Crypto Payments Nigeria: What You Need to Know

When talking about crypto payments Nigeria, the use of cryptocurrencies to send, receive, or settle value within Nigeria's economy. Also known as digital crypto transactions in Nigeria, it offers faster, cheaper alternatives to traditional banking. This ecosystem rests on blockchain, a distributed ledger that records every crypto move securely, relies on digital wallets, software apps that store private keys and let you manage crypto balances, and is shaped by the Nigerian regulatory environment, the set of laws and guidelines issued by the Central Bank of Nigeria and other authorities. Together, these pieces form a network that lets anyone with a phone move money across borders in minutes.

Why crypto payments matter for Nigerians

Remittances have always been a lifeline for families back home, and crypto payments are changing the game. By bypassing costly correspondent banks, a Nigerian working abroad can send dollars that arrive as stablecoins or local tokens almost instantly. E‑commerce platforms are also hopping on board, letting shoppers pay with Bitcoin, USDT, or emerging Nigerian‑focused tokens, which boosts online sales without waiting for card settlements. The Fintech sector, companies that blend technology with financial services is rapidly integrating crypto APIs, so a mobile‑money app can now convert naira to crypto and back with a few taps. This blend of blockchain, digital wallets, and fintech tools makes cross‑border trade smoother, cuts fees, and opens financial services to the unbanked.

But the journey isn’t all smooth. The regulatory environment influences how quickly businesses adopt crypto payments, and compliance can be a headache. Recent statements from the Central Bank of Nigeria warn against unlicensed crypto activities, pushing firms to obtain proper licenses or partner with regulated exchanges. Security is another hot topic: users must safeguard private keys, use hardware wallets when possible, and stay alert to phishing scams that target crypto‑savvy Nigerians. Despite these hurdles, the market keeps growing, driven by a young, mobile‑first population eager for alternatives to a shaky fiat system. Below you’ll find deep dives into airdrop opportunities, exchange reviews, tax guidance, and more—each article tackles a piece of the puzzle, whether you’re curious about how to claim a token, want to compare exchange fees, or need to understand the legal side of crypto payments in Nigeria.

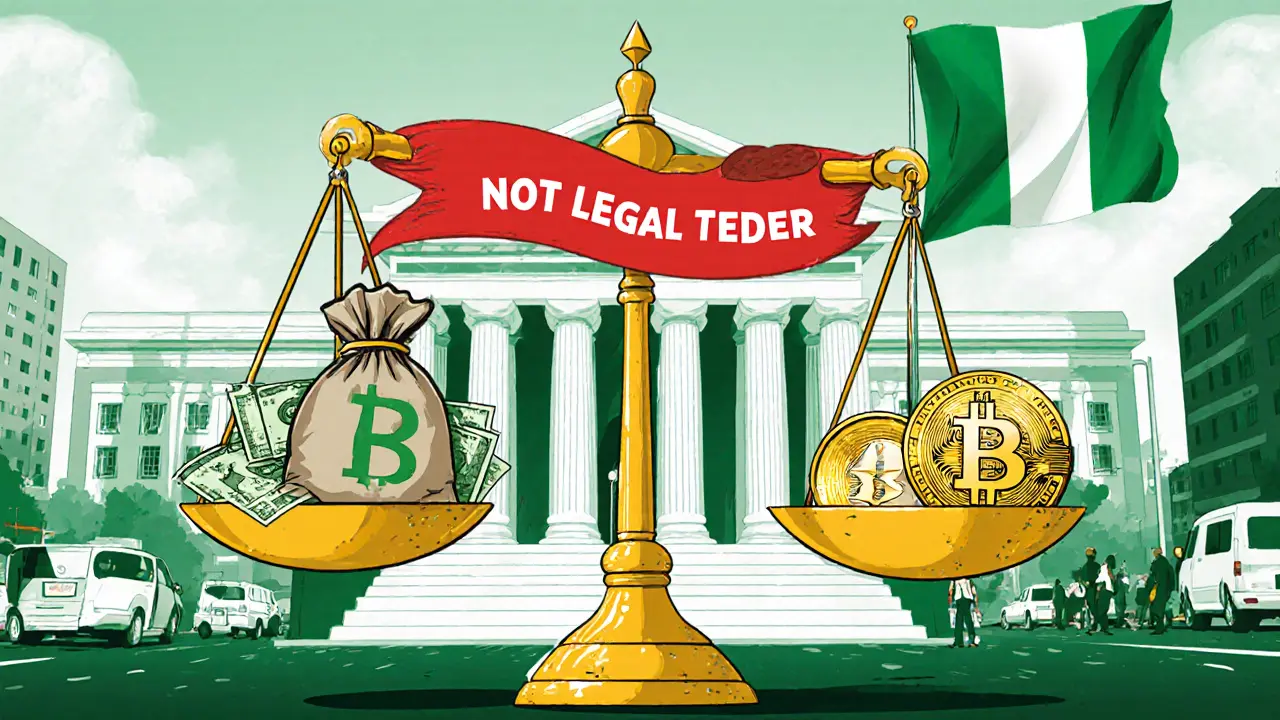

Crypto Payments in Nigeria: Legal Status, Regulations & How to Use Them Safely

Crypto payments are legal but not official tender in Nigeria. This guide explains the 2025 regulations, licensing steps, tax rules, and how to pay with crypto safely.