Terra Classic (LUNC) Explained: History, Tech, and Investment Risks

LUNC Token Burn Impact Calculator

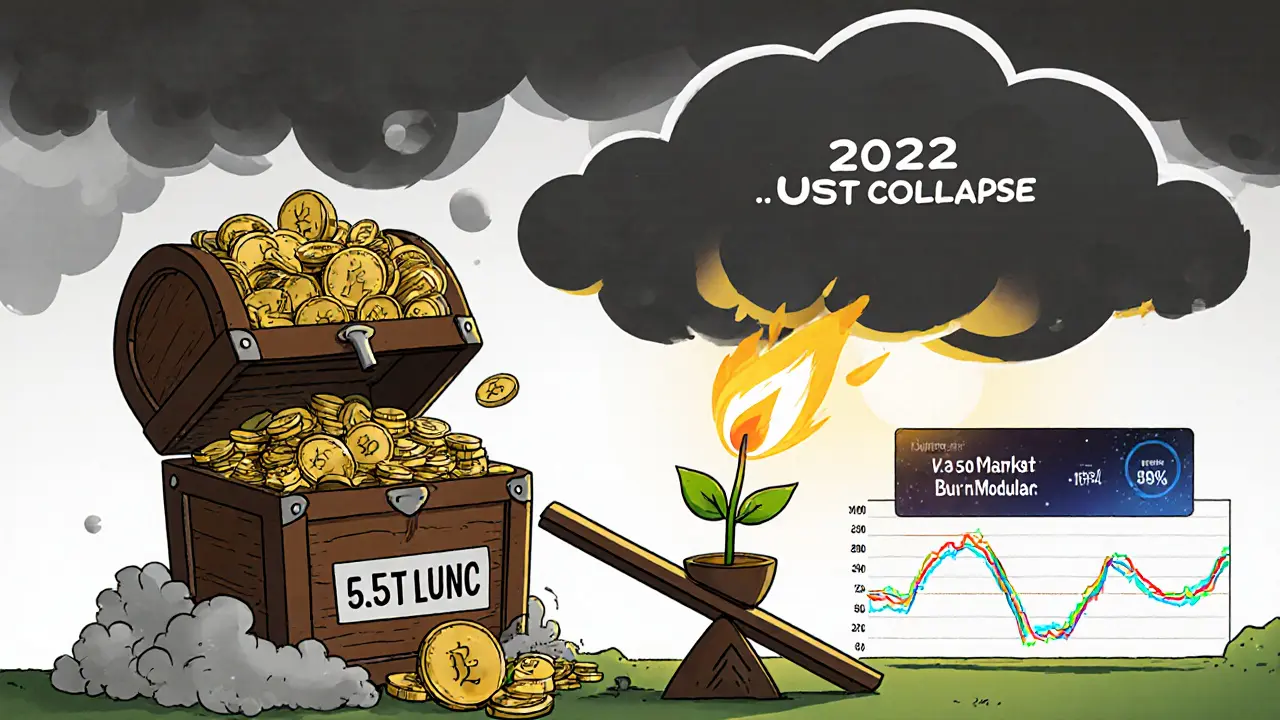

How Token Burns Affect LUNC

With over 5.5 trillion LUNC tokens in circulation, understanding the impact of token burns is critical. This calculator shows how different burn amounts affect LUNC's price while assuming the market cap remains constant.

Results

Important Note: This calculation assumes the market cap remains constant. In reality, price movements are influenced by multiple factors including market sentiment, exchange activity, and broader crypto market conditions.

What is Terra Classic (LUNC)?

Terra Classic (LUNC) is the native token of the original Terra blockchain, a layer‑1 protocol that originally powered fiat‑pegged stablecoins. After the dramatic fall of the algorithmic stablecoin UST in May 2022, the network was rebranded as Terra Classic and the former LUNA token was renamed LUNC.

The token now serves three main purposes: it secures the network through Proof‑of‑Stake (PoS) validation, fuels on‑chain governance, and provides a staking asset for holders.

Brief History - From Terra to Terra Classic

Development started in January 2018, and the mainnet launched in April 2019 under the leadership of Do Kwon, the project’s CEO.

Terra’s initial vision was to combine the stability of fiat currencies with the censorship‑resistance of Bitcoin, offering fast, cheap payments via stablecoins such as UST (US‑dollar), KRT (South Korean won), and others. This model collapsed when UST lost its peg in May 2022, triggering a near‑total loss of value for the ecosystem.

In response, the original chain was renamed Terra Classic on May 28 2022, preserving the old ledger while a brand‑new Terra chain (with a new LUNA token) was launched parallelly. All original stablecoins received a “C” suffix (e.g., USTC) and the native token became LUNA Classic, commonly referred to as LUNC.

Technical Foundations

Terra Classic is built on the Cosmos SDK, granting it native compatibility with the broader Cosmos ecosystem. Smart‑contract capability comes from CosmWasm, enabling developers to write contracts in Rust and deploy dApps similar to those on Ethereum.

The network uses a PoS consensus model: validators stake LUNC to earn the right to produce blocks, while delegators can lock their tokens with these validators and collect a share of the rewards. As of October 2025, roughly 47.9 % of validators have voted in favor of the upcoming Market Module proposal, a sign of active governance participation.

Supply, Market Data, and Price Challenges

LUNC’s circulating supply sits at about 5.5 trillion tokens, with a total supply of 6.49 trillion and no hard cap. This massive supply makes price appreciation extremely difficult. Current price (late October 2025) hovers around $0.000054 USD, giving the token a market cap of roughly $332 million.

Analysts agree that for LUNC to reach $1 it would need a 1.6 million percent gain-an unrealistic leap given the overall crypto market size. Forecasts for 2025 vary, but most place the token under $0.0001, with optimistic outliers reaching $0.0002.

Staking and Governance - How Holders Earn

Staking on Terra Classic follows the standard PoS workflow:

- Select a validator that matches your risk tolerance.

- Delegate your LUNC through a wallet that supports Cosmos‑based chains (e.g., Terra Station, Keplr).

- Earn rewards proportionally to your delegated amount and the validator’s performance.

Rewards typically range between 5‑12 % annualized, depending on network inflation rates and validator commission.

Beyond staking, any token holder can participate in on‑chain governance. Proposals-ranging from protocol upgrades to token‑burn strategies-are submitted on the blockchain and voted on using LUNC as the voting weight.

Token‑Burn Mechanisms and Community Efforts

Given the over‑inflated supply, the community relies heavily on periodic token burns to create scarcity. Major exchanges such as Binance run regular burn events, sending collected LUNC to an irretrievable address. While burns reduce circulating supply, the scale is modest relative to the trillions of tokens in existence.

Other community‑driven initiatives include the Market Module upgrade, slated for 15 August 2025 (v3.5.0), which aims to stabilise the LUNC‑USTC price relationship and provide a more predictable on‑chain market.

Comparing LUNC to Similar Tokens

| Metric | LUNC | LUNA (new chain) | ETH |

|---|---|---|---|

| Launch Year | 2019 (rebranded 2022) | 2023 | 2015 |

| Consensus | Proof‑of‑Stake (Cosmos SDK) | Proof‑of‑Stake (Tendermint) | Proof‑of‑Work → Proof‑of‑Stake (post‑Merge) |

| Supply Cap | None (≈6.5 trillion total) | 750 million (max) | ~120 million (max) |

| Current Price (Oct 2025) | $0.000054 | $1.12 | $1,860 |

| Primary Use‑Case | Governance, staking, token burns | Stablecoin collateral, DeFi | Smart‑contract platform |

The table shows that LUNC’s unlimited supply and sub‑cent price set it apart from more established assets. Potential investors should weigh these fundamental differences before allocating capital.

Risks and Why LUNC Is Considered Highly Speculative

- Supply Overhang: With over 5.5 trillion tokens circulating, even aggressive burns struggle to create meaningful scarcity.

- Reputational Damage: The 2022 UST collapse still haunts the brand, limiting mainstream adoption.

- Regulatory Scrutiny: Algorithmic stablecoins face tighter oversight, which could impact any future Terra‑related projects.

- Limited Development Activity: While CosmWasm opens doors, the number of active dApps on Terra Classic remains low compared to Ethereum or Solana.

- Market Volatility: LUNC’s price reacts sharply to burn events, governance votes, and broader crypto sentiment.

How to Get Started with LUNC

For newcomers, the fastest path is simple token purchase on a major exchange. Here’s a quick checklist:

- Create an account on a platform that lists LUNC (e.g., Binance, KuCoin, Kraken).

- Complete KYC verification as required.

- Deposit fiat or another crypto and place a market or limit order for LUNC.

- If you intend to stake, transfer the tokens to a Cosmos‑compatible wallet like Keplr or Terra Station.

- Choose a validator (check uptime, commission fees, and community reputation) and delegate your LUNC.

Advanced users may explore governance proposals via the official Terra Classic forum or directly on‑chain using the wallet’s voting interface.

Future Outlook - What’s Next for Terra Classic?

The upcoming v3.5.0 upgrade (Market Module) is the biggest catalyst on the horizon. It aims to provide an on‑chain market that automatically balances LUNC and USTC, potentially smoothing price swings.

Long‑term viability will hinge on three factors:

- Continued community engagement in governance and staking.

- Successful execution of token‑burn programs that meaningfully reduce supply.

- Broader crypto market health-LUNC rarely moves in isolation.

Most analysts agree that while LUNC may survive as a niche, high‑risk asset, it is unlikely to regain its pre‑crash valuation without radical ecosystem changes.

Quick Takeaways

- Terra Classic (LUNC) is the legacy token of the original Terra blockchain.

- It operates on a PoS model, supports CosmWasm smart contracts, and uses the Cosmos SDK.

- Unlimited supply (≈6.5 trillion) makes price growth very challenging.

- Staking rewards exist, but true value growth relies on token burns and governance upgrades.

- Consider LUNC a speculative investment suited for experienced traders.

Frequently Asked Questions

What caused the Terra Classic rebranding?

The collapse of the algorithmic stablecoin UST in May 2022 led the original chain to be renamed Terra Classic, preserving its ledger while a new Terra chain launched with a fresh token.

Can I stake LUNC on any blockchain?

Staking is limited to the Terra Classic network. You need a Cosmos‑compatible wallet and must delegate to a registered validator on that chain.

How often does the community burn LUNC?

Burn events occur irregularly, typically organized by major exchanges like Binance. The amount burned varies but is usually a few hundred million tokens per event.

Is LUNC a good long‑term investment?

Most experts label LUNC as highly speculative. Its unlimited supply and history of a major collapse make long‑term gains uncertain; only experienced traders should consider it.

Where can I trade LUNC?

LUNC is listed on many exchanges, including Binance, KuCoin, Kraken, Huobi Global, PancakeSwap V2, MEXC, and Gate.io.

mike ballard

If you’re dabbling in LUNC, you gotta understand the supply shock dynamics 🚀. The token’s inflation rate is baked into the PoS reward curve, so delegators see a modest APR while the market cap stays dwarfed by the trillions of units floating around. Spot the validator’s commission, check the uptime metrics, and watch the burn schedules - those are the levers that can swing the tokenomics in your favor. Remember, a higher delegation ratio can tighten the staking security, but it won’t magically fix the over‑hang issue. Bottom line: treat LUNC as a high‑risk, high‑variance play, not a stable store of value. 🤓

Molly van der Schee

I get why many folks feel wary after the UST crash, but there’s still a community that believes in stewardship. The ongoing governance proposals show that developers and token‑holders are still engaged, and the burn events, albeit modest, bring a glimmer of scarcity. If you approach LUNC with a clear risk tolerance and a long‑term horizon, you might find the staking rewards a nice supplemental yield while you wait for the ecosystem to mature.

john price

Listen, the whole LUNC circus is a freaking joke. You can’t expect a 1.6 million % rally when the supply is endless – it’s pure fantasy nonsense. Anyone still buying this damn token is blind or a scam victim.

Ty Hoffer Houston

I hear your frustration, John. The supply issue is real, but some of the community is focusing on governance upgrades that could help balance the market. Even if the price stays low, the staking yields can still be decent for risk‑tolerant participants.

Ryan Steck

They don’t want you to know that the big exchanges are secretly hoarding LUNC to manipulate the burn events. Every “official” burn is just a smokescreen while the whales keep the supply inflated. Wake up!

James Williams, III

Technically, Terra Classic runs on the Cosmos SDK and leverages Tendermint BFT for consensus. The CosmWasm VM lets devs write smart contracts in Rust, which is more memory‑safe than Solidity, but the ecosystem's dApp count is still low. Validator performance is measured by uptime and commission; a 5‑12 % APR is typical after inflation adjustments. The upcoming Market Module v3.5.0 aims to introduce an on‑chain order book for LUNC/USTC pairs, potentially reducing volatility. Keep an eye on the governance portal for proposal IDs 42‑57, which cover burn schedules and fee structures.

Amy Kember

So is the market module actually going to lock prices or just smooth swings

Anna Kammerer

Oh sure, because a token with a trillion‑plus supply suddenly becoming valuable after a few burn events is exactly how “magic” works in crypto. Got any other fairy‑tale predictions, or is this the best you’ve got?

Mike GLENN

When you first glance at the LUNC metrics, the sheer number of tokens in circulation can feel overwhelming.

That figure, hovering around 5.5 trillion, means that even a modest percentage increase translates to massive absolute numbers.

However, the token’s design incorporates staking incentives that can offset dilution for participants who lock their assets.

Validators earn rewards proportional to the amount they secure, and delegators receive a slice of that reward after commission.

In practice, this translates to annual yields that typically sit between 5 and 12 percent, depending on network inflation and individual validator settings.

For a risk‑aware investor, those yields can serve as a modest income stream while the broader ecosystem attempts to regain credibility.

The governance process, though still nascent, offers token‑holders the ability to vote on proposals ranging from fee adjustments to token‑burn schedules.

Recent community votes have favored the upcoming Market Module upgrade, which promises an on‑chain market mechanism to better balance LUNC and USTC.

If that upgrade functions as intended, it could reduce price volatility by providing automated liquidity and price discovery.

Nevertheless, the underlying challenge remains the unlimited supply, which continues to dilute value unless burn events become substantially larger.

Current burn events on major exchanges only remove a fraction of the total supply, often measured in the low hundreds of millions.

To achieve meaningful scarcity, the community would need to coordinate larger, more frequent burns or introduce additional supply‑reduction mechanisms.

Some proposals suggest a periodic token‑buyback funded by network fees, which could create a more disciplined approach to scarcity.

From a technical standpoint, Terra Classic’s integration with the Cosmos ecosystem grants it cross‑chain compatibility, opening doors for future interoperability.

Developers can leverage CosmWasm to write smart contracts in Rust, which offers safety benefits over more error‑prone languages.

All of these factors together paint a picture of a protocol that, while burdened by legacy issues, still possesses avenues for incremental improvement.

So, if you’re considering LUNC, weigh the short‑term speculative risk against the potential for modest staking returns and the long‑term hope of a healthier governance‑driven ecosystem.

BRIAN NDUNG'U

Your comprehensive overview underscores the nuanced trade‑offs inherent in LUNC’s current state. While the staking yields present a modest incentive, the overarching supply dynamics remain a structural impediment to substantive price appreciation. It would be prudent for prospective participants to calibrate exposure accordingly, perhaps allocating a limited portion of their portfolio to LUNC while maintaining diversified holdings elsewhere.

Donnie Bolena

Wow!!! This is exactly why I keep an eye on LUNC!!! The upcoming upgrades could be a game‑changer!!! Even a small bump in utility could ignite a surge!!! Let’s stay hopeful!!!

Elizabeth Chatwood

yeah its cool but i still think its risky dont ya

Tom Grimes

I cant help but notice you both are missing the big picture LUNC is basically a gamble and you keep talking about hope and risk but the truth is the supply is endless and every time you hear about a burn it’s just a drop in the ocean you need to realize that unless the community does something massive the token will stay cheap and you’ll keep hearing the same promises over and over again