Upbit KYC Violations: Inside the 500,000 Crypto Compliance Cases

Upbit KYC Breach Impact Calculator

Impact Summary

Enter values and click 'Calculate Impact' to see results.

When South Korea’s Financial Intelligence Unit (FIU) uncovered more than half a million KYC breaches at the country’s biggest crypto platform, the crypto world sat up straight. The Upbit KYC violations expose how a single exchange can become a compliance nightmare and why regulators are tightening the screws on digital‑asset firms worldwide.

Upbit is South Korea’s largest cryptocurrency exchange, handling roughly 80% of domestic crypto trading volume and processing over $8billion daily as of early 2025. The platform is operated by Dunamu, a fintech company that went public in 2020 and has since become the backbone of the nation’s crypto infrastructure. The investigation was launched by the Financial Intelligence Unit, the investigative arm of South Korea’s Financial Services Commission, which enforces the country’s anti‑money‑laundering (AML) regime.

At the heart of the case is the Special Financial Transactions Act, a law that demands stringent Know Your Customer (KYC) checks for any entity handling virtual assets. The FIU alleges that Upbit repeatedly fell short of these KYC standards, accepting photocopied IDs, ignoring serial‑number verification on driving licences, and even processing transactions with unregistered foreign exchanges.

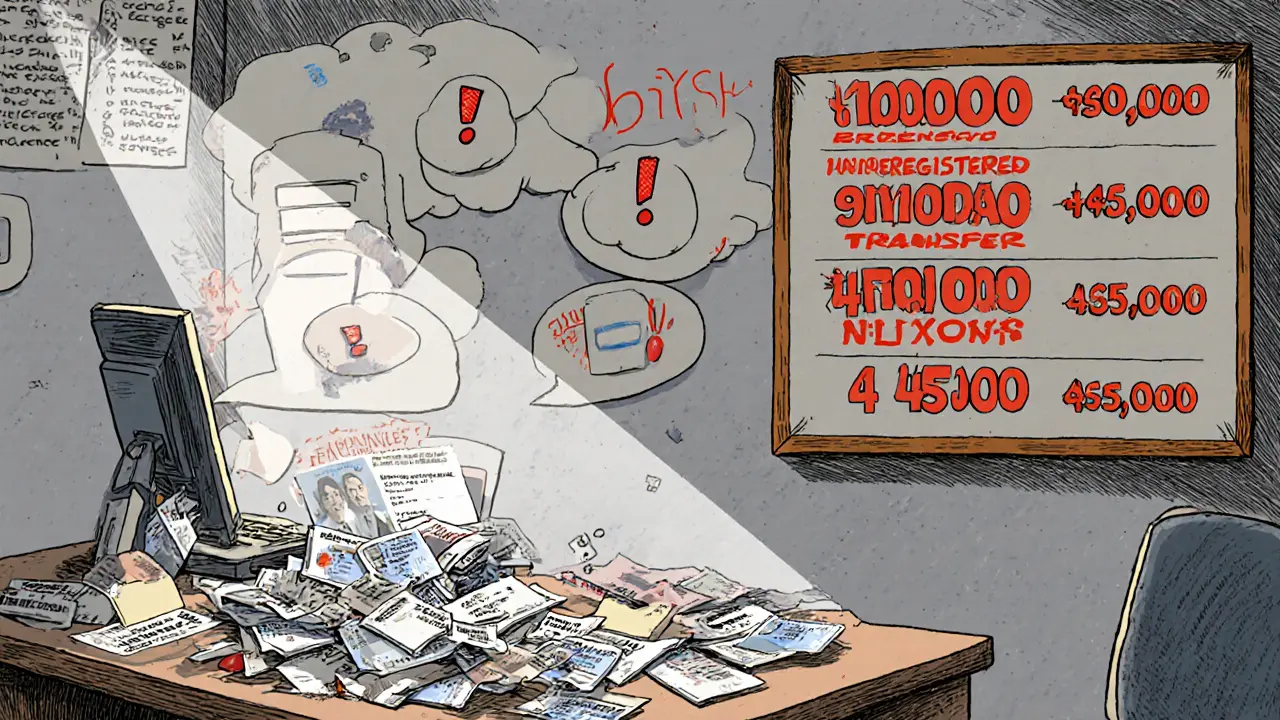

What the FIU Found: A Breakdown of the Violations

- ~190,000 accounts used driving‑license data without authenticating the encrypted serial number required by South Korean law.

- Over 9million re‑verification attempts where no official ID was collected at all.

- Approximately 45,000 cross‑border transfers to unregistered foreign exchanges, directly contravening reporting obligations.

- Photocopied or blurred identification documents accepted for new account registrations.

These failures weren’t isolated glitches; they point to a systematic breakdown in Upbit’s compliance infrastructure. The FIU’s audit, conducted during a routine license‑renewal review in late 2024, flagged each shortfall as a direct breach of the Special Financial Transactions Act.

How the Scale Compares Globally

Until now, no crypto‑exchange has faced a KYC investigation of this magnitude. For context, Binance negotiated a $4.3billion settlement with U.S. authorities in 2023, but the case involved far fewer individual violations. Upbit’s 500,000+ breaches dwarf most prior enforcement actions, both in count and in the potential financial exposure.

| Aspect | Upbit (South Korea) | Binance (United States) |

|---|---|---|

| Regulatory body | Financial Intelligence Unit (FIU) / Financial Services Commission | U.S. Department of Justice & Financial Crimes Enforcement Network |

| Violations identified | ≈500,000 KYC breaches | ≈30,000 AML‑related findings |

| Potential maximum fine | Up to 100millionKRW per breach (theoretical $34billion) | $4.3billion settlement |

| Immediate operational sanction | 6‑month suspension of new user registrations | No suspension; continued operation under monitoring |

| Market share impact | Potential shift of 80% domestic volume | Global market share remained largely stable |

Why This Matters for Crypto Traders and Exchanges

Upbit’s dominance in South Korea means any disruption reverberates through the $50billion daily Korean crypto market. Traders worry about access to funds, while rival exchanges see an influx of users seeking a more compliant platform.

For exchange operators worldwide, the case is a wake‑up call. The FIU’s audit demonstrated that regulators now scrutinize historical onboarding data, not just current practices. Compliance teams must be ready to produce three‑year‑old KYC records, complete document‑authentication logs, and transaction audit trails on demand.

Compliance Lessons: Upgrading KYC in Practice

- Document authenticity checks: Deploy AI‑driven image analysis and encrypted serial‑number verification for government IDs and driving licences.

- Multi‑layer identity verification: Combine biometric facial recognition with real‑time data cross‑checks against national registries.

- Continuous re‑verification: Schedule periodic KYC refreshes for inactive accounts and flag any missing documentation.

- Cross‑border transaction monitoring: Implement automated screening for transfers to unregistered foreign exchanges, with real‑time alerts.

- Robust audit‑ready data storage: Maintain immutable logs for at least five years, searchable by regulator request.

These steps increase operational costs, but they also reduce the risk of punitive fines and protect user trust.

Legal and Market Outlook

Upbit’s operator, Dunamu, has filed a lawsuit challenging the FSC’s suspension notice, signaling a protracted legal battle. The critical deadline for Upbit’s response is January202025, with the FSC slated to announce final penalties on January212025. While nothing is decided yet, analysts expect a negotiated settlement that will still require Upbit to overhaul its compliance framework.

Should Upbit emerge with a revamped KYC system, South Korea could solidify its reputation as a crypto‑friendly yet rigorously regulated hub, encouraging other jurisdictions to adopt similar intensive licensing reviews. Conversely, a harsh penalty could push domestic traders toward offshore platforms, fragmenting the market.

What Traders Can Do Right Now

- Monitor official announcements from the FSC and Upbit’s corporate communications.

- Consider diversifying holdings across multiple exchanges, especially those with transparent compliance reports.

- Keep personal KYC documents up to date and store copies securely; this speeds up any re‑verification requests.

- Stay informed about broader global regulatory trends; upcoming AML rules in the EU and U.S. may affect cross‑border liquidity.

Key Takeaways

- Upbit faces over 500,000 KYC breaches, the largest crypto compliance case on record.

- Potential fines could reach billions, though a negotiated settlement is more likely.

- The case forces exchanges worldwide to tighten document‑verification and audit‑readiness.

- South Korea’s crackdown may set a new global standard for crypto‑exchange licensing.

Frequently Asked Questions

What specific KYC failures did Upbit commit?

The FIU flagged four main issues: accepting photocopied IDs, not verifying encrypted serial numbers on driving licences, failing to collect any ID in over 9million re‑verification attempts, and processing transfers to unregistered foreign exchanges.

How much could Upbit be fined?

Under the Special Financial Transactions Act, each breach can carry up to 100millionKRW (about $68,600). With 500,000+ breaches, the theoretical maximum exceeds $34billion, though actual penalties will likely be far lower after settlement negotiations.

Will Upbit stop operating?

The FSC has proposed a six‑month suspension of new user registrations, but existing accounts remain active. A complete shutdown is not on the table at this stage.

How does this case affect other exchanges?

It sets a precedent for deep‑dive licensing audits. Exchanges in similar jurisdictions will likely see stricter document‑verification requirements, longer audit trails, and higher compliance staffing budgets.

What should traders do now?

Keep an eye on official announcements, consider spreading funds across multiple compliant exchanges, and make sure your personal KYC documents are current and validated.

Debra Sears

Seeing the sheer scale of the Upbit breaches, it's clear that everyday traders could face real liquidity headaches. Many users rely on that platform for quick swaps, and a suspension could freeze access to funds for weeks. The ripple effect might push folks toward less regulated offshore services, which defeats the purpose of tighter rules. For anyone with assets on Upbit, now's the time to back up private keys and consider diversifying across compliant exchanges. Staying informed about official FSC updates will help mitigate surprise downtime.

Matthew Laird

This kind of lax oversight proves why we need stricter American crypto regulations right now.

Jason Wuchenich

Upbit's situation is a stark reminder that compliance isn't a nice‑to‑have-it's the foundation of a trustworthy market. Exchange teams should view this as a catalyst to invest in robust KYC pipelines, even if it bumps up operational costs. Automated document verification, biometric checks, and immutable audit logs can go a long way. Traders also benefit from knowing their platform can survive regulatory scrutiny. In the long run, these upgrades protect both users and the broader ecosystem.

Lara Decker

Upbit's negligence borders on criminal, given the volume of falsified IDs they processed. Accepting blurred documents and ignoring serial‑number checks shows a blatant disregard for the law. The fact that they allowed millions of re‑verification attempts without proper ID suggests systemic fraud. Regulators should treat this as a warning sign for every exchange that cuts corners. If they don't face a crushing fine, the entire Korean crypto market loses credibility.

Anna Engel

Sure thing, but the damage is already done.

Marcus Henderson

While the concerns raised about Upbit's documentation processes are indeed serious, it is essential to recognize that remediation can be achieved through phased implementation of AI‑driven verification tools. By integrating encrypted serial‑number validation and real‑time cross‑checks with governmental registries, the exchange can restore regulatory confidence. Additionally, transparent reporting to the FIU during each remediation stage will demonstrate good faith. A collaborative approach between Upbit and the FSC may ultimately reduce the punitive financial exposure while safeguarding market stability.

Andrew Lin

Yo, this is the biggest crypto scandal since the Binance thing, and Upbit looking like a clown with a broken circus tent! They let half a million shady accounts run wild and now the gov't is ready to drop a bomb on their heads. If they don't fix it ASAP, we're gonna see a massive bleedout of Korean crypto users to shady offshore sites. This could be the end of Korean crypto as we know it, no joke.

Nicholas Kulick

Upbit's breach scale indeed dwarfs previous cases, but the fine calculations depend on negotiated settlements rather than maximum statutory penalties.

Heather Zappella

Comparing South Korea's crackdown to the EU's upcoming AML directives highlights a global shift toward stricter oversight. While the EU focuses on a risk‑based approach, Korea is opting for zero‑tolerance on documentation fraud. This divergence can create compliance challenges for exchanges operating in multiple jurisdictions, requiring them to maintain parallel KYC frameworks. Traders who value regulatory certainty may gravitate toward platforms that can seamlessly adapt to both regimes. Ultimately, such international pressure could elevate overall market integrity.

Kate O'Brien

Honestly, it feels like the FIU is being used as a tool for a hidden power‑play. Maybe there's a bigger agenda to push Korean users onto foreign exchanges they control. The timing with upcoming elections is weird, right?

Ricky Xibey

Keep an eye on the FSC's official notices and back up any private keys you hold on Upbit.

Sal Sam

Monitoring the FSC release pipeline and maintaining an offline cold‑storage of private keys mitigates exposure to potential suspension‑induced liquidity constraints.

Moses Yeo

The Upbit KYC debacle, while sensationalized in mainstream crypto media, actually underscores a deeper philosophical tension between state sovereignty and individual financial autonomy. Regulators, armed with sweeping legislative tools, are effectively rewriting the social contract that underpins digital asset transactions. By demanding exhaustive identity verification, they risk converting the blockchain from a trustless ledger into a government‑run registry. Moreover, the sheer volume of breaches-half a million-could be interpreted not merely as negligence but as a collective act of civil disobedience against intrusive oversight. When citizens are forced to submit photocopied IDs and blurred documents, they are, in effect, consenting to a system that compromises privacy for the illusion of security. The narrative that fines will simply "punish" Upbit ignores the opportunity cost imposed on every user whose assets become collateral in a geopolitical power play. In many jurisdictions, similar enforcement actions have precipitated capital flight, eroding the tax base that governments purportedly aim to protect. The South Korean case, therefore, may serve as a cautionary tale: heavy‑handed regulation can catalyze the very market fragmentation it seeks to prevent. One could argue that the FIU's aggressive audit is less about compliance and more about establishing a precedent for future digital currency control. The resultant market shift-projected at up to 80% domestic volume-could disrupt liquidity pools and destabilize price discovery mechanisms. Simultaneously, it offers a fertile ground for offshore exchanges to capture disaffected users, thereby amplifying the global regulatory arbitrage problem. From a philosophical standpoint, the Upbit saga raises the question of whether financial liberty can survive under an ever‑expanding surveillance state. If the answer is no, we may witness a new era of cryptographic innovation designed explicitly to evade KYC constraints. Conversely, if regulators succeed in imposing uniform standards, the ecosystem might evolve toward greater transparency and reduced illicit activity. Neither outcome is inherently desirable; each carries its own set of trade‑offs that require rigorous public discourse. Ultimately, the Upbit case is less a story of a single exchange's failings and more a mirror reflecting society's unresolved conflict between freedom and security.

Caitlin Eliason

Honestly, this whole “freedom vs. security” drama just sounds like an excuse for regulators to tighten their grip, and anyone who thinks otherwise is turning a blind eye to the very real harm these breaches cause to ordinary investors.

Ken Pritchard

In summary, the Upbit investigation highlights three key takeaways: the necessity of rigorous KYC, the potential market impact of regulatory enforcement, and the broader implications for global crypto compliance. Traders should stay vigilant, diversify wisely, and keep their documentation up to date. Exchanges must invest in reliable verification tech and maintain transparent audit trails. By learning from this episode, the community can foster a safer, more resilient market for everyone.

Richard Bocchinfuso

yeah, cant wait to see how this all plays out.