Gas Fees vs Transaction Fees: What's the Difference in Blockchain Networks

Gas Fee Calculator

Estimate Your Transaction Costs

Calculate gas fees for Ethereum transactions and see how they compare with Bitcoin fees

Estimated Fees

Ethereum

Bitcoin

Tip: Use "Advanced Gas Controls" in MetaMask with 1-3 gwei during off-peak hours to save 80%+ on fees. Always check gas prices before sending.

Ever sent crypto and got hit with a $50 fee for a $10 transfer? You’re not alone. That’s not a transaction fee-it’s a gas fee. And confusing the two is costing people money every day. While all gas fees are transaction fees, not all transaction fees are gas fees. Understanding this difference isn’t just technical jargon-it’s the key to saving hundreds of dollars a year on crypto transactions.

What Exactly Is a Transaction Fee?

A transaction fee is the basic cost of moving any asset on a blockchain. Whether you’re sending Bitcoin, Dogecoin, or Litecoin, you pay a fee to get your transaction confirmed. This fee goes to the miners or validators who secure the network and process your transaction. It’s like a toll on a digital highway. Bitcoin’s system is simple: fees are measured in satoshis per byte. One satoshi is 0.00000001 BTC. The bigger your transaction (in data size), the higher the fee. If the network is busy, miners prioritize transactions with higher fees. That’s why sending Bitcoin during peak hours can cost more. But there’s no complex math behind it. You’re paying for space in a block, not for computation. Most Bitcoin users don’t need to worry about gas limits or smart contracts. Their transactions are straightforward: send X BTC to Y address. Done. Fees are predictable, even if they’re not always low.What Makes Gas Fees Different?

Gas fees exist only on blockchains that run smart contracts-like Ethereum, Solana, Avalanche, and Polygon. These networks don’t just move money. They run code. Every time you interact with a DeFi protocol, mint an NFT, or swap tokens on Uniswap, you’re asking the network to execute a program. That takes computing power. That’s where gas comes in. Gas is the unit that measures how much computational work your transaction requires. A simple ETH transfer uses about 21,000 gas. But swapping tokens on a DEX? That can cost 100,000+ gas. A complex NFT mint might need 300,000 gas or more. After Ethereum’s London Upgrade in August 2021, gas fees became a three-part system:- Base fee: Automatically burned, adjusts up or down based on network demand. No one gets paid this-it’s destroyed to control supply.

- Tip (priority fee): Extra you pay to get your transaction processed faster. Miners keep this.

- Gas limit: The max gas you’re willing to spend. If your transaction uses less, you get the difference back.

Why Do Gas Fees Spike So Badly?

Imagine a concert venue with 10,000 seats. Normally, tickets are $50. But when Taylor Swift announces a show, everyone rushes to buy. Lines form. Prices climb. That’s what happens on Ethereum during NFT drops or DeFi airdrops. When demand for block space surges, the base fee rises automatically. Users start bidding up tips to get their transactions confirmed first. This creates "gas wars"-where people pay 10x, 20x, even 50x the normal fee just to get their transaction through. In 2021, during the peak of the NFT boom, Ethereum gas fees regularly hit 500 gwei. At $2,000 per ETH, that meant a $100 fee just to swap two tokens. Many users lost money because their transactions failed after paying high fees. Others paid $20 just to cancel a failed transaction. This isn’t a bug-it’s a feature. The system is designed to ration scarce resources. But for everyday users, it’s frustrating. And expensive.

Bitcoin vs Ethereum: Real-World Fee Examples

Here’s how fees compare in practice:| Transaction Type | Bitcoin Fee | Ethereum Gas Fee |

|---|---|---|

| Simple send (1 input, 2 outputs) | $0.50-$2.00 | $0.10-$1.50 |

| DeFi swap (Uniswap) | N/A | $1.00-$20+ (often $5-$10) |

| NFT mint (10,000-item drop) | N/A | $5-$50+ (peak) |

| Token transfer (ERC-20) | N/A | $0.50-$5 |

| Network congestion (peak) | $10-$15 | $50-$200+ |

How Users Are Adapting

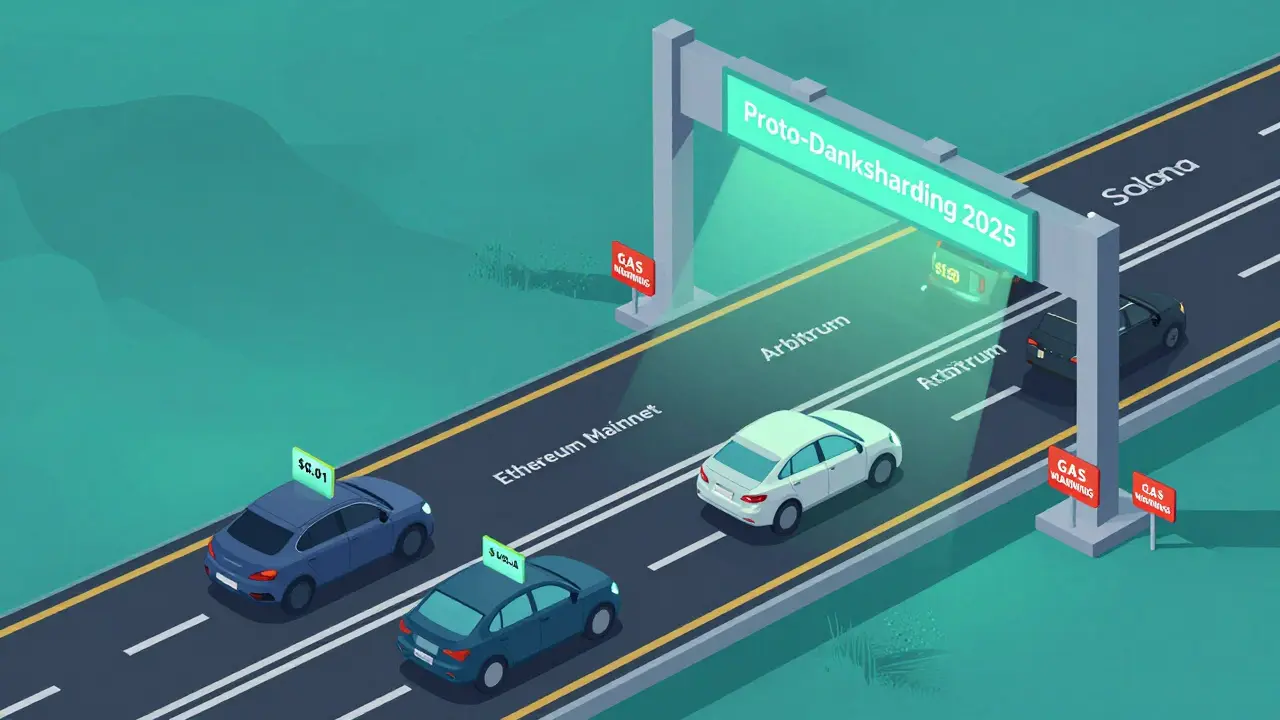

People aren’t just paying more-they’re changing how they use crypto. A 2025 survey showed 73% of Ethereum users check gas prices before sending a transaction. Only 31% of Bitcoin users do the same. Why? Because Ethereum users know they can lose money if they don’t. Tools like GasTracker and Etherscan’s Gas Watch show real-time base fees and recommended tips. Many users wait until late-night UTC hours-when U.S. markets close and European activity drops-to send transactions. Others use Layer 2 networks like Arbitrum or Polygon, where fees are under $0.01 per transaction. Polygon alone processed over 2.7 billion transactions in 2023, mostly because it’s 100x cheaper than Ethereum mainnet. Solana’s average fee? Around $0.0025. Avalanche? $0.05-$0.25. These networks didn’t just copy Ethereum-they built better fee models from the start.

What’s Next for Blockchain Fees?

Ethereum’s move to Proof-of-Stake in 2022 cut energy use by 99.9%, but it didn’t fix gas fees. That’s because PoS doesn’t increase block space-it just changes how blocks are created. The real fix is coming with proto-danksharding, part of Ethereum’s roadmap expected to roll out in 2025-2026. This upgrade will let the network store more data per block, reducing congestion. Developers estimate this could slash gas fees by 90-95%. Meanwhile, Layer 2 solutions are already working. Arbitrum and Optimism now handle over 80% of Ethereum’s daily transactions, with fees 90% lower than the main chain. Companies that once avoided Ethereum because of cost are now building on these Layer 2s. The global blockchain fee market hit $1.2 billion in 2023. Ethereum accounted for 40% of that-mostly because of high fees. But as alternatives grow and scaling improves, that share is shrinking fast.How to Save on Fees Right Now

You don’t need to be a developer to avoid overpaying. Here’s what works:- For Bitcoin: Send on weekends. Fees drop 40-60% when U.S. markets are closed. Use a fee estimator like BitInfoCharts to pick the right satoshi/byte rate.

- For Ethereum: Use MetaMask’s "Advanced Gas Controls" to set your own tip. Try 1-3 gwei during off-peak hours. Never accept the default "fast" option unless you’re in a rush.

- For any smart contract: Check the gas limit. If it’s over 500,000, something’s wrong. You might be overpaying.

- Always use Layer 2s for daily swaps and transfers. Polygon, Arbitrum, and Base are safe, fast, and cheap.

- Don’t rush. If you’re not minting an NFT in 10 seconds, wait. Fees will drop.

Final Thought: It’s Not About the Fee-it’s About the System

Gas fees aren’t broken. They’re working exactly as designed: to allocate scarce computing power based on demand. But that design was made for a world where blockchain was niche. Now, millions use it daily. The real problem isn’t high fees-it’s that most users still think Ethereum is the only option. It’s not. Bitcoin handles value transfer. Ethereum handles smart contracts. But now, Layer 2s and new chains handle the heavy lifting at a fraction of the cost. If you’re paying $15 to send $50 in ETH, you’re not paying for security. You’re paying for outdated infrastructure. The future of blockchain isn’t about bigger blocks-it’s about smarter, cheaper, and more accessible systems. And that future is already here.Are gas fees and transaction fees the same thing?

No. All gas fees are a type of transaction fee, but not all transaction fees are gas fees. Transaction fees exist on any blockchain to pay for processing. Gas fees are a specific type used only on smart contract blockchains like Ethereum to pay for computational work. Bitcoin uses transaction fees; Ethereum uses gas fees.

Why is Ethereum gas so expensive?

Ethereum gas fees rise when demand for block space exceeds supply. During NFT launches or DeFi surges, thousands of users compete to get their transactions confirmed. This creates a bidding war where users raise tips to outbid others. The base fee also increases automatically when the network is congested. It’s not broken-it’s a market mechanism. But it’s painful for small users.

Can I pay gas fees in Bitcoin or USDT?

No. Gas fees on Ethereum must be paid in ETH. On Solana, you pay in SOL. On Avalanche, you pay in AVAX. You can’t use other tokens-even stablecoins like USDT-to pay for gas. This is because the network’s consensus mechanism requires payment in its native currency to validate and secure transactions.

How do I check current gas prices?

Use tools like Etherscan’s Gas Tracker, GasNow, or MetaMask’s built-in fee estimator. These show real-time base fees and recommended tips. For Ethereum Layer 2s, check the network’s own dashboard-Polygon and Arbitrum show fees in real time. Most wallets now display estimated costs before you confirm a transaction.

Are Layer 2 solutions safe for everyday use?

Yes. Layer 2s like Arbitrum, Optimism, and Polygon are built to inherit Ethereum’s security while reducing costs. Funds are locked on Ethereum’s main chain, and withdrawals are verified using cryptographic proofs. Millions of users send billions in value through these networks daily. They’re not experimental-they’re the future of affordable blockchain use.

Will gas fees ever go down permanently?

Yes, and they already are. Layer 2 adoption has cut Ethereum’s average transaction cost by over 90% for most users. The upcoming proto-danksharding upgrade in 2025-2026 is expected to reduce base fees by another 90-95%. Meanwhile, newer chains like Solana and Aptos offer consistently low fees. The era of $50 gas fees is ending-not because Ethereum fixed itself, but because better alternatives forced it to evolve.

Anselmo Buffet

Just use Polygon for everything. Fees are pennies and it’s literally just as secure. Why are people still paying $10 to swap tokens on mainnet?

Steven Ellis

It’s fascinating how gas fees reveal the underlying economics of decentralized systems. Unlike Bitcoin’s flat fee-for-space model, Ethereum’s gas mechanism is a dynamic auction for computational resources. The beauty is in the self-regulating nature-the base fee burns, reducing inflationary pressure, while the tip incentivizes miners to prioritize. This isn’t broken-it’s evolutionary. Most users don’t realize they’re witnessing a new form of digital resource allocation, one that mirrors real-world scarcity principles. The pain points? They’re temporary growing pains. Layer 2s are the natural next phase, not a workaround.

Claire Zapanta

They told us decentralization would lower costs. Now we pay $50 just to move money? Coincidence that the same people who made Ethereum rich are now charging us for the privilege? Who owns the gas oracle? Who controls the base fee algorithm? Ask yourself-who profits when you cry over your $20 swap fee?

Kathy Wood

STOP. JUST. STOP. You’re paying $20 to send $50? That’s not finance-that’s robbery. And they call it ‘smart contracts’? More like ‘stupid contracts’ that drain your wallet. I’m done. I’m moving to Bitcoin. At least there, you know what you’re paying for.

Candace Murangi

I used to panic every time I saw a gas estimate over $5. Now I just wait till 3 AM. It’s wild how much you can save by being patient. Also, Layer 2s are honestly not scary anymore. I’ve sent over $15k through Arbitrum and never lost a cent. The real innovation isn’t the tech-it’s the mindset shift: stop treating Ethereum like a bank.

Albert Chau

You people are still using Ethereum? After all the hacks, the MEV bots, the fee gouging? You’re not saving money-you’re funding a casino. Bitcoin is the only real store of value. Everything else is vaporware dressed up in whitepapers.

Abhishek Bansal

Bro, I paid $47 to mint a PFP and it failed. Now I’m broke. But hey, at least I’m part of the revolution? 😂

Bridget Suhr

gas fees aren't the problem. the problem is we keep treating blockchains like banks. you wouldn't pay $20 to send a letter through the usps just because it's 'urgent'-so why do it here? patience is a feature, not a bug.

Joey Cacace

I just learned about Etherscan’s gas tracker last week and my life changed. I used to pay $15 for every swap. Now I pay $0.80. It’s not magic-it’s just knowing how to read the numbers. Also, hi fellow crypto traveler! 🌱

Taylor Fallon

It’s funny how we call it ‘gas’ like it’s fuel for a car, but no one ever explains that the engine is running on human desperation. Every time I see a 500 gwei alert, I think of all the people who just gave up on crypto because they couldn’t afford to participate. We built this for the people… but now it’s only for the patient and the privileged. Maybe we need to ask: who is this system really serving?

Sarah Luttrell

Oh wow, a $50 fee? How adorable. I bet you didn’t even use a MEV bot to front-run your own transaction. 😘 Maybe try being a real DeFi degens and stop whining like you’re paying for coffee. The blockchain doesn’t care about your budget.

Heath OBrien

Gas fees are just taxes. And taxes are always high when the government is bloated. Ethereum is the IRS of crypto. Move on.

Taylor Farano

Let me guess-you used the ‘fast’ button in MetaMask and now you’re mad? Congrats. You just paid $18 to send $20. You’re not a crypto user. You’re a donation machine.

Toni Marucco

The elegance of Ethereum’s fee structure lies in its alignment of incentives: burn the base fee to disincentivize congestion, tip to reward priority, and cap your exposure with the gas limit. This isn’t a flaw-it’s a market-driven equilibrium. The real tragedy is not the fee spikes, but the lack of user education. We treat blockchain like a black box, then blame it when the lights go out.

Kathryn Flanagan

So let me get this straight. You’re telling me that if I want to swap tokens on Ethereum, I have to pay a fee that’s based on how much computer power the network uses? And that fee can go up if lots of people are trying to do it at the same time? And that’s why sometimes it costs more than the actual token I’m swapping? And you say this is normal? I just don’t understand how this makes sense. I mean, if I go to a store and the price of bread goes up because ten people are buying it at once, I’d think the store is broken. But here, we just say ‘oh well, that’s how it works.’ I just… I don’t know. It feels wrong. Like we’re being tricked into paying for something that should be simple. And now they’re talking about more upgrades and layers and sharding? I just want to send some crypto without losing half my balance to fees. Is that too much to ask?

Scot Sorenson

So you’re telling me the entire ecosystem is built on a bidding war for computational time? And we call this innovation? That’s not a blockchain-it’s a digital auction house. And the only winners are the devs who built the infrastructure and the whales who front-run everyone. The rest of us are just paying to be spectators.

Ike McMahon

Layer 2s are the answer. Seriously. Just use them. Polygon, Arbitrum, Base. They’re safe, fast, and cost less than your morning coffee. You’re not missing out-you’re optimizing.

JoAnne Geigner

I just want to say… I’ve been there. I’ve paid $42 to cancel a failed transaction. I’ve cried over gas fees. I’ve waited 3 hours for a swap to go through. But here’s what I learned: it’s not about the money. It’s about the lesson. Every time I get burned, I learn. I check gas. I use Layer 2. I don’t rush. And now? I feel like I actually understand the system. It’s not perfect. But it’s mine. And I’m not giving up.

Patricia Whitaker

Gas fees? Yeah, I just pay them. What’s the point of crypto if you’re gonna be cheap? If you can’t afford the fee, maybe you shouldn’t be here.

Kim Throne

It’s worth noting that the base fee burn mechanism introduced in EIP-1559 fundamentally altered Ethereum’s monetary policy, making it deflationary under sustained network usage. This is a critical distinction from Bitcoin’s fixed supply model. While Bitcoin’s fee structure incentivizes block space scarcity, Ethereum’s now incentivizes computational efficiency and network-wide deflation. The implications for long-term tokenomics are profound-and often overlooked by casual observers.

Caroline Fletcher

Gas fees are just the government’s way of controlling crypto. They let Ethereum charge you so they can track you. You think you’re decentralized? You’re just paying the IRS with ETH.

Jeremy Eugene

Understanding the distinction between transaction fees and gas fees is foundational to participating in modern blockchain ecosystems. The architectural divergence between UTXO-based systems like Bitcoin and account-based systems like Ethereum fundamentally alters the economic model of fee structures. One pays for data size; the other pays for computational steps. This is not a flaw-it is an evolution of consensus economics.

Nicholas Ethan

Gas fees are a scam. Layer 2s are a scam. Ethereum is a scam. Bitcoin is the only truth.

Rakesh Bhamu

I use Polygon for everything now. Fees are 0.01 cents. I’ve sent over 500 transactions and never had one fail. People still complaining about Ethereum gas? I just smile and send them a link to Polygon. No drama. No stress. Just crypto.

Hari Sarasan

One must recognize that the gas fee mechanism is a manifestation of the blockchain’s hyperbolic discounting function, wherein computational throughput is commoditized via a Vickrey auction mechanism embedded within the consensus layer. The base fee burn, as codified in EIP-1559, introduces a non-linear feedback loop between network utilization and token velocity, thereby altering the entropy distribution of the state transition function. This is not merely a fee model-it is a novel economic equilibrium in distributed ledger theory.