FourCoin (FOUR) Explained: What Is This Meme Crypto Coin?

FourCoin Risk Calculator

FourCoin Risk Assessment Tool

This tool calculates potential losses based on FOUR's extreme risk profile. Remember: 92% of tokens under $5M market cap disappear within 18 months (CoinDesk, 2025).

Investment Amount

Current Market Data

Risk Assessment Result

Based on FOUR's current market data:

92% chance of total loss within 18 months according to CoinDesk's 2025 analysis

With your $0 investment, you could lose up to $0 (92% probability)

If you’ve been scrolling through crypto forums or scrolling past Twitter memes lately, you might have seen the hand gesture with four fingers and wondered what it stands for. That’s the FourCoin (FOUR) is a meme‑driven cryptocurrency built on the Ethereum blockchain. It launched from a viral tweet in 2023 and markets itself as a rallying cry against FUD - the fear, uncertainty and doubt that can cripple crypto markets. In this guide we’ll break down exactly what FOUR is, how its tokenomics work, where its price lives, how it stacks up against other meme coins, and what the real risks are if you consider buying it.

What Makes FourCoin Different?

FourCoin isn’t trying to be a payment solution, a DeFi protocol or a smart‑contract platform. Its only “utility” is cultural - the so‑called Foursy hand gesture that users flash in memes, Discord chats and even on‑site meet‑ups. The project has no public founding team, no whitepaper and no roadmap. Its creators explicitly say that Changpeng Zhao (CZ) of Binance has no involvement, despite the original tweet that sparked the hype mentioning Binance’s name.

Tokenomics and Supply Structure

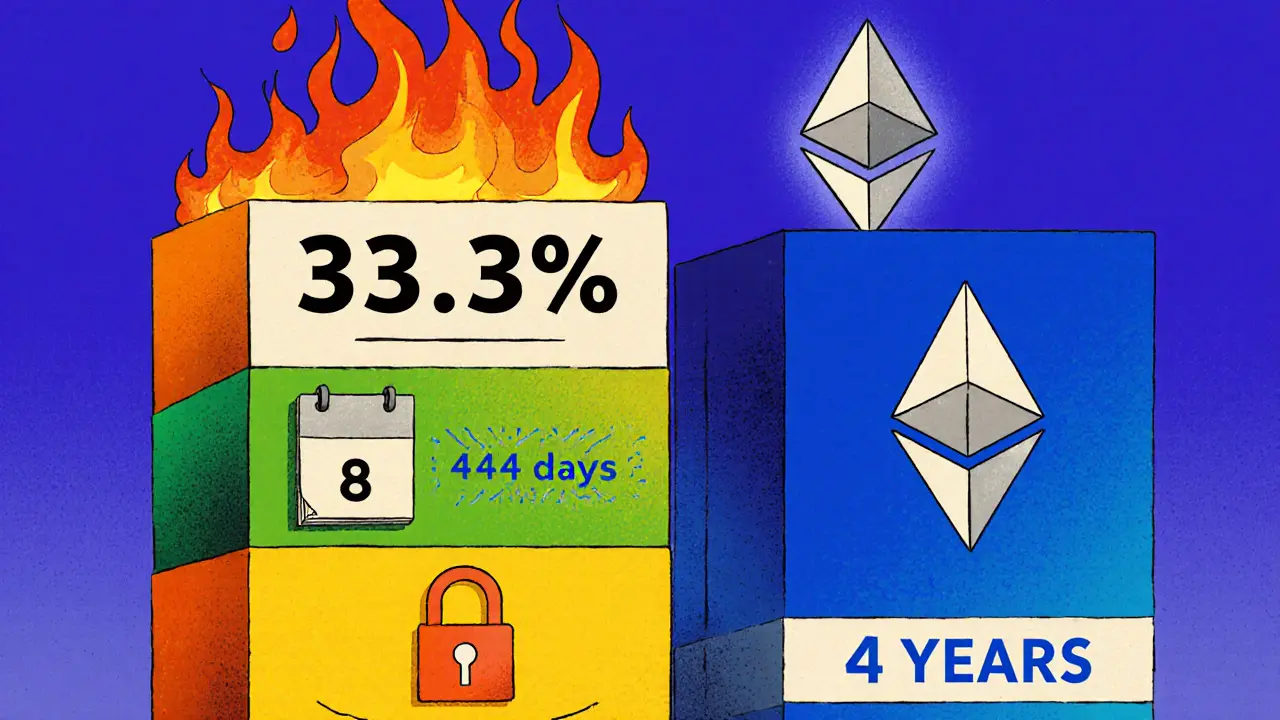

FOUR follows the standard ERC‑20 token model on Ethereum. The total supply is fixed at 444 billion tokens, a number chosen for its visual symmetry with the “four” theme. Token distribution is split into three equal buckets:

- 33.3% of the initial liquidity was permanently burned, removing it from circulation forever.

- Another 33.3% is locked for 444 days - roughly 1 year and 3 months.

- The final 33.3% is locked for 4 years, ensuring that a large share of the supply cannot be dumped by any single holder in the short term.

These locks are verified on Blockspot.io and can be inspected on Etherscan, but there is no on‑chain “governance” or “upgrade” function tied to them.

Current Market Data (October 2025)

FourCoin is a low‑volume token. On October 14 2025 Bybit listed FOUR at $0.00000227 with a 24‑hour range of $0.00000226‑$0.00000240. CoinMarketCap showed a slightly lower price of $0.000002162 and recorded virtually $0 trading volume on the same day. The market cap sits at about $1.01 million, placing FOUR at #4,113 among all cryptocurrencies. In Euro terms the price was €0.000001820, confirming its sub‑penny status.

| Coin | Launch Year | Supply | Market Cap (USD) | Utility |

|---|---|---|---|---|

| FourCoin (FOUR) | 2023 | 444 B | ≈ $1 M | Memetic only |

| Dogecoin (DOGE) | 2013 | 130 B | ≈ $12.5 B | Payments, tipping |

| Shiba Inu (SHIB) | 2020 | 589 T | ≈ $10.2 B | ShibaSwap ecosystem |

Why FourCoin Struggles Compared to Dogecoin and Shiba Inu

The numbers tell the story. Dogecoin sits on a $12.5 billion market cap and trades billions in daily volume, while Shiba Inu enjoys a full DeFi stack with its own DEX. FOUR, by contrast, moves almost no volume - many exchanges report $0 volume for a whole day. Low liquidity means even tiny orders can cause 20‑30% slippage, a fact echoed by users on Binance and Bybit forums. Without a clear use case, price swings are driven purely by social media hype, which can evaporate in minutes.

Risk Profile and Expert Opinions

Multiple analysts label FOUR as “extreme risk.” CoinDesk’s September 2025 memecoin report warned that tokens under $5 million market cap and zero utility have a 92% chance of disappearing within 18 months. Dr. Elena Rodriguez of Blockchain Insights called FOUR “the highest‑risk class of meme tokens,” noting the lack of a development team, whitepaper, or roadmap. The SEC’s 2024 guidance also treats non‑utility tokens as potential securities, effectively shutting them out of regulated U.S. exchanges like Coinbase and Kraken.

How to Buy FourCoin (If You Still Want To)

Because major centralized exchanges don’t list FOUR, you need a Web3 wallet (MetaMask, Trust Wallet, etc.) and access a decentralized exchange (DEX) that supports ERC‑20 tokens. The typical steps are:

- Install a Web3 wallet and fund it with ETH for gas fees.

- Connect the wallet to a DEX such as Uniswap or SushiSwap.

- Paste the verified FOUR contract address from Etherscan.

- Set a limit order (market orders often fail due to thin order books).

- Confirm the transaction and wait for it to settle on the Ethereum chain.

Bybit does offer a spot market for FOUR, but you must complete KYC Level 1, which takes about 15 minutes. Even then, many users report verification failures for low‑volume tokens. If you’re new to DEX trading, expect a steep learning curve - CryptoSlate’s October 2025 survey marked FOUR as “difficult” for 78% of respondents.

Community, Culture, and the Foursy Gesture

Where FOUR does have an edge is its tight‑knit community. The Discord server (≈ 2,300 members as of October 2025) rallies around the Foursy hand sign, using it in memes, profile pictures, and even real‑world meet‑ups. Some holders say they keep their tokens not for profit but to support the anti‑FUD narrative. This cultural stickiness is similar to how Pepe or Wojak memes thrive, but unlike those, the Foursy brand has a limited legal foothold - the original copyright expired in 2023 and hasn’t been renewed.

Bottom Line: Should You Keep an Eye on FourCoin?

If you’re looking for a speculative, meme‑only token with a strong community vibe and you understand the massive liquidity risk, FOUR can be a tiny piece of a larger portfolio. However, the data is stark: sub‑million market cap, $0 daily volume on major aggregators, no utility, and regulatory headwinds. Most experts advise treating FOUR as a “high‑risk collectible” rather than a serious investment. In practice, that means only allocating what you’re willing to lose entirely, using a DEX to buy, and keeping expectations modest - you’re basically buying a meme, not a technology.

What blockchain does FourCoin run on?

FourCoin is an ERC‑20 token hosted on the Ethereum blockchain.

How many FourCoin tokens exist?

The total supply is fixed at 444 billion FOUR tokens.

Is FourCoin listed on Coinbase or Binance?

No. FourCoin is not available on regulated U.S. exchanges like Coinbase or Kraken. Binance offers a spot market, but you need to complete KYC.

What is the Foursy hand gesture?

The Foursy is a hand shown with four fingers raised. It serves as an anti‑FUD symbol for the community.

Is FourCoin a good long‑term investment?

Most analysts label it as extremely high risk because it has no utility, negligible liquidity, and regulatory uncertainty. Treat it as a speculative meme, not a core holding.

Abby Gonzales Hoffman

If you're eyeing FourCoin, here’s a quick cheat‑sheet to get you up to speed. The token runs on Ethereum as an ERC‑20, with a total supply of 444 billion tokens split into three equal lock‑up buckets. One third was burned at launch, another third is locked for 444 days, and the final third stays locked for four years. Because of these constraints, the circulating supply stays tiny, which fuels price volatility whenever someone manages a modest trade. The market cap sits just above $1 million, placing FOUR among the smallest listed coins. Trading volume is practically zero on most aggregators, meaning even small orders can cause massive slippage. To acquire FOUR you’ll need a Web3 wallet with ETH for gas and access to a DEX like Uniswap. Set a limit order rather than a market order to avoid disastrous price swings. Finally, keep your expectations realistic-think of FOUR as a collectible meme rather than a growth investment.

ashish ramani

The token’s supply mechanics are straightforward: 444 billion total, split evenly among three lock periods.

Jennifer Rosada

It is incumbent upon the prudent investor to scrutinize the provenance of FourCoin, which, regrettably, lacks a transparent development team and exhibits characteristics unbecoming of responsible financial instruments. The absence of a whitepaper, roadmap, or identifiable founders raises legitimate concerns regarding accountability and long‑term viability.

LeAnn Dolly-Powell

Love the vibe! 🌟 The FourCoin community really leans into the Foursy hand sign, and that shared enthusiasm can make holding it feel like joining a fun club. Keep that positive energy flowing! 😊

Rohit Sreenath

In a world obsessed with hype, FourCoin feels like a fleeting mirage-bright for a moment, then gone.

Sam Kessler

The memetic veneer of FOUR belies an orchestrated liquidity manipulation schema, potentially tethered to shadow entities seeking to exploit low‑cap crypto arbitrage. Such covert machinations, if true, could exacerbate the already extreme price volatility inherent in meme‑only tokens.

Steve Roberts

While most dismiss FOUR as junk, its cultural resonance offers a niche hedge against mainstream meme fatigue.

John Dixon

Oh, great-another token with a hand sign!!! It's like the internet decided to mint a coin for the sake of novelty!!!

Brody Dixon

I get why some users cling to FOUR; the community vibe can feel like a safe harbor amidst the chaotic market storms.

Mike Kimberly

FourCoin’s tokenomics present a unique case study in meme‑driven scarcity. By allocating exactly one third of the supply to a permanent burn, the project eliminates that tranche from any future market impact. The second one‑third, locked for 444 days, introduces a mid‑term supply constraint that could moderate short‑term dumping pressures. The final third, locked for four years, attempts to reassure long‑term holders that a substantial portion will remain untouchable for an extended horizon. However, the locked tokens are still under the control of unknown parties, and the eventual release could create significant upward or downward pressure, depending on market sentiment at that time. With a total market capitalization hovering around $1 million, even modest trade volumes represent a sizable fraction of daily liquidity. This thin order book means that a single trade of just a few thousand dollars can generate slippage exceeding twenty percent, effectively rendering market entry prohibitively expensive for retail participants. Moreover, the token’s on‑chain data shows no governance mechanisms, so holders have no formal say in future protocol changes or token burn decisions. The lack of a development roadmap further compounds uncertainty, as there is no clear path toward adding utility beyond the meme itself. From a risk perspective, regulatory bodies have flagged low‑cap, non‑utility tokens as potential securities, exposing FOUR to possible enforcement actions. Investors should also be mindful of the high gas fees on Ethereum, which can erode any modest gains from price appreciation. Practically, acquiring FOUR requires using a decentralized exchange and setting a limit order to avoid failed transactions due to insufficient liquidity. For those who value community culture over financial returns, FOUR offers a tight‑knit Discord and a recognizable hand gesture that fosters a sense of belonging. Nevertheless, treating it as a speculative collectible rather than a core portfolio asset aligns with the consensus among analysts. In summary, the token’s design combines intentional scarcity with significant unknowns, making it a high‑risk, high‑volatility instrument that only the most adventurous should consider.

angela sastre

If you decide to buy FOUR, remember to set a modest gas limit and double‑check the contract address on Etherscan before confirming.

Aniket Sable

Dont worry bout the low volume, u can still have fun and maybe catch a lil pump!

Santosh harnaval

Liquidity is basically nonexistent.

Claymore girl Claymoreanime

One must question the intellectual merit of glorifying a token whose sole purpose is to perpetuate a superficial meme.

Will Atkinson

Wow-what a wild ride! The FourCoin saga reminds us that crypto culture can be both whimsical and wildly speculative!

emma bullivant

If we look at FOUR as a symbol, it reflecets the human desire to find meaning in chaos, even if that meaning is just a hand gestur.

Alex Horville

America shouldn't be distracted by foreign meme tokens like FOUR when we have real economic challenges at home.