What Is Raydium (RAY) Crypto Coin? A Simple Guide

Raydium (RAY) Token Value Calculator

Your RAY Token Investment Analysis

Current Value: $0.00

Projected Value (1 Year): $0.00

Potential Gain: $0.00

ROI Percentage: 0%

RAY Token Info

Current Price: $1.82

Market Cap: $529M

Circulating Supply: ~290.8M

Key Features

- Decentralized Exchange

- Order-book Integration

- Yield Farming

- Governance Rights

Important Risks

- Impermanent Loss

- Network Congestion

- Smart Contract Bugs

- Regulatory Uncertainty

If you’ve been browsing Solana’s DeFi scene, you’ve probably seen the name Raydium (RAY) pop up over and over. But what exactly is it, and why should you care? In plain English, Raydium is a decentralized exchange (DEX) that blends the speed of Solana with the depth of an order‑book system, all powered by its native RAY token. Below we break down the core ideas, how you can start using it, and the risks you should keep in mind.

What Is Raydium?

Raydium is a decentralized exchange and automated market maker built on the Solana blockchain. Launched in February 2021, it was created by a pseudonymous team that includes AlphaRay, XRay, GammaRay, StingRay, and RayZor. Raydium’s main claim to fame is its hybrid model: it runs typical AMM pools while also tapping into the order‑book liquidity of the Serum/OpenBook platform.

This design lets traders enjoy lightning‑fast swaps and low fees, yet still benefit from the deeper market depth that a traditional order book provides.

How Raydium Works: AMM Meets Order Book

Most DEXs fall into two camps. Pure AMMs like Uniswap determine prices algorithmically based on the ratio of tokens in a pool. Pure order‑book exchanges like traditional stock markets match buyers and sellers at specific price points. Raydium marries the two.

- Liquidity Pools: Users deposit token pairs into a pool. The pool’s price adjusts automatically as trades happen.

- Order‑Book Integration: Raydium forwards its pool liquidity to the OpenBook order book, allowing other traders to fill orders against Raydium’s deep reserves.

- Speed & Cost: Because everything runs on Solana, individual swaps settle in under a second and cost fractions of a cent-orders of magnitude cheaper than Ethereum‑based DEXs.

The result is a platform that can offer tighter spreads and better slippage than most single‑model AMMs.

Key Features That Set Raydium Apart

Raydium isn’t just another DEX; it brings a toolbox that appeals to both traders and developers.

- Permissionless Pool Creation: Anyone can spin up a new liquidity pool with just a few clicks, whether it’s a constant product pool (CPMM) or a concentrated liquidity pool (CLMM).

- Accelerator Program: New projects can launch tokens directly on Raydium, instantly tapping into its existing user base for liquidity.

- Yield Farming & Staking: Liquidity providers can stake LP tokens in dedicated farms to earn extra RAY rewards, while token holders can stake RAY itself for additional yields.

- Governance: RAY holders vote on protocol upgrades, fee structures, and new feature rollouts.

RAY Token Basics

RAY is the native utility token of the Raydium ecosystem. It serves three main purposes:

- Governance: Token‑based voting on protocol changes.

- Rewards: Distributed to liquidity providers, stakers, and participants in the Accelerator program.

- Fee Discounts: Holding RAY can reduce swap fees on the platform.

Supply stats (as of October2025):

- Maximum supply: 555million RAY

- Circulating supply: ~290.8million RAY

- Current price: $1.82

- Market cap: $529million

- All‑time high: $16.93 (Sept2021)

Tokenomics include a gradual unlocking schedule that slows over time, limiting inflation, and a possible future burning mechanism that could increase scarcity.

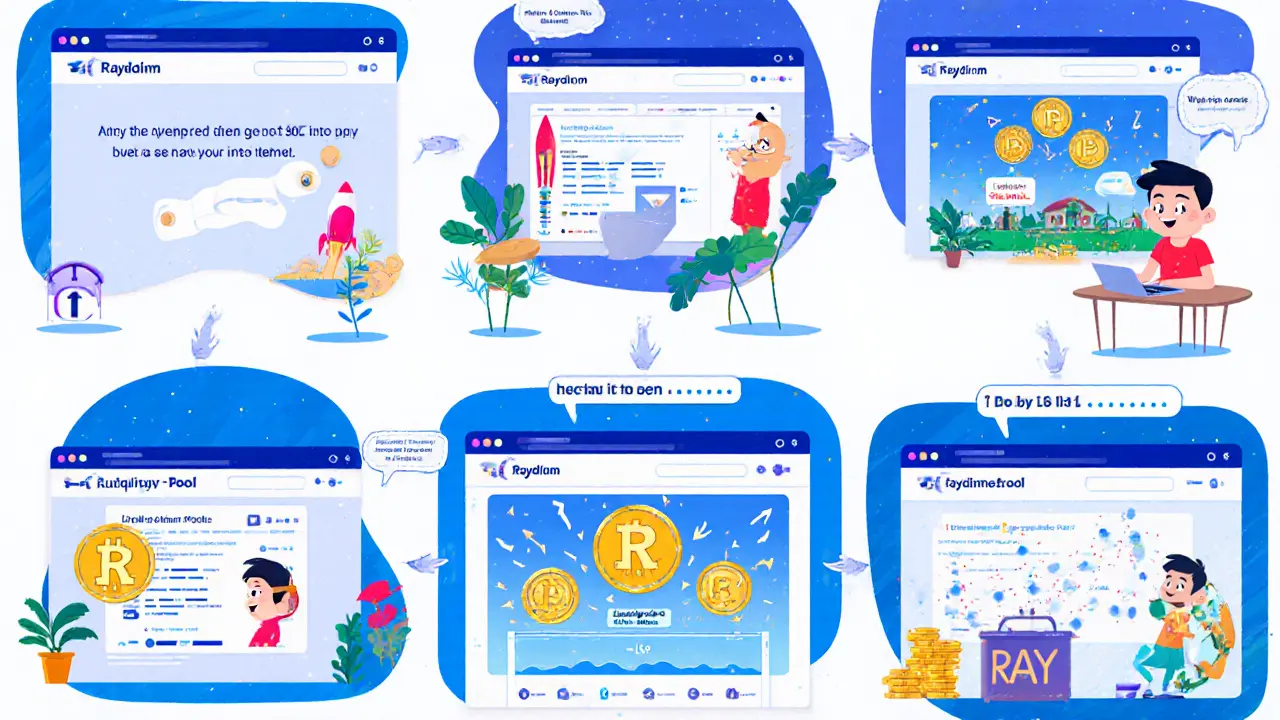

Getting Started: A Step‑by‑Step Walkthrough

Before you jump in, you’ll need a Solana‑compatible wallet. The most popular choice is Phantom, though Solflare works equally well.

- Install a Wallet: Download Phantom from the Chrome Web Store or the official website. Create a new wallet and back up the seed phrase.

- Fund with SOL: Purchase SOL on a centralized exchange (e.g., Binance) and transfer it to your Phantom address. SOL pays for transaction fees on Raydium.

- Connect to Raydium: Visit raydium.io and click “Connect Wallet”. Approve the connection in Phantom.

- Swap Tokens: Choose the token pair you want to trade, enter the amount, and confirm. The swap will settle in under a second.

- Provide Liquidity (Optional): Navigate to the “Liquidity” tab, select a pool, deposit your tokens, and receive LP tokens in return.

- Farm RAY Rewards: Head to the “Farms” section, stake your LP tokens, and start earning RAY on top of pool fees.

The entire process can be mastered within a few days, though fully optimizing yields may take a couple of weeks of experimentation.

Earning on Raydium: Liquidity Provision, Yield Farming, and Staking

Raydium’s biggest draw for passive investors is the ability to earn RAY rewards while providing liquidity. Here’s how the three main avenues work:

- Liquidity Provision: You deposit a balanced pair (e.g., SOL/USDC) into a pool. Traders pay a 0.25% swap fee, a portion of which goes to you.

- Yield Farming: After receiving LP tokens, you can lock them in a farm. Farms typically offer 15‑40% APR in RAY, depending on pool popularity.

- Staking RAY: Even if you don’t provide liquidity, you can stake raw RAY in the platform’s staking contract and collect a modest 6‑12% annual yield.

Keep in mind the concept of impermanent loss-if the price ratio of your pooled assets diverges dramatically, your dollar‑value return may be lower than simply holding the assets.

Risks, Challenges, and How to Mitigate Them

No DeFi protocol is risk‑free. With Raydium, the main concerns are:

- Solana Network Congestion: When Solana experiences high traffic, transaction confirmation times can spike, though fees remain low.

- Impermanent Loss: Providing liquidity to volatile pairs can erode value. Use stable‑coin pairs (e.g., USDC/USDT) if you want to minimize this.

- Smart‑Contract Bugs: While Raydium’s code has been audited, any bug could lead to loss of funds. Stick to well‑audited pools and avoid brand‑new, untested farms.

- Regulatory Uncertainty: DEXs operate in a gray area in many jurisdictions. Keep records of your transactions and stay informed about local crypto regulations.

Mitigation strategies include diversifying across multiple pools, using a hardware wallet for large amounts, and tracking network health via Solana’s explorer.

Raydium vs. Other DEXs: A Quick Comparison

| Feature | Raydium (Solana) | Uniswap (Ethereum) | Orca (Solana) |

|---|---|---|---|

| Transaction Speed | ~0.5seconds | ~12‑15seconds | ~0.6seconds |

| Average Fee (per swap) | $0.001 (≈0.0001SOL) | $2‑$5 (gas) | $0.0015 |

| Order‑Book Integration | Yes (via OpenBook) | No | No |

| Yield Farming APR | 15‑40% RAY | 5‑25% (varies by pool) | 10‑30% (ORCA) |

| Native Token Utility | Governance, rewards, fee discounts | Governance, liquidity incentives | Governance, staking rewards |

Raydium’s hybrid model gives it an edge on price depth, while its Solana base ensures cheap, fast trades. If you value low fees above everything, Raydium is a clear winner; if you’re tied to Ethereum’s ecosystem, Uniswap remains the go‑to.

Future Outlook and Roadmap Highlights

The Raydium team continues to iterate. Recent updates (mid‑2025) include:

- Improved UI for concentrated liquidity management.

- Expansion of the Accelerator program to support cross‑chain token launches.

- Beta support for a multi‑chain bridge that will let users bring assets from other L1s onto Raydium.

Analysts generally see Raydium’s growth tied to Solana’s overall adoption. As more DeFi projects choose Solana for its performance, Raydium’s liquidity pool will likely capture a larger slice of TVL (Total Value Locked). The main downside remains Solana’s occasional network outages, which could push users toward multi‑chain DEXs if the issue persists.

Quick Checklist Before You Jump In

- Install a Solana‑compatible wallet (Phantom or Solflare).

- Have a small amount of SOL for fees.

- Understand impermanent loss and choose pools accordingly.

- Start with a test amount, then scale up once you’re comfortable.

- Keep an eye on Solana network health via Solana Explorer.

Frequently Asked Questions

What is the main advantage of Raydium’s order‑book integration?

By connecting to the OpenBook order book, Raydium can pull in external liquidity, giving traders tighter spreads and less slippage than a pure AMM would provide.

Do I need a lot of capital to start farming RAY?

No. Many farms accept as little as $10‑$20 worth of LP tokens. However, larger stakes usually earn higher absolute rewards.

Can I use Raydium on a mobile device?

Yes. Both the Phantom wallet and Raydium’s web interface are mobile‑friendly, and there’s also a dedicated iOS/Android app in beta.

Is RAY considered a security?

Regulators have not classified RAY as a security in major jurisdictions, but the legal landscape is evolving. Stay updated on local crypto laws.

What’s the biggest risk when providing liquidity on Raydium?

Impermanent loss-if the price of the two tokens in your pool diverges sharply, the value of your share can fall below simply holding the tokens.

Raydium sits at the intersection of speed, cost efficiency, and deep liquidity. Whether you’re a trader looking for quick swaps, a yield farmer hunting RAY rewards, or a project seeking a launchpad, the platform offers a solid set of tools. Just remember to start small, understand the mechanics, and keep an eye on Solana’s network health. Happy swapping!

angela sastre

Just started using Raydium last week and honestly? It’s been a game-changer. Swaps are instant, fees are next to nothing, and the farms are actually paying out. I put in $50 in SOL/USDC and made back more than that in RAY rewards in two weeks. No drama, no stress. Perfect for beginners.

Rohit Sreenath

This whole thing is just a fancy ponzi scheme wrapped in Solana hype. Everyone chasing yields while ignoring the fact that 90% of these tokens will go to zero. You think you're smart farming RAY? You're just feeding the machine until the rug gets pulled.

Anastasia Alamanou

Hey Rohit, I get where you're coming from-but let’s not throw the baby out with the bathwater. Raydium’s architecture is legitimately innovative. The order-book + AMM hybrid isn’t just marketing fluff; it’s solving real liquidity fragmentation issues. Yes, there’s risk, but so is holding cash under your mattress. Knowledge is the real hedge here.

Sam Kessler

Oh wow, another sheep following the Solana cult. Did you know Solana’s core devs have ties to former Binance insiders? And that the entire ‘low fee’ narrative is just a distraction while they quietly centralize validator control? RAY isn’t a token-it’s a surveillance tool disguised as DeFi. You think you’re decentralized? You’re just a data point in a corporate blockchain experiment.

Steve Roberts

Wow. Just… wow. You people actually think this is innovation? A DEX that’s just a wrapper around another DEX? That’s not progress-that’s a Rube Goldberg machine built by people who can’t code a proper AMM. And don’t even get me started on ‘accelerator programs’-it’s just a free ad for exit scams.

Brody Dixon

Hey, I was nervous jumping into this too. But I started with $20 in USDC/SOL, kept it simple, and didn’t chase the highest APR farms. Took me a week to understand impermanent loss, but now I’m comfortable. You don’t need to be a genius-just patient and curious. And always, always test small first.

Mike Kimberly

It’s fascinating how the cultural adoption of decentralized finance mirrors the early internet’s transition from academic curiosity to mainstream utility. Raydium, in this context, represents a critical node in the evolution of financial sovereignty-where individuals, not institutions, control liquidity provision, pricing mechanisms, and governance outcomes. The hybrid AMM-orderbook model is not merely technical; it’s sociotechnical. It redefines trust architecture by embedding economic incentives directly into protocol design, thereby minimizing reliance on centralized intermediaries. This is not just a DEX-it’s a new social contract for value exchange.

Patrick Rocillo

Just did my first LP on Raydium and I’m lowkey obsessed 🤯 Like… I deposited $30 in SOL/USDC and now I’m getting RAY just for existing? It’s like getting paid to sleep. Also, the UI is so clean, even my grandma could use it (and she thinks ‘crypto’ is a type of coffee). 10/10 would rug-pull again… jk, but seriously, this is the future.

Aniket Sable

raydium is good but solana go brrr too fast sometimes. i lost 2 dollars in fees once because i clicked too fast lol. but still worth it. ray rewards are real. i made back my first 10 dollar deposit in 3 days. no cap.

Santosh harnaval

Been using Raydium since 2022. Solana’s outages are annoying but the rewards keep me coming back. Simple, fast, no fluff.

John Dixon

Oh, so now we’re celebrating a platform that lets you ‘farm’ your way to becoming a financial serf? You deposit your assets, earn ‘rewards’ that vanish when the next meme coin launches, and call it ‘decentralized finance’? Meanwhile, the team’s wallet holds 12% of RAY supply… and you’re high-fiving each other? I’m not impressed-I’m embarrassed for you.