Understanding Zero-Confirmation Transaction Risks and How to Manage Them

Zero-Confirmation Risk Calculator

Transaction Details

Risk Assessment Result

When a crypto payment lands in your wallet instantly, it feels like magic-until the money vanishes. That sudden loss is the core of zero-confirmation transaction risks. This article breaks down why those risks exist, who’s most exposed, and practical steps to keep your business safe while still enjoying near‑instant payments.

What is a Zero-Confirmation Transaction?

Zero-Confirmation Transaction is a cryptocurrency payment that has been broadcast to the network but has not yet been recorded in a block on the blockchain. In other words, the transaction lives in the Mempool - the pool of all pending transactions waiting for miners to scoop them up. Because the transaction hasn’t been sealed by a miner, the sender can still try to spend the same coins elsewhere.

How Does It Work?

When you hit “send” in a wallet, your client builds a transaction, signs it, and pushes it to several Network Nodes - computers that relay the data across the peer‑to‑peer network. Those nodes immediately share the transaction with their peers, creating a wave of propagation. Merchants who run a node or use a payment processor can see that wave and decide, “I’ll trust this because it’s already spreading far enough.”

Traditional payments wait for at least one block confirmation (about 10 minutes for Bitcoin). Zero‑conf skips that wait, relying on the assumption that a widely propagated transaction will likely be included in the next block.

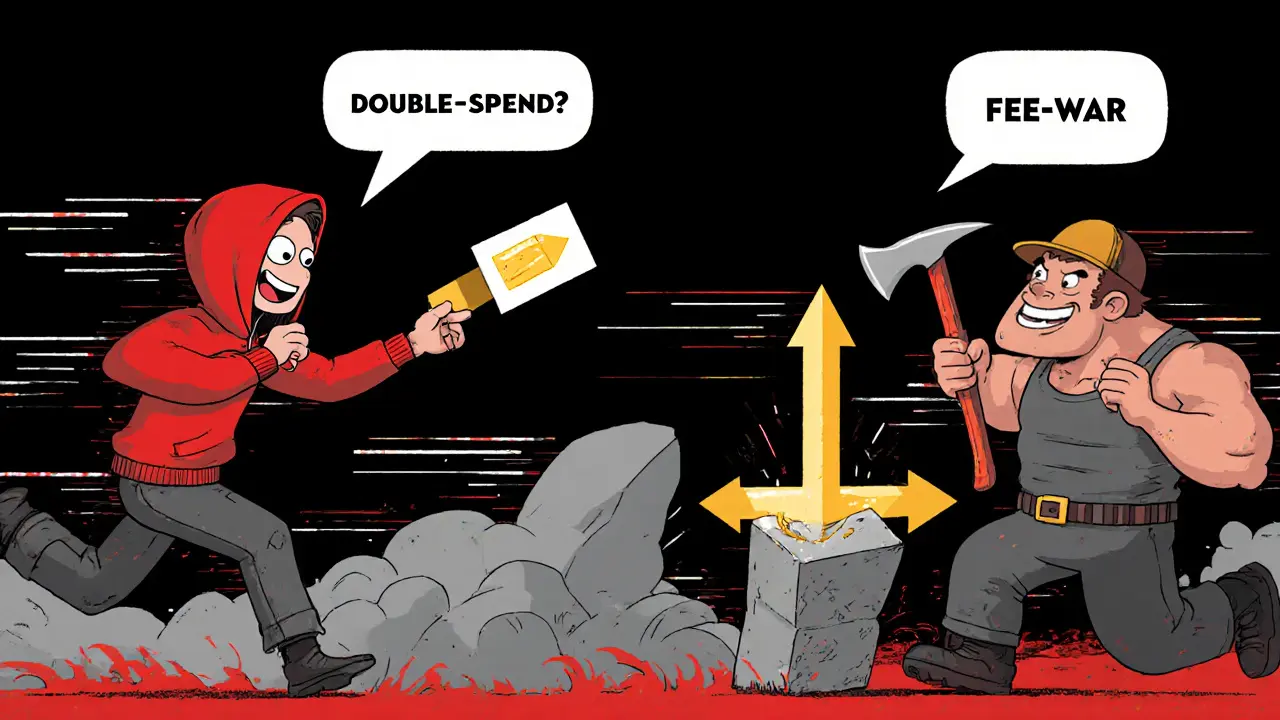

The Biggest Threat: Double‑Spending

The term Double‑Spending describes the act of attempting to spend the same digital coins in two separate transactions. Because a zero‑conf transaction isn’t yet part of the immutable ledger, a malicious sender can broadcast a competing transaction that pays a different party. Miners will eventually choose one of the two, and the other will be rejected.

Successful double‑spends usually follow a pattern: the attacker sends a low‑fee zero‑conf transaction to a merchant, immediately follows with a higher‑fee conflicting transaction that targets a miner they control or have bribed. The miner includes the high‑fee version in the next block, effectively reversing the merchant’s receipt.

Other Not‑So‑Obvious Risks

- Miner Censorship - Some miners may deliberately ignore certain zero‑conf transactions, especially if they see higher‑fee alternatives, leaving merchants with unpaid orders.

- Transaction Fee Manipulation - Sending a transaction with a fee too low can keep it stuck in the mempool for hours, increasing exposure to double‑spend attempts. In extreme cases the transaction may be dropped entirely.

- Network Congestion - During spikes in usage, even well‑fee’d transactions linger, widening the attack window.

- Payment Processor Reliability - Some processors claim instant verification but lack robust conflict detection, exposing merchants to hidden risk.

When Is It Reasonable to Accept Zero‑Conf?

Not every payment needs the same protection. Here’s a quick rule of thumb many merchants follow:

- Low‑Value Purchases: Under $50 (or equivalent crypto) - the potential loss is small enough to accept the convenience.

- Trusted Counterparties: Repeat customers, known businesses, or partners with a strong reputation.

- Fast‑Moving Goods: Food, coffee, vending‑machine items where delay would break the sale.

- High‑Risk Scenarios: Anything above the threshold, large‑ticket items, or first‑time buyers - wait for at least one confirmation.

Risk‑Mitigation Strategies

Below are proven tactics you can layer to shrink the attack surface.

- Widen Propagation: Broadcast the transaction to as many nodes as possible. Some payment APIs let you push the transaction to a list of high‑connectivity peers.

- Real‑Time Conflict Monitoring: Use tools that watch the mempool for double‑spend attempts. If a conflicting transaction appears, abort the sale.

- Dynamic Fee Adjustment: Offer a “fast‑pay” option that adds a higher fee, encouraging miners to prioritize the transaction.

- Threshold Limits: Set a dollar‑value ceiling for zero‑conf acceptance; automatically fall back to confirmed payments beyond that.

- Payment Processor Integration: Choose processors that provide instant risk scoring, conflict alerts, and the ability to revert goods if a reversal occurs.

Technical Checklist for Merchants

| Aspect | Zero‑Confirmation | Confirmed (1+ block) |

|---|---|---|

| Speed | Seconds to minutes | 10‑60+ minutes |

| Security | Vulnerable to double‑spending, miner censorship | Cryptographic finality after sufficient confirmations |

| Typical Use Cases | Low‑value retail, vending, digital content | High‑value purchases, escrow, contracts |

| Recommended Fee Strategy | Medium to high fee for fast inclusion | Standard fee; optional fee bump for urgency |

| Risk Management Tools | Conflict detectors, propagation monitors | Standard block explorer verification |

Future Outlook: Beyond Zero‑Conf

Second‑layer solutions like Lightning Network, state channels, and sidechains aim to give instant finality without the double‑spend window. While these technologies are still maturing, they promise a future where merchants can enjoy speed *and* security.

In the meantime, the best approach is a hybrid model: accept zero‑conf for tiny, high‑frequency sales, switch to confirmed payments for anything larger, and continuously monitor the evolving risk landscape.

Frequently Asked Questions

Can I accept zero‑confirmation payments for Bitcoin?

Yes, but only for low‑value transactions where the potential loss is acceptable. Pair it with real‑time conflict monitoring to spot double‑spend attempts.

What software can detect double‑spending?

Several open‑source tools like Bitcoin Core’s getrawmempool API, as well as commercial services such as BlockCypher and BitPay, provide conflict alerts. Choose one that fits your infrastructure.

How much fee should I attach to a zero‑conf transaction?

Aim for a fee that places your transaction in the top 10% of the mempool’s fee market. During high congestion, this could mean paying 1‑2sat/byte for Bitcoin.

Is miner censorship a real concern?

It can be, especially for low‑fee transactions. Some miners favor higher‑fee traffic, so a zero‑conf payment with an inadequate fee may be ignored, leaving you without confirmation.

Should I switch to the Lightning Network?

If your business handles many small, repeat payments, Lightning offers true instant finality with low fees. However, it adds operational complexity, so evaluate the trade‑offs before migrating.