Dubai VARA Crypto Licensing: Rules, Costs, and Restrictions in 2026

Dubai’s VARA Is the Hardest Crypto License to Get - and That’s Why So Many Companies Want It

If you’re trying to launch a crypto exchange, custody service, or NFT platform in the Middle East, you’re not just applying for a license. You’re applying to join a club that doesn’t let just anyone in. The Dubai Virtual Assets Regulatory Authority (VARA) doesn’t hand out approvals like candy. It screens applicants like a bank auditing a terrorist network. And yet, since 2022, more than 120 crypto firms - including Binance, Crypto.com, OKX, and Bybit - have jumped through its hoops. Why? Because in 2026, if you want global credibility in crypto, you need a VARA license.

Most countries treat crypto like a wild west. Dubai treats it like a nuclear reactor. One mistake, one slip in compliance, and you’re out. But if you get it right, you get access to a market stretching from Africa to Southeast Asia, zero corporate tax, and a government that actually wants you to succeed.

What Exactly Does VARA Regulate?

VARA doesn’t just cover Bitcoin trading. It regulates every single way you can touch digital assets in Dubai - outside the DIFC financial free zone. That includes:

- Virtual asset exchanges (buying/selling crypto for fiat or other crypto)

- Custody services (holding crypto for clients)

- Broker-dealer services (acting as middleman for trades)

- Token issuance (launching new coins or tokens)

- Wallet providers (custodial or non-custodial)

- Transfer services (moving crypto between users)

- Decentralized finance (DeFi) protocols - yes, even unhosted ones

- NFT marketplaces and platforms

If your business touches any of these, and you’re operating from Dubai mainland or a free zone (not DIFC), you need VARA approval. No exceptions. Even if you’re just selling NFTs from a Dubai office, you’re under VARA’s microscope.

The Hidden Cost: It’s Not Just About Money

People think the biggest barrier is the price. It’s not. It’s the total commitment.

Here’s what you actually pay:

- Application fee: AED 40,000 to AED 100,000 ($11,000-$27,000)

- Annual supervision fee: AED 80,000 to AED 200,000 ($22,000-$54,000)

- Capital requirements: AED 100,000 to AED 5 million ($27,000-$1.36 million)

But here’s the kicker: if you want multiple licenses, the capital stacks up fast. Want to run an exchange AND custody AND broker services? You need AED 10 million in paid-up capital - that’s over $2.7 million. Most startups can’t touch that. That’s intentional. VARA doesn’t want small operators. It wants serious players with deep pockets and long-term plans.

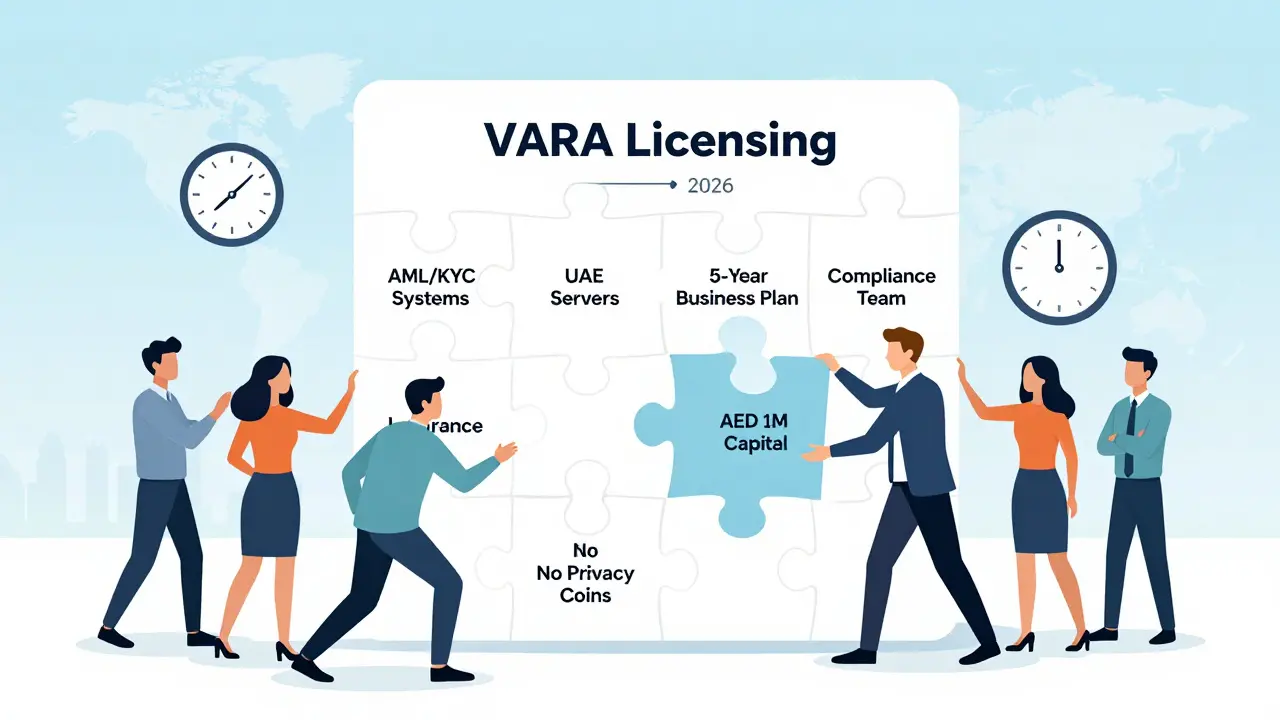

And that’s just the money. You also need:

- A legally incorporated entity in Dubai mainland or a free zone

- A detailed business plan with 5-year projections

- Full AML/CFT and KYC systems built into your tech stack

- External audit reports every year

- Insurance coverage for digital asset losses

- Proof of secure data storage (servers must be in the UAE)

This isn’t filling out a form. This is building a compliance department from scratch.

The Ban List: What You Can’t Offer

VARA doesn’t just regulate - it censors. In 2023, it banned privacy coins outright. That means:

- Monero (XMR) - banned

- Zcash (ZEC) - banned

- Other privacy-focused tokens - banned

No gray area. No exceptions. Even if you’re just listing them on your exchange, you’re breaking the law. VARA says these coins are too risky for money laundering. And they’re right - they are. But that also means you can’t offer them to your users, even if they ask.

Then there’s advertising. You can’t just run a TikTok ad saying “Buy Bitcoin in Dubai.” Every single marketing campaign - social media, billboards, influencer posts - needs VARA’s written approval before launch. They check the language, the tone, the claims. No hype. No promises of returns. No misleading visuals. If your ad says “earn 20% daily,” you’re done.

Token Rules: Not All Crypto Is Equal

VARA doesn’t treat every token the same. It has a three-tier system:

- Category 1: Asset-backed tokens and stablecoins - These are treated like securities. You need full VARA licensing to issue them. Examples: USD-backed stablecoins like USDT or tokenized real estate.

- Category 2: Utility tokens - These give access to a service (like a platform token). You don’t need to issue them directly, but your distributor must be VARA-licensed.

- Exempt: Loyalty points and in-game credits - These don’t need approval, but VARA still monitors them. If they start trading like crypto, you’ll get flagged.

So if you’re launching a token for your app, you better know which category it falls into. Get it wrong, and you’re not just fined - you’re shut down.

VARA vs. DFSA vs. FSRA: Who’s Who in UAE Crypto

Dubai isn’t the only place in the UAE with crypto rules. But VARA is the biggest.

| Authority | Area Covered | Focus | License Cost Range |

|---|---|---|---|

| VARA | Dubai mainland + most free zones | Full spectrum: exchanges, DeFi, NFTs, custody | AED 100,000 - AED 10 million+ |

| DFSA | Dubai International Financial Centre (DIFC) | Investment firms, institutional trading, funds | AED 500,000 - AED 15 million |

| FSRA | Abu Dhabi Global Market (ADGM) | Brokers, custodians, advisers, exchanges | AED 300,000 - AED 8 million |

VARA has the widest reach. If you’re not in DIFC or ADGM, VARA is your only option. And because it covers everything from NFTs to DeFi, it’s the most attractive for startups and global exchanges alike.

Why Do Big Players Choose VARA?

Binance didn’t move to Dubai because it was easy. They moved because VARA gives them legitimacy.

In 2025, the EU passed MiCA - a strict crypto law that forced many exchanges to pull out of Europe. Singapore tightened its rules. The U.S. is still chasing crypto companies with lawsuits. But in Dubai? VARA says: “Come in. We’ve got your back.”

Here’s what companies get:

- 100% foreign ownership in free zones

- No corporate or personal income tax

- Clear rules - no guessing what’s allowed

- Access to 200+ million customers across the Middle East, Africa, and South Asia

- Government-backed credibility - investors trust VARA-approved firms

One founder told me: “We spent two years trying to get licensed in Switzerland. VARA approved us in six months - and we didn’t have to move our team.”

What Happens If You Skip VARA?

Some companies think they can operate under the radar. They set up a server in Dubai, use a local bank, and assume no one will notice.

They’re wrong.

VARA works with banks, payment processors, and even cloud providers to track unlicensed activity. If you’re processing crypto transactions from a Dubai IP address without a license, you’ll get flagged. Your bank account will be frozen. Your domain could be seized. You could face criminal charges.

And if you’re a foreign company? You won’t be able to open a bank account anywhere in the UAE. No VARA license = no banking. No banking = no business.

Is VARA Right for You?

Ask yourself these questions:

- Do you have over AED 1 million in capital to invest upfront?

- Can you build a full compliance team with AML, KYC, and legal experts?

- Are you willing to give up privacy coins and flashy marketing?

- Do you plan to operate in the Middle East for the next 5+ years?

If you answered yes to all four - then VARA is your golden ticket.

If you’re a small startup with $50,000 and a side hustle? Walk away. This isn’t for you. Try a jurisdiction with lighter rules - but know you’ll never get the trust or scale VARA gives you.

The Future: What’s Next for VARA?

VARA isn’t done. In 2026, expect:

- New licensing categories for DAOs (decentralized autonomous organizations)

- Stricter rules on DeFi protocols that interact with users directly

- Integration with FATF’s travel rule for cross-border transfers

- More collaboration with Singapore and the EU on standards

VARA is building the world’s most advanced crypto regulatory ecosystem. It’s not perfect. It’s expensive. It’s rigid. But it’s the only one that actually works - and works at scale.

If you’re serious about crypto in 2026, you don’t just need a license. You need VARA.”

Can I get a VARA license if I’m not based in Dubai?

No. You must have a legal entity registered in Dubai mainland or a designated free zone. Foreigners can own 100% of a company in free zones, but you still need to incorporate locally. You can’t apply from overseas.

How long does VARA licensing take?

On average, 4 to 6 months. But if your documentation is incomplete or your compliance system is weak, it can stretch to 9-12 months. Companies with full legal and tech teams in place get approved faster.

Are stablecoins allowed under VARA?

Yes - but only if they’re fully backed and issued by a VARA-licensed entity. USDT and USDC are allowed because their issuers are licensed. You can’t launch your own stablecoin without full Category 1 licensing.

Can I use a third-party custody provider instead of getting my own license?

Only if the provider is VARA-licensed. You can’t outsource custody to an unlicensed firm - even if it’s based in the U.S. or Europe. VARA requires all custody to be handled by licensed entities within the UAE.

What happens if my VARA license gets revoked?

Your operations must stop immediately. You’ll be barred from reapplying for at least 3 years. Your bank accounts will be frozen, and your assets may be seized. In serious cases (like money laundering), criminal charges can follow. VARA doesn’t warn twice.

Do I need to hire local staff to get licensed?

Not necessarily, but you need a local representative - usually a compliance officer or legal agent based in Dubai. Most firms hire a local compliance manager even if the rest of the team is remote.

Gavin Francis

VARA's got balls. Most places are still figuring out if crypto is real. Dubai just built a fortress and said 'come if you're serious'. 🚀

Dylan Morrison

It's wild how a place can turn chaos into order. Dubai didn't ban crypto, they gave it a spine. 🌍✨