Yield Bearing Index: Your Guide to Passive Crypto Returns

When exploring Yield Bearing Index, a curated basket of crypto assets that generate income through various decentralized finance strategies. Also known as Yield Index, it lets investors capture returns without manually managing each protocol. The concept builds on DeFi, the ecosystem of financial services built on blockchain, draws power from Yield Farming, the practice of locking assets in smart contracts for rewards, and often relies on Staking, the act of delegating tokens to secure a network and earn fees. In simple terms, a Yield Bearing Index aggregates these income‑generating mechanisms into a single, tradable product, much like a traditional index fund bundles stocks. This approach lets you earn passive crypto returns while spreading risk across multiple protocols.

How the Index Connects to Core Crypto Strategies

The Yield Bearing Index works because it combines three key attributes: diversification, automation, and transparency. Diversification comes from including assets from different Index Funds, investment vehicles that track a basket of securities and DeFi projects, which reduces exposure to any single protocol’s failure. Automation is achieved through smart contracts that rebalance the basket, harvest rewards, and reinvest them without user intervention. Transparency is baked in because every transaction is recorded on-chain, letting you verify performance at any time. These three pillars create a semantic triple: “Yield Bearing Index requires automation, enables diversification, and provides transparency.” As a result, the index acts as a bridge between traditional finance concepts and the fast‑moving crypto world.

Below you’ll find a curated collection of articles that dive deeper into each piece of the puzzle. We cover real‑world airdrop opportunities that can boost the underlying yields, detailed reviews of exchanges where you can buy or trade index tokens, and regulatory insights that affect how these products operate globally. Whether you’re new to DeFi or looking to fine‑tune an existing strategy, the posts ahead give practical steps, risk warnings, and up‑to‑date data to help you decide if a Yield Bearing Index fits your portfolio. Ready to explore the specifics? Let’s see what the articles reveal about building a steady, crypto‑based income stream.

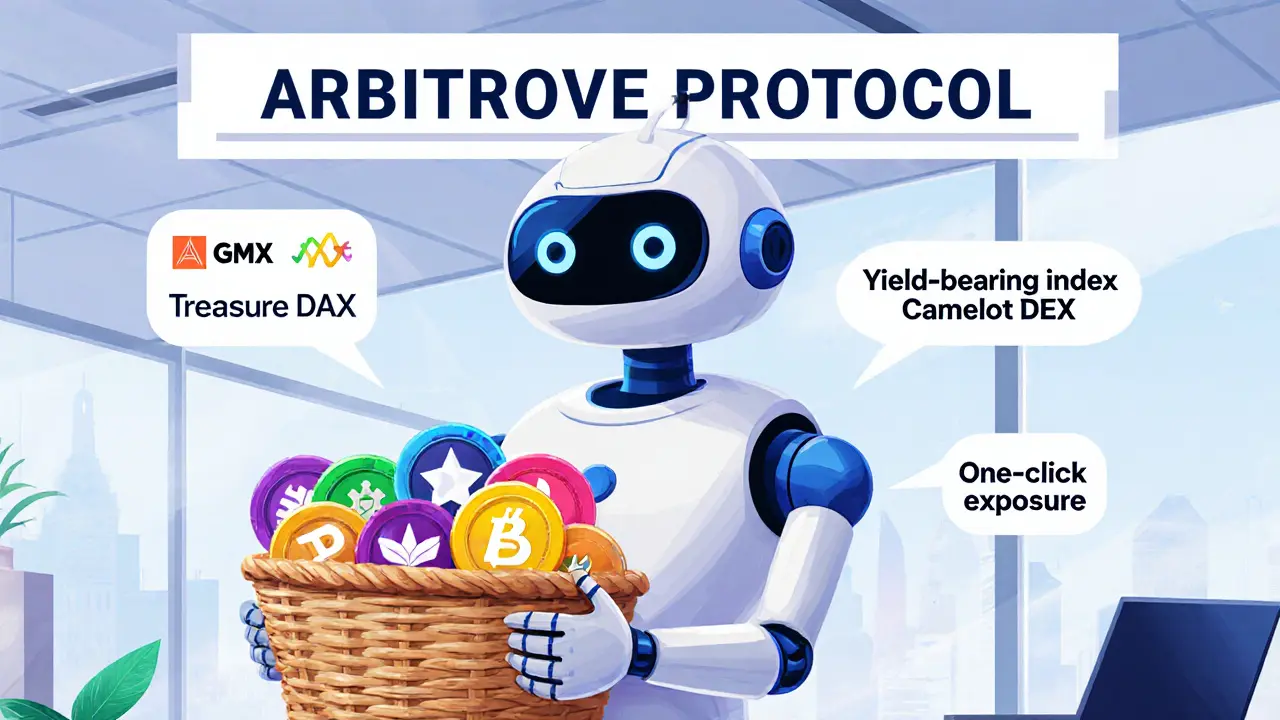

Arbitrove Protocol (TROVE) Explained: What It Is and How It Works

Discover what Arbitrove Protocol and its TROVE token are, how they function on Arbitrum, tokenomics, market performance, and key risks for investors.