Cryptocurrency Security: Protect Your Assets in Web3

When working with Cryptocurrency Security, the practice of defending digital assets from theft, fraud, and regulatory pitfalls. Also known as crypto safety, it spans multiple layers of protection. One key layer is Exchange Security, the measures exchanges use to shield user funds and data. Another vital piece is Wallet Security, how individuals store and secure private keys. Finally, Tax Compliance, the process of reporting crypto gains to tax authorities connects the technical side to legal obligations. Cryptocurrency security encompasses wallet protection, exchange safeguards, and regulatory compliance, creating a holistic defense system for your portfolio.

Core Topics Covered

Exchange security is more than just two‑factor authentication. Reputable platforms run regular smart‑contract audits, keep cold‑storage reserves, and employ bug‑bounty programs to catch vulnerabilities before they hit users. When an exchange fails on any of these fronts, the risk of a hack or loss skyrockets, as seen in several high‑profile breaches last year. By choosing exchanges that publish audit reports and insurance coverage, you add an extra safety net to your holdings.

Wallet security starts with understanding the difference between hot and cold wallets. Hot wallets stay online for quick trading but expose private keys to internet threats. Cold wallets—hardware devices or paper backups—keep keys offline, dramatically reducing exposure. Pairing a hardware wallet with a strong PIN and a backup seed phrase stored in a fire‑proof safe gives you a layered defense that most thieves can’t bypass.

Regulatory compliance and tax reporting turn security into a legal requirement. In many jurisdictions, failing to declare crypto gains can lead to hefty fines or criminal charges. The IRS, for example, now expects detailed Form 8949 filings for every transaction, while countries like Russia and India have introduced specific crypto tax brackets. Staying compliant means tracking each trade, converting fiat values at the time of the transaction, and keeping records for the required retention period.

Non‑KYC exchanges promise privacy, but that privacy often comes with hidden dangers. Without identity verification, these platforms can become havens for money‑laundering, fraud, and ransomware payouts. Users may also lose recourse if the service disappears or gets hacked. Weighing anonymity against security is a personal decision, but most experts recommend limiting large balances on non‑KYC sites and moving funds promptly to a secured wallet.

Effective security requires strong authentication and smart‑contract audits, creating a two‑pronged shield that protects both the user interface and the underlying code. Using hardware‑based keys, biometric login, and unique passwords for each service reduces the attack surface. Meanwhile, developers should integrate automated testing tools and third‑party audit firms to catch vulnerabilities before contracts go live.

Regulatory compliance influences how users manage tax reporting, shaping the way you record gains, losses, and cost‑basis calculations. Proper documentation not only avoids legal trouble but also helps you spot patterns in your trading behavior, enabling smarter risk management. Many portfolio trackers now export data in formats ready for tax software, making the reporting process less painful.

Below you’ll find a curated collection of articles that dive deeper into each of these areas. Whether you’re looking for a step‑by‑step wallet setup, an honest review of exchange security practices, guidance on filing crypto taxes in Russia or India, or a risk assessment of non‑KYC platforms, the posts below have you covered. Explore real‑world examples, practical checklists, and up‑to‑date regulations to sharpen your defense strategy and keep your crypto journey on the right side of the law.

Software Wallets: Convenience vs Security - What You Really Need to Know

Software wallets make crypto easy to use but come with serious security risks. Learn how to balance convenience and safety when storing digital assets - and why most experts recommend using both software and hardware wallets.

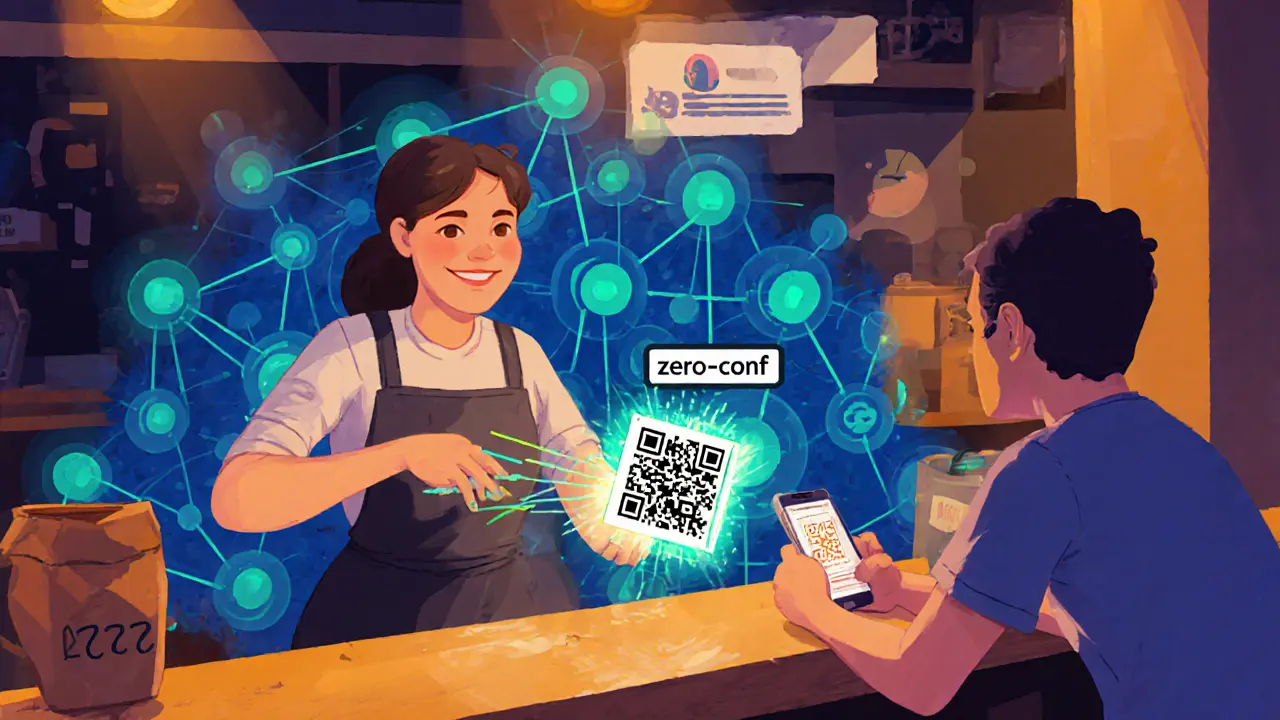

Zero-Confirmation Transaction Risks: What Merchants Need to Know

Learn the security pitfalls of zero-confirmation crypto payments, when they're safe, and how merchants can protect themselves from double-spending and other risks.