What is Ink Finance (QUILL) Crypto Coin? A Practical Guide to the DAO Financial Tool

Most crypto coins are built for trading, speculation, or simple payments. But Ink Finance (QUILL) isn’t one of them. It’s a financial operating system for decentralized organizations - think of it as QuickBooks meets Ethereum, built specifically for DAOs that need to manage money, make investments, and govern their treasury without a central bank.

What Exactly Is Ink Finance?

Ink Finance is a platform that gives DAOs (Decentralized Autonomous Organizations) the tools to handle money like a real company - but on the blockchain. It’s not just another token. It’s a full suite of financial modules: treasury management, credit lending, investment tracking, and governance voting - all tied together with one native token: QUILL.

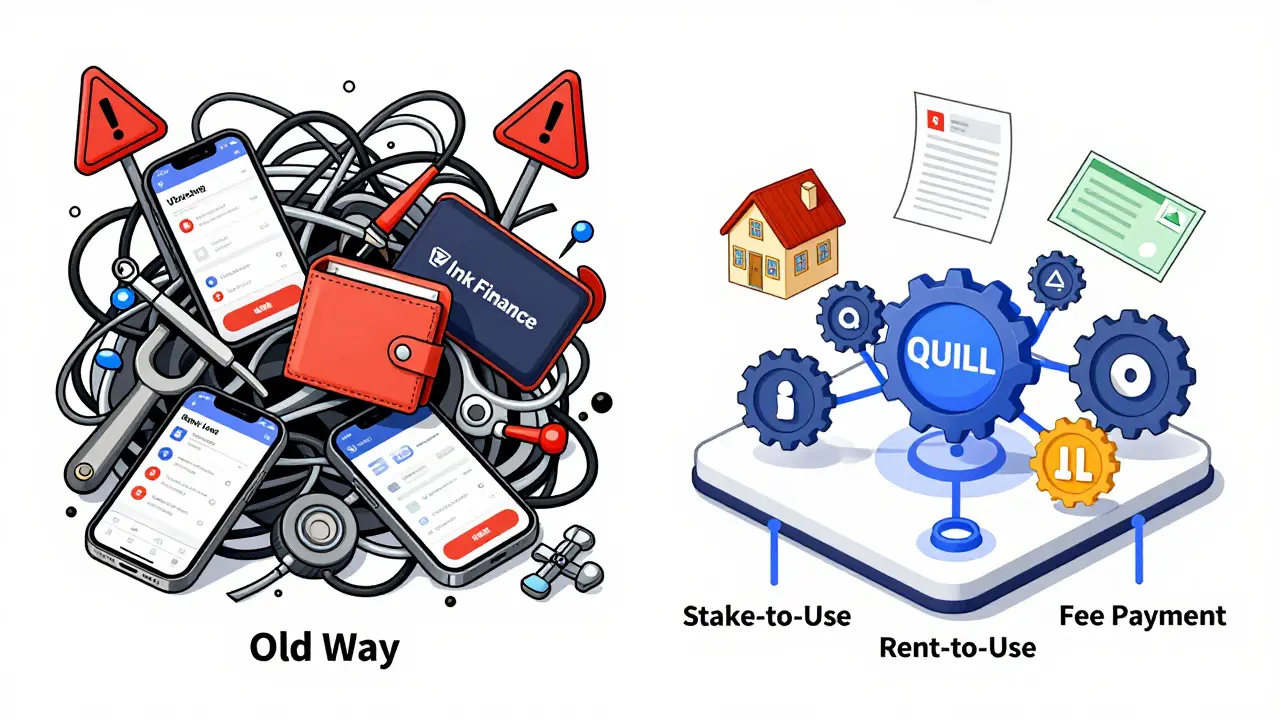

Before Ink Finance, DAOs had to stitch together multiple tools. One for voting, another for holding assets, a third for lending. Ink Finance combines all of it into a single, plug-and-play system. You don’t need to hire a team of developers to build custom smart contracts. The platform lets you configure rules through a no-code dashboard. Want to set up a rule that only allows spending if 60% of token holders approve? Done. Want to lock funds until a milestone is reached? Easy.

How Does the QUILL Token Work?

The QUILL token is the engine of Ink Finance. It’s not just a currency - it’s the key to using the platform. There are three main ways QUILL powers the system:

- Stake-to-use: DAOs stake QUILL to unlock access to financial tools. The more you stake, the more features you can use - like higher credit limits or advanced governance controls.

- Rent-to-use: Instead of staking, you can rent access by paying QUILL as a recurring fee - similar to leasing software.

- Transaction fees: Every time a DAO makes a payment, takes a loan, or moves assets through Ink Finance, a small fee is paid in QUILL.

This model is unusual. Most DeFi tokens are used for yield farming or staking rewards. QUILL is designed to be consumed - used up as part of doing business. That makes it more like a utility tool than a speculative asset.

Technical Specs You Need to Know

QUILL is an ERC-20 token, but it runs primarily on the Avalanche C-Chain. That’s because Avalanche offers fast, low-cost transactions - critical for DAOs making dozens of daily decisions.

- Total supply: 100,000,000 QUILL (fixed, no inflation)

- Current price: Around $0.0035-$0.0037 USD (as of January 2026)

- 24-hour volume: $15K-$60K (very low compared to top DeFi tokens)

- All-time high: $1.16 (December 2024)

- All-time low: $0.003476 (July 2025)

The price drop from $1.16 to under $0.004 isn’t a crash - it’s a reset. Early buyers who bought at peak hype are long gone. What’s left are users who actually need the platform. That’s a good sign.

What Makes Ink Finance Different?

Most DAO tools focus on one thing: governance (like Aragon) or treasury security (like Safe). Ink Finance does both - plus credit, investment tracking, and cross-chain asset management.

The standout feature is the InkEnvelope Asset Abstraction Layer. It lets DAOs move assets between chains - say, from Polygon to Arbitrum - without needing third-party bridges. That’s huge. Bridges are the #1 cause of hacks and lost funds in DeFi. Ink Finance handles it internally, reducing risk.

It also supports real-world assets (RWAs). A DAO can tokenize a rental property, a patent, or even a revenue stream from a Web2 business, and manage it alongside crypto assets. No other DAO finance tool does that at scale.

Who’s Using It?

As of late 2024, over 390 DAOs are actively using Ink Finance. Most are mid-sized - treasuries between $500,000 and $5 million. These aren’t hobby projects. They’re professional groups running communities, funds, or even small businesses.

Users report real savings. One DAO manager on Reddit said using Ink Finance saved them over 40 developer hours by replacing custom code with pre-built modules. Another praised the cross-chain asset moves - something that used to take days and cost hundreds in gas fees.

But it’s not perfect. Around 42% of users say the interface is too complex for non-technical members. The documentation is solid, but it assumes you know what a smart contract is. If your DAO has artists, writers, or volunteers who aren’t coders, onboarding them takes time.

Where Can You Buy QUILL?

QUILL isn’t on Coinbase or Binance. You’ll find it on smaller exchanges: BingX, KuCoin, and LFJ. That’s a red flag for some - but it’s also a sign of its niche focus. It doesn’t need mass retail adoption. It needs serious DAOs.

Trading volume is low - under $60K daily. That means big buys or sells can swing the price. Don’t treat it like Bitcoin. This is a tool token. Buy it if you’re running or joining a DAO that uses Ink Finance. Don’t buy it hoping to flip it.

Pros and Cons at a Glance

| Feature | Ink Finance (QUILL) | Safe (Gnosis) | Aragon | Compound |

|---|---|---|---|---|

| Core Focus | Full financial suite for DAOs | Treasury security | Governance voting | Lending & borrowing |

| Cross-chain support | Yes (Avalanche, Polygon, Arbitrum, BSC, Bitlayer) | Partial | No | No |

| RWA integration | Yes (InkEnvelope) | No | No | No |

| Token utility | Stake-to-use, rent-to-use, fee payment | Not applicable | Not applicable | Staking rewards only |

| Liquidity | Low ($15K-$60K/day) | N/A | N/A | High ($100M+/day) |

| Learning curve | Medium to high | Medium | Medium | Low |

Is Ink Finance Worth It?

If you’re a DAO treasurer, developer, or investor in a decentralized org - yes. It solves real problems. Managing a treasury across multiple chains? Done. Setting up credit lines for contributors? Built-in. Tracking real-world asset income? Possible.

If you’re a retail investor looking for the next 10x coin - no. The market is tiny. The token isn’t designed for speculation. Its value comes from usage. And usage is still growing slowly.

The platform’s growth is real - 47% quarterly increase in active DAOs. But it’s competing against giants like Safe and Llama, which have more users, more funding, and better marketing. Ink Finance’s edge is depth, not breadth.

What’s Next for QUILL?

Ink Finance has a clear roadmap:

- Adding Solana and Ethereum L2s (like Base and Linea)

- Launching institutional custody tools for hedge funds and family offices

- Expanding InkEnvelope to support more real-world assets - think invoices, royalties, carbon credits

- Partnering with Asian banks to bridge Web2 and Web3 finance

They’ve already signed pilot deals with three banking groups. That’s huge. If traditional finance starts using Ink Finance to tokenize assets, QUILL’s utility could explode.

But it’s risky. Regulatory scrutiny on DAO tokens is increasing. The SEC’s new guidance on “programmatic tokens” could classify QUILL as a security if it’s seen as an investment contract. That’s not guaranteed - but it’s a shadow hanging over the project.

How to Get Started

If you’re ready to try it:

- Get a Web3 wallet (MetaMask, Rabby, or Phantom)

- Buy QUILL on KuCoin or BingX

- Go to ink.finance and connect your wallet

- Follow the setup wizard - choose your treasury structure, set voting rules, pick your asset chains

- Stake or rent QUILL to unlock features

Don’t skip the video tutorials. The platform is powerful, but it’s not intuitive. The Discord server has 3,200+ members and responds to 85% of questions within 4 hours. Use it.

Expect to spend 15-20 hours learning before you’re fully comfortable. But if you manage a DAO, that time will pay off in saved costs and fewer mistakes.

Is QUILL a good investment?

QUILL isn’t designed as an investment. It’s a utility token for DAOs. Its value rises when more organizations use it - not when traders buy it. If you’re not running or deeply involved in a DAO, buying QUILL is speculative and risky due to low liquidity and price volatility.

Can I stake QUILL for rewards?

You can stake QUILL, but not for yield. Staking unlocks platform access - it’s a fee payment, not an interest-bearing deposit. There are no staking rewards like you’d see on Ethereum or Solana. The reward is using the tools.

What blockchains does Ink Finance support?

Ink Finance currently runs on Avalanche, Polygon, Arbitrum, BNB Smart Chain, and Bitlayer. More chains, including Solana and Ethereum L2s, are planned for 2025. This cross-chain design lets DAOs move assets without relying on risky bridges.

How is QUILL different from other DAO tokens like UNI or AAVE?

UNI and AAVE are governance tokens for DeFi protocols that let users vote on interest rates or new features. QUILL is a financial operating system token - it’s used to pay for access to treasury tools, credit systems, and asset management. It’s not about voting on protocol changes - it’s about running a DAO’s finances.

Can I use Ink Finance if I’m not a DAO?

Not directly. Ink Finance is built for decentralized organizations with multiple members and treasury needs. Individuals can’t use it to manage personal crypto. But if you’re part of a community, project, or collective that operates like a DAO - even informally - you can set it up.

Is QUILL regulated?

Currently, QUILL is treated as a utility token. But regulators, especially the SEC, are watching DAO tokens closely. If QUILL is seen as offering financial returns or investment opportunities, it could be classified as a security. That’s the biggest legal risk for the project.

Final Thoughts

Ink Finance isn’t flashy. It doesn’t have celebrity backers or viral memes. But it’s solving a real problem: how do decentralized groups manage money without a CEO or accountant? The answer isn’t more crypto. It’s better tools.

QUILL is the key to those tools. If you’re building or managing a DAO - especially one with real assets or multi-chain needs - this is one of the few platforms that actually makes sense. For everyone else, it’s just another crypto token with a low price and thin volume.

The future of DAOs isn’t about bigger token prices. It’s about better finance. Ink Finance is betting on that. And so far, the numbers say it’s winning.

Nishakar Rath

This is the most overhyped piece of garbage I've seen all year. QUILL? More like QUILL-ify your wallet into dust. Nobody needs another 'DAO OS' when Safe and Aragon work fine. This is just VC bait wrapped in blockchain jargon. Low volume? Good. Means the suckers haven't found it yet.

Jason Zhang

I read this whole thing and still don't get why anyone would use this over Gnosis Safe. It's like buying a Ferrari to drive to the corner store. The interface complexity alone makes this a non-starter for most DAOs. Save the gas fees and stick with what works.

Katherine Melgarejo

So let me get this straight… you’re paying in crypto to manage your crypto… using a platform that’s basically a fancy Excel sheet with blockchain stickers on it? Cute.

Patricia Chakeres

Of course they’re partnering with 'Asian banks'. That’s just a cover for China’s CBDC push. This isn’t decentralized finance-it’s a Trojan horse for state-controlled asset tokenization. The SEC is already drafting Rule 10b-5 amendments targeting 'programmatic utility tokens'. They’re coming for QUILL next. Mark my words.

Anna Gringhuis

I’ve used this platform for my co-op’s treasury and it saved us 30+ hours/month. Yes, the UI is clunky-but once you get past the learning curve, the cross-chain asset abstraction is a game changer. The documentation is dense, but the Discord team walks you through it. Stop complaining and try it. Real DAOs aren’t run by meme traders.

Michael Jones

The article contains several grammatical inconsistencies, particularly in the use of em dashes and inconsistent capitalization of 'InkEnvelope.' Additionally, the phrase 'stake-to-use' should be hyphenated consistently throughout. Minor, but important for credibility.

Lauren Bontje

American DAOs don’t need this. We have real finance. This is just another foreign crypto scam trying to sell vaporware to gullible devs. Low volume? That’s because real investors know this is a dead end. Buy Bitcoin. Hold it. Stop chasing unicorn tools built by guys who think 'governance' means voting on a Discord poll.

Stephanie BASILIEN

While the conceptual framework of Ink Finance is undeniably sophisticated, one must consider the ontological implications of tokenizing real-world assets within a decentralized governance architecture. The regulatory uncertainty, particularly under the Howey Test, presents a non-trivial existential risk to the long-term viability of the QUILL token as a utility instrument.

Deb Svanefelt

There’s something beautiful here. DAOs are just communities trying to survive without hierarchies. Most tools treat them like corporations. Ink Finance treats them like people. The fact that it lets a poet, a mechanic, and a grad student manage a shared fund without a CFO? That’s not tech. That’s a revolution. The price doesn’t matter. The use does.

Telleen Anderson-Lozano

I’m torn. On one hand, the cross-chain asset abstraction is revolutionary, and the InkEnvelope system could prevent billions in bridge-related losses. On the other hand, the interface is still too complex for non-technical members, and the low liquidity means even small trades can cause massive slippage. So… it’s amazing, but risky. Maybe if they simplified the onboarding? Or added a ‘basic mode’? I’d love to see that.

Stephen Gaskell

This is why America is falling behind. We don’t need some blockchain accounting tool. We need real jobs. This is just another crypto cult trying to make money off confused millennials.

CHISOM UCHE

The tokenomics are fascinating from a mechanism design perspective. The consumption-based utility model-stake-to-use, rent-to-use, fee-payment-is a novel departure from the yield-farming paradigm. However, the lack of dynamic fee adjustment based on network congestion or treasury volume introduces potential suboptimal equilibria in DAO liquidity provisioning.

Ashlea Zirk

For DAOs managing real-world assets like rental properties or IP royalties, this is one of the few tools that actually works. The documentation is dense, yes-but the templates and pre-built governance modules are incredibly well-designed. I’ve onboarded three non-tech DAOs onto this platform. Each one saved over $10k in legal and dev costs in the first quarter. It’s not sexy. But it works.

Shaun Beckford

Let’s be real: this is a graveyard token. $1.16 to $0.003? That’s not a reset-it’s a corpse. And now they’re trying to rebrand it as 'utility'? Please. The only people using this are the same 390 DAOs that have been stuck on Avalanche since 2023. No growth. No liquidity. No future.

Chris Evans

This isn’t finance. It’s a new religion. We’ve moved from gods in the sky to gods in smart contracts. QUILL isn’t a token-it’s a sacrament. The DAOs that use it don’t just manage money-they perform ritual governance. The low volume? That’s because the faithful are few. But the faithful? They don’t sell. They worship. And when the next oracle fails, they’ll still be here, staking their souls in QUILL.