StellarTerm Crypto Exchange Review: Features, Security, and How It Stacks Up

StellarTerm Features Comparison Tool

Select features to compare between StellarTerm and competing platforms:

| Feature | StellarTerm | Lobstr | Solar Wallet |

|---|---|---|---|

| Platform | Web + Desktop | Mobile (iOS/Android) | Mobile (iOS/Android) |

| Open-source | Yes (GitHub) | No (closed source) | No (closed source) |

| Wallet support | LOBSTR, WalletConnect, Freighter, Ledger, Trezor | Lobstr native, Ledger (via integration) | Solar native, Ledger (via QR) |

| Auto-update | Web version yes, Desktop no | Yes (app stores) | Yes (app stores) |

| Fees | Network fee only | Network fee + 0.5% service fee on trades | Network fee + 0.25% platform fee |

| Advanced orders | None | Limit only | Limit only |

Key Insights

StellarTerm stands out as the most open-source and feature-rich decentralized exchange client. While it lacks advanced order types and auto-updating desktop clients, it offers the highest degree of user control and transparency.

Key Takeaways

- StellarTerm is a free, open‑source client that lets you trade directly on the Stellar Decentralized Exchange without handing over private keys.

- It supports popular wallets such as LOBSTR, WalletConnect, Freighter, Ledger and Trezor, giving you flexible access to your assets.

- All transaction signing happens locally, which boosts security but also means you need to manage backups yourself.

- The web version auto‑updates, while desktop builds require manual updates and lack some of the latest UI tweaks.

- For users who value decentralization and low‑fee trading, StellarTerm is a solid choice; however, it lacks advanced order types and deep liquidity found on major centralized exchanges.

StellarTerm is an open‑source web client for the Stellar network that enables trading on the Stellar Decentralized Exchange, asset transfers, and wallet management. It runs in any modern browser and also offers downloadable desktop versions for Windows, macOS and Linux. Because the software never stores private keys on a server, users retain full control over their funds, a core tenet of the Stellar ecosystem.

In this review we’ll walk through the platform’s core features, security model, user experience, and how it measures up against other Stellar‑focused tools. By the end you’ll know whether StellarTerm fits your trading style or if you should look elsewhere.

What Sets StellarTerm Apart?

StellarTerm sits at the intersection of three distinct entities:

- Stellar network is a public, permission‑less blockchain designed for fast, low‑cost cross‑border payments.

- Decentralized Exchange (DEX) is the on‑chain order‑matching engine that lets anyone trade assets without a central order book built into the Stellar network.

- Open‑source codebase is publicly available on GitHub, allowing anyone to audit, fork, or contribute to the client.

Because the DEX lives on‑chain, trades settle in seconds and cost a fraction of a cent. StellarTerm simply provides a friendly UI to interact with that engine. If you prefer a graphical interface over raw SDK calls, StellarTerm is the most direct bridge between your wallet and the Stellar DEX.

Supported Wallets and Connection Methods

One of the biggest friction points for newcomers is connecting a wallet. StellarTerm aims to reduce that friction by supporting a wide range of wallet providers:

- LOBSTR wallet is a user‑friendly mobile app that stores Stellar keys and integrates directly with StellarTerm.

- WalletConnect is a protocol that lets you link any QR‑code‑compatible wallet to the web client, expanding compatibility beyond Stellar‑specific apps.

- Freighter is a browser extension wallet built for Stellar developers and power users.

- Hardware wallets: Ledger and Trezor are industry‑standard devices that store private keys offline and sign transactions via USB.

The integration works by sending an unsigned transaction to the chosen wallet, which then signs locally and returns the signed blob to StellarTerm. Because the private key never leaves the wallet, the risk of server‑side theft is essentially zero.

Security Model: Keys, Signing, and Updates

Security is a two‑part story: how keys are handled and how the client stays up‑to‑date.

Key handling: When you click “Send” or “Trade”, StellarTerm builds a transaction object, hands it off to your wallet, and receives a signed version back. This process mirrors the “sign‑then‑broadcast” flow championed by hardware wallets. No secret ever touches the StellarTerm servers.

Local signing ensures that even if the StellarTerm website were compromised, an attacker could not forge transactions without your physical device or seed phrase.

Updates: The web version automatically pulls the latest code from the repository each time you load the page, meaning you always get security patches instantly. Desktop builds, however, are static packages; you must download the new version manually. This trade‑off gives you offline capability but adds a responsibility to track releases.

User Experience: Interface, Fees, and Liquidity

The UI follows a clean, two‑pane layout: the left side lists your balances, the right side shows the order book for the selected asset pair. You can filter by asset code, set custom price limits, and view transaction history in real time.

Fees on the Stellar network are baked into the protocol-typically 0.00001 XLM per operation. StellarTerm does not add any additional charge, so the total cost of a trade is effectively just the network fee.

Liquidity, however, depends on the assets you trade. Popular pairs like XLM/USD or XLM/EUR usually have deep order books, while obscure tokens may suffer from thin spreads. Because the DEX runs on‑chain, you can always see the exact depth before committing.

Pros and Cons at a Glance

- Pros

- Zero custody: you keep full control of private keys.

- Supports major hardware wallets for added security.

- Free to use; only network fees apply.

- Open‑source, community‑audited code.

- Instant settlement thanks to the Stellar ledger.

- Cons

- Desktop client requires manual updates.

- No advanced order types (e.g., stop‑loss, trailing stop).

- Liquidity varies widely by asset; not a replacement for major CEXs.

- Interface can feel sparse for beginners accustomed to flashy CEX dashboards.

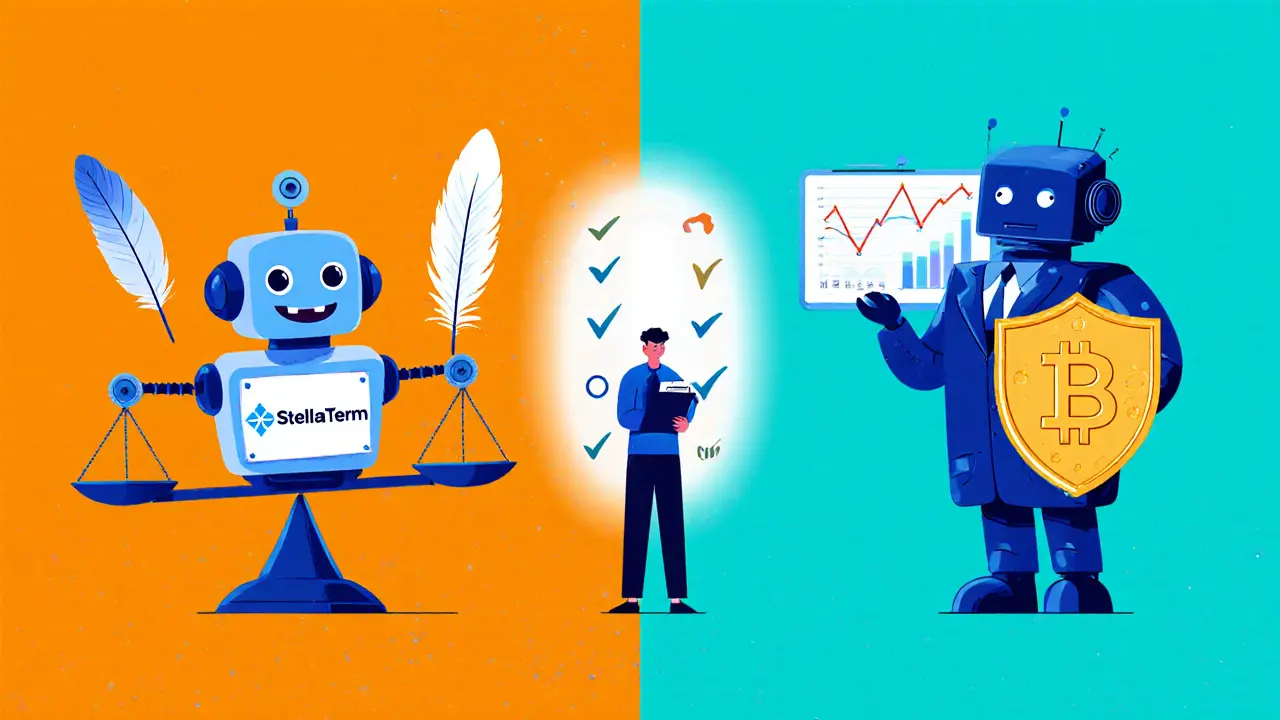

How StellarTerm Stacks Up Against Competitors

| Feature | StellarTerm | Lobstr | Solar Wallet |

|---|---|---|---|

| Platform | Web + Desktop | Mobile (iOS/Android) | Mobile (iOS/Android) |

| Open‑source | Yes (GitHub) | No (closed source) | No (closed source) |

| Wallet support | LOBSTR, WalletConnect, Freighter, Ledger, Trezor | Lobstr native, Ledger (via integration) | Solar native, Ledger (via QR) |

| Auto‑update | Web version yes, Desktop no | Yes (app stores) | Yes (app stores) |

| Fees | Network fee only | Network fee + 0.5% service fee on trades | Network fee + 0.25% platform fee |

| Advanced orders | None | Limit only | Limit only |

If you need a fully custodial experience with slick charts, a centralized exchange might suit you better. But if you value transparency, zero custody, and low fees, StellarTerm is the most feature‑rich open‑source option currently available.

When to Use StellarTerm

Consider StellarTerm if you meet any of the following scenarios:

- You already hold XLM or issued assets on the Stellar network and want to trade without moving to a custodial platform.

- You possess a hardware wallet and demand the highest level of key isolation.

- You enjoy tinkering with open‑source software and want to audit the client yourself.

- You are a developer looking to integrate directly with the Stellar DEX via a UI you can customize.

Skip it if you need features like margin trading, high‑frequency order books, or deep liquidity across dozens of fiat pairs-those are still the domain of large centralized exchanges.

Getting Started in Five Minutes

- Visit stellarterm.com and click “Launch App”.

- Choose a wallet connection method (e.g., “Connect Ledger”). Follow the on‑screen prompts to unlock your device.

- After the wallet loads, your balances appear on the left pane. Pick a trading pair from the dropdown (e.g., XLM/USD).

- Enter the amount you want to buy or sell, set a limit price if desired, and hit “Submit”. Confirm the transaction on your hardware wallet.

- Watch the transaction confirm on the Stellar ledger (usually < 5 seconds) and see the trade reflected in your portfolio.

That’s it. Because there’s no account registration, you’re ready to trade the moment you have a wallet.

Potential Pitfalls and How to Avoid Them

- Missing backup phrase: If you lose the seed for a non‑hardware wallet, you lose access forever. Always store the mnemonic offline.

- Desktop client lag: Manual updates mean you might run an older version with known bugs. Check the GitHub releases page monthly.

- Thin order books: For low‑volume assets, your limit order may sit unfilled for hours. Consider using larger, higher‑volume pairs for quicker execution.

- Phishing sites: Always double‑check the URL (stellarterm.com) and verify the SSL certificate before entering any wallet connection.

Final Verdict

If you value decentralization, low fees, and full control over your keys, StellarTerm review shows a trustworthy, community‑driven client that delivers exactly that. It isn’t a one‑stop shop for every trading need, but it excels at what it promises: a clean, open‑source gateway to the Stellar DEX.

Frequently Asked Questions

Is StellarTerm a custodial exchange?

No. StellarTerm never stores your private keys. All signing happens locally in your chosen wallet, so you retain full custody of your assets.

What fees will I pay when trading on StellarTerm?

Only the native Stellar network fee, usually 0.00001 XLM per operation. StellarTerm itself does not add any markup.

Can I use StellarTerm on a mobile device?

Yes. The web app works in mobile browsers, and you can connect mobile wallets like LOBSTR or WalletConnect. For a native experience you might prefer the LOBSTR app, but it’s not required.

Does StellarTerm support custom assets issued on Stellar?

Absolutely. Any asset that follows the Stellar asset standard (code + issuer) appears in the asset selector once you add its trust line.

How often should I update the desktop client?

Check the GitHub releases page at least once a month. Critical security patches are announced there, and the installer is a simple double‑click download.

Darren Belisle

StellarTerm looks promising, especially for anyone who loves open‑source projects, you’ve got a solid UI, and the zero‑custody model is a big win!!!

Brian Lisk

Reading through the review, I’m impressed by how StellarTerm manages to keep the user experience simple while still exposing the full power of the Stellar DEX; the fact that all signing happens locally is a crucial security feature that cannot be overstated. The open‑source nature means that anyone can audit the code, which builds trust across the community. Because the web client auto‑updates, users are always protected by the latest patches without any manual intervention. The desktop client, while requiring manual updates, gives power users the ability to run the software offline, a benefit for those who keep air‑gapped wallets. Support for hardware wallets such as Ledger and Trezor adds an extra layer of protection, preventing private keys from ever touching an internet‑connected device. The fee structure is also noteworthy: only the minimal network fee is charged, which keeps trading costs near zero. In terms of liquidity, the DEX performs well for popular pairs like XLM/USD, but you’ll notice thinner order books for niche assets, something to keep in mind when planning larger trades. The UI is clean, with a two‑pane layout that separates balances from the order book, making navigation intuitive for both beginners and seasoned traders. The lack of advanced order types might be a downside for professional traders, yet for most retail users the simplicity is a strength rather than a weakness. One should also be aware of the manual update requirement for the desktop version; forgetting to update could expose you to known bugs. The integration of WalletConnect broadens compatibility, letting you pair with any QR‑code‑compatible wallet, which is a nice touch. Overall, StellarTerm strikes a balance between decentralization, user‑friendliness, and security, making it a compelling option for anyone looking to trade on Stellar without surrendering custody of their keys. The community‑driven development model ensures that the platform will continue evolving, addressing any gaps in functionality over time. If you value transparency, low fees, and open‑source software, this client should be at the top of your list.

Don Price

Sure, the UI looks slick, but remember that every "decentralized" app still relies on a handful of servers to serve the JavaScript bundle, and those servers could be compromised. The claim of “zero custody” is only as strong as the wallet you link, and many users still store their seed phrases on cloud‑synced devices, which is a huge attack surface. Also, the lack of advanced order types means you’re at the mercy of market volatility – no stop‑losses, no trailing stops. If you think the network fees are negligible, try moving large volumes; the cumulative cost can become noticeable when you factor in the hidden fees of the services you use to bridge fiat into XLM. Finally, the manual‑update desktop client is a security nightmare – outdated binaries are a perfect hunting ground for malicious actors. Stay vigilant.

Dawn van der Helm

Sounds good! 🚀

Monafo Janssen

If you already have XLM or other Stellar assets, StellarTerm gives you a straightforward way to trade them without giving up control of your keys.

Michael Phillips

The interface can feel a bit sparse at first, but once you get used to the two‑pane layout it’s pretty efficient.

Jason Duke

Look, the platform is open‑source, it supports hardware wallets, and it charges only network fees-what’s not to love???!!

Bryan Alexander

Honestly, using StellarTerm feels like stepping into the future; the moment you sign a transaction on your Ledger, you’re part of a decentralized revolution-no middle‑man, pure power.

Patrick Gullion

People always hype up the DEX, but if you’re chasing deep liquidity you’ll still end up on a big CEX, so keep your expectations realistic.

Jack Stiles

Totally get it-StellarTerm is chill for quick swaps, just remember the order books can be thin on rare tokens.

Ritu Srivastava

It’s irresponsible for any platform to let users trade without proper safeguards; the lack of stop‑loss orders is a glaring omission that puts retail investors at risk.

Liam Wells

Indeed, while the open‑source ethos is commendable, the absence of robust risk‑management tools-such as automated stop‑loss mechanisms-undermines the platform’s suitability for serious traders; this oversight must be rectified posthaste.

Caleb Shepherd

For anyone still on the fence, just remember that StellarTerm’s code is publicly auditable on GitHub, meaning you can verify exactly what’s running before you trust it with your assets.

Ken Pritchard

Exactly-transparency is key, and pairing that with a supportive community makes StellarTerm a solid entry point for new users while still offering depth for veterans.