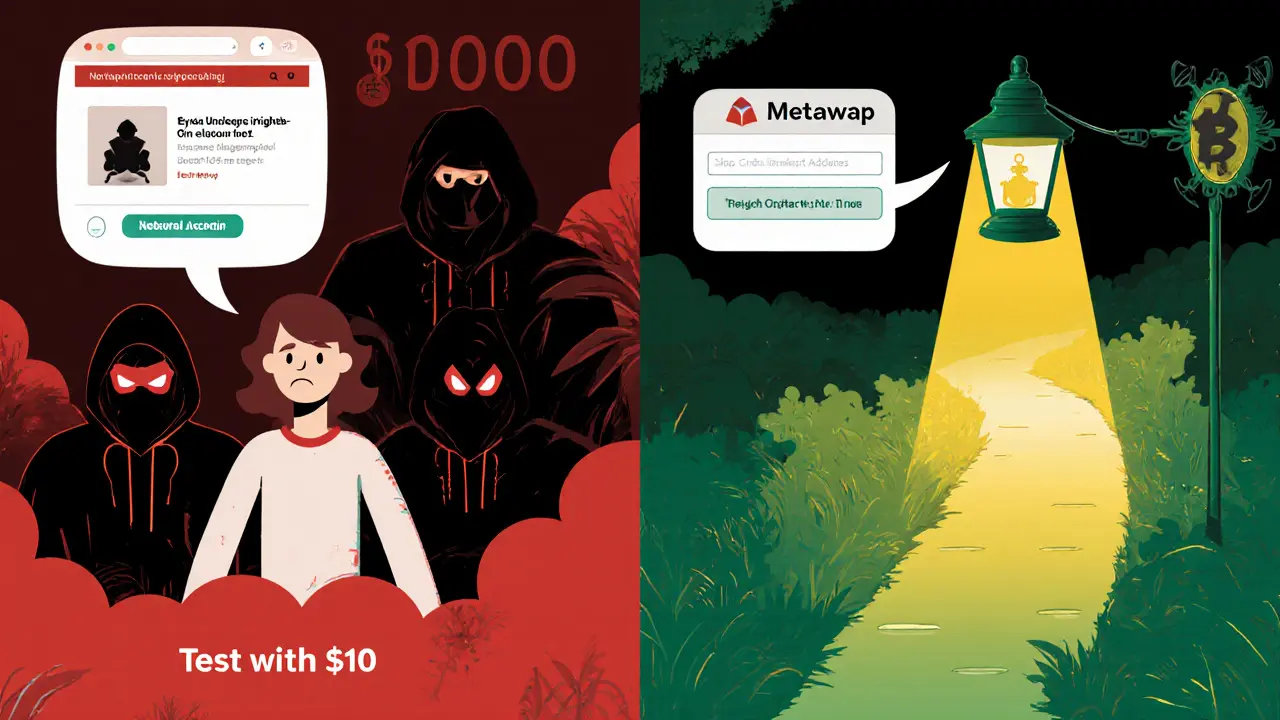

Test With Small Amounts

First swap? Do $10. Not $1,000. CoinGape’s October 2025 guide says 72% of beginner errors happen on the first big trade. A $10 test lets you see how gas works, how slippage affects you, and whether the interface feels right.

Pros and Cons of DeFi Swaps

DeFi swaps aren’t magic. They have real trade-offs.

Pros

- No KYC. No identity checks. You can swap from anywhere.

- Non-custodial. You control your keys. No exchange gets hacked and steals your coins.

- 24/7 access. No bank holidays. No customer service hold times.

- Lower fees than centralized exchanges for small trades.

- You can earn yield by adding liquidity. APYs range from 2% to 15%.

Cons

- High gas fees on Ethereum. Can make small swaps useless.

- Impermanent loss. If you provide liquidity and prices swing, you lose money compared to just holding.

- Bridge hacks. Cross-chain platforms like Symbiosis rely on bridges. There were 7 major bridge exploits in 2025.

- Scams. Fake tokens, phishing links, and rug pulls are everywhere. Always check contract addresses.

- No refunds. If you send to the wrong address? Your money is gone.

Who Should Use DeFi Swaps?

DeFi swaps aren’t for everyone. But they’re perfect for some.

Use DeFi Swaps If You:

- Want full control over your crypto

- Trade across multiple blockchains

- Are comfortable with wallets and gas fees

- Want to avoid KYC

- Are swapping under $5,000 per transaction

Stick With a Centralized Exchange If You:

- Are new to crypto and want help

- Trade large amounts ($10,000+)

- Want customer support when things go wrong

- Prefer to use fiat (USD, EUR) to buy crypto

The Future of DeFi Swaps

The next big shift? Intent-based swaps. Instead of selecting tokens, fees, and slippage, you’ll just say: "Swap my ETH for the most USDC I can get, in under 10 seconds, on any chain." The platform figures out the rest.

Uniswap’s V4 hooks, Symbiosis’ no-loss feature, and 1inch’s Chainlink CCIP integration are all steps toward that future. By 2026, DeFi swap volume could hit $1.2 trillion.

But risks remain. Regulatory pressure is growing. The EU will require KYC for swaps over €1,000 starting January 2026. The SEC is suing DeFi platforms. If governments crack down, some platforms may disappear.

Final Thoughts

DeFi swap exchanges are the backbone of modern crypto. They’re faster, cheaper, and more open than centralized exchanges. But they demand responsibility. You’re your own bank now.

For Ethereum users: Uniswap V4 is still king. For low fees: PancakeSwap. For stablecoins: Curve. For cross-chain: Symbiosis. For advanced traders: 1inch.

Start small. Learn gas. Watch slippage. Never trust a link. And always, always double-check the contract address before you confirm.

Frequently Asked Questions

Are DeFi swaps safe?

DeFi swaps are safe if you use trusted platforms and follow basic security rules. Your funds aren’t held by a company-they’re in smart contracts. But smart contracts can have bugs. Always check if a platform has been audited by firms like CertiK or Trail of Bits. Never use a swap with no audit history. Also, avoid clicking random links. Scammers create fake Uniswap or PancakeSwap sites that look real. Always go to the official website directly.

Do I need to do KYC to use a DeFi swap?

No, you don’t need KYC on most DeFi swaps. That’s one of their biggest advantages. You connect your wallet and swap. But starting January 1, 2026, the EU’s MiCA regulation will require KYC for swaps over €1,000 if the platform serves European users. Some platforms may block EU users entirely to avoid compliance. For now, outside the EU, KYC is still optional.

What’s the difference between a DeFi swap and a centralized exchange?

Centralized exchanges (like Binance or Coinbase) hold your crypto for you. You log in, trade, and they store your coins. DeFi swaps don’t hold anything. You connect your wallet and trade directly from it. That means no account, no password, no email. But it also means no customer support. If you send crypto to the wrong address, there’s no way to get it back.

Can I lose money on a DeFi swap?

Yes, in three main ways. First, gas fees can eat into small profits. Second, slippage can give you a worse price than expected. Third, if you provide liquidity, you can suffer impermanent loss when token prices move sharply. For example, if you add ETH and USDC to a pool and ETH drops 30%, you’ll have less value than if you’d just held ETH. That’s not a scam-it’s how AMMs work. Always understand the risks before adding liquidity.

Which wallet should I use for DeFi swaps?

MetaMask is the most popular and supports 89 blockchains as of October 2025. It’s easy to use and works with most DeFi platforms. Phantom is better for Solana. Rabby Wallet is newer but has better security features like transaction simulation. Never use a wallet you don’t control. Avoid exchange wallets like Binance Wallet for swaps-they’re custodial and defeat the purpose of DeFi.

Why do some DeFi swaps have higher fees than others?

Fees come from two places: protocol fees and gas fees. Protocol fees go to the platform (like Uniswap’s 0.3% fee). Gas fees go to the blockchain network (Ethereum, Polygon, etc.). Ethereum has high gas because it’s congested. Polygon and Solana have low gas because they’re faster and cheaper. So a swap on Uniswap might cost $2 in gas + 0.3% fee. The same swap on PancakeSwap might cost $0.02 in gas + 0.17% fee. The platform doesn’t control gas-it’s the blockchain.

Mehak Sharma

DeFi swaps are the quiet revolution nobody talks about but everyone uses. No middlemen, no begging for approval, just pure ownership. I started with $20 on Uniswap and now I’m managing multiple chains. The freedom is intoxicating. You’re not trading crypto-you’re participating in a new financial ecosystem. And yes, gas fees hurt, but once you learn to time your swaps, it’s like catching waves. The real win? Knowing your keys are yours and no bank can freeze them. This isn’t finance-it’s autonomy.

bob marley

Wow. Another glowing review of DeFi. Let me guess-you also think Bitcoin is the future of pizza delivery. You missed the part where 7 bridge hacks in 2025 wiped out $1.2B. And you call that 'infrastructure'? It’s a casino with smart contracts. If you’re not using a centralized exchange, you’re not smart-you’re just lucky. And don’t even get me started on Curve. You think swapping USDC for DAI is 'efficient'? It’s a glorified money printer with zero oversight.

Jeremy Jaramillo

I appreciate the breakdown. A lot of people don’t realize how much work goes into choosing the right platform. Uniswap for Ethereum, Pancake for BNB, Curve for stablecoins-it’s like having different tools for different jobs. And Symbiosis? It’s rough around the edges, but the no-loss feature is a game changer. Beginners should definitely start with small amounts. I’ve seen too many people lose money because they skipped the $10 test. Take your time. Learn the gas patterns. Watch slippage. It’s not magic, but it’s worth the effort.

Sammy Krigs

I tried symbiosis last week and it was a mess. Like, the interface looked like it was made in 2018. And i swear i lost 20 bucks on gas because the swap failed and they didnt refund. But then i did a second one and it worked so maybe i just clicked wrong. Also curve is fire for usdc but dont even try to swap eth on it. it just says error. why? no one knows. lol

naveen kumar

Let’s be honest-this entire DeFi narrative is a distraction. The $800B in swaps? That’s mostly wash trading and yield farming bots. The real value is in the mining rigs and the offshore servers running these protocols. And don’t tell me about 'non-custodial'-the wallets are still hosted on cloud services. MetaMask is owned by a venture-backed startup. You think you’re free? You’re just renting freedom from a Silicon Valley VC. The SEC is coming. They’ve already got the data. This is a house of cards built on gas fees and hype.

Bruce Bynum

Start small. Learn gas. Watch slippage. Double-check addresses. That’s it. No need to overcomplicate it. If you do those four things, you’ll be ahead of 90% of people. I’ve swapped $500 across five platforms. Lost $3 in gas once. Got lucky on a stablecoin arbitrage. No drama. No panic. Just steady. DeFi isn’t about getting rich overnight. It’s about staying in control. And that’s worth more than any APY.

Wesley Grimm

TVL numbers are meaningless without liquidity depth analysis. Uniswap’s $4.2B looks impressive until you realize 68% is in ETH/USDC pairs with 90% concentration. That’s a single point of failure. PancakeSwap’s volume is inflated by memecoins with 48-hour lifespans. Curve’s stability is a mirage-it only works because stablecoins are pegged to fiat, which is itself a Ponzi. And Symbiosis? The 2.3% slippage on low-volume chains isn’t a bug-it’s a feature designed to extract value from retail users who don’t understand AMM mechanics.

Masechaba Setona

I’ve been in crypto since 2017. I’ve seen every 'revolution' come and go. DeFi? It’s just Wall Street with a blockchain filter. You think you’re free? You’re just a data point in a DeFi protocol’s risk model. And those 'audits'? CertiK is paid by the platforms themselves. They give green lights to code that’s full of backdoors. I’ve seen it. I’ve lost money because of it. And now you’re telling me to 'start small'? Start small? I lost $12K because I trusted a 'trusted' platform. Don’t be naive.

Kymberley Sant

I think uniswap v4 is kinda sus tbh. like why do they need concentrated liquidity? sounds like they just want to make it harder for normal people. and curve? sounds like a bank but without the suits. also i tried symbiosis and my wallet just vanished for 12 mins. i thought i got hacked. turns out it was just slow. i’m just gonna stick with binance. at least when i mess up they call me and say hey u did a thing

Edgerton Trowbridge

The structural advantages of decentralized finance are undeniable. The elimination of intermediary risk, the transparency of on-chain transactions, and the programmability of smart contracts represent a paradigm shift in asset exchange. However, the current user experience remains suboptimal for the average participant. The cognitive load associated with gas optimization, slippage tolerance, and contract verification imposes a significant barrier to adoption. Until user interfaces are engineered with behavioral psychology in mind, mass adoption will remain constrained to technologically literate subgroups. The future lies in intent-based systems, but the transition must be managed with educational scaffolding.

mark Hayes

I just swap when I feel like it. No stress. No charts. If it’s on the list you mentioned, I’m good. Uniswap for ETH, Pancake for doge stuff, Curve for usdc. Symbiosis if I’m moving between chains. I’ve lost maybe $15 total in gas over 8 months. Got back $300 in yield. No KYC. No forms. No waiting. Just open the wallet and go. If it breaks? I’m not crying. It’s crypto. It’s supposed to be messy. 🤷♂️

Derek Hardman

I’ve been running a small DeFi education group in London. The most common mistake? Users assume that low fees mean low risk. They’ll swap $500 on PancakeSwap because gas is $0.02, then get rekt by a fake CAKE token with a nearly identical contract address. The interface ease doesn’t reduce risk-it masks it. We run weekly workshops on contract verification. We show them how to check the token’s audit status, the liquidity pool’s history, and the dev wallet’s activity. Knowledge is the only real security. No wallet can replace that.

Eliane Karp Toledo

You know who benefits most from DeFi? Not you. Not me. The people who built the bridges. The ones who own the audit firms. The ones who created the liquidity pools that get drained by insiders. Every 'no-loss' feature is a trap. Every 'easy interface' is designed to make you click faster. The EU’s KYC move? That’s not regulation-it’s the beginning of the end. They’re not coming to shut it down. They’re coming to take it over. And when they do, they’ll call it 'regulated DeFi'. You’ll still be swapping, but now you’ll be paying them 20% of your gains. They’ve been planning this since 2021.

Phyllis Nordquist

The comprehensive analysis presented herein is both methodical and illuminating. It is imperative to underscore that the operational integrity of DeFi platforms is contingent upon the rigorous auditing of smart contracts, the prudent management of slippage parameters, and the disciplined adherence to wallet security protocols. While the proliferation of cross-chain interoperability solutions such as Symbiosis represents a significant technical advancement, the attendant risks-including bridge vulnerabilities and impermanent loss exposure-demand a calibrated risk-assessment framework. Novice participants are strongly advised to commence with microtransactions, to verify contract addresses via on-chain explorers, and to consult independent audit reports prior to any liquidity provision. The democratization of finance is not synonymous with the abdication of due diligence.