Arbitrum DeFi: Scaling Decentralized Finance on Ethereum’s Fastest Layer‑2

When you hear Arbitrum DeFi, decentralized finance applications built on the Arbitrum Layer‑2 scaling solution for Ethereum. Also known as Arbitrum L2 DeFi, it’s basically the shortcut that lets you swap, lend, or earn without paying the usual Ethereum gas. Think of it as the express lane at a grocery store – the same goods, but you spend far less time and money. Arbitrum DeFi brings that speed to everything from stablecoin farms to NFT marketplaces, and the ecosystem keeps expanding as developers add new tools.

To get why this matters, you need to understand three core pieces. First, Arbitrum, an optimistic rollup that batches Ethereum transactions off‑chain and posts a single proof to the mainnet handles the heavy lifting. By compressing data, it slashes fees by up to 95 % and pushes confirmation times to a few seconds. Second, DeFi, a set of open‑source financial protocols that let anyone lend, borrow, trade, or earn interest without a middleman provides the use‑case layer – you’re not just moving tokens, you’re interacting with algorithms that replace banks. Finally, the rollup, the technology that bundles many transactions into one proof and posts it to Ethereum glue keeps everything secure and trustless; it’s the bridge that guarantees whatever happens on Arbitrum can be verified on Ethereum if needed. The three together create a feedback loop: rollup tech makes DeFi cheap, cheap DeFi attracts users, and more users fund further rollup improvements.

What to watch in Arbitrum DeFi today

Now that the basics are clear, let’s look at what’s actually happening on the ground. Decentralized exchanges like Uniswap V3 and SushiSwap have already deployed on Arbitrum, offering lower slippage for traders who move large volumes. Lending platforms such as Aave and Compound mirror their Ethereum counterparts but charge a fraction of the gas, which opens doors for smaller investors to earn yields they’d otherwise avoid. Token bridges, for example the Arbitrum Bridge, let you move assets from Ethereum to Arbitrum in minutes, and new cross‑chain bridges are emerging to connect other ecosystems like Binance Smart Chain or Solana. Because all of these projects rely on smart contracts, the security model stays the same – audit your contracts, watch for update proposals, and keep an eye on the governance forums where protocol changes are debated. If you’re new to the space, start by experimenting with a modest amount on a trusted DEX, then explore yield farms that lock tokens for a set period. For seasoned players, the real edge comes from spotting emerging projects that launch directly on Arbitrum, where early adopters often reap the biggest rewards. Keep tabs on community channels, follow the Arbitrum Discord, and monitor the weekly “Arbitrum Week” announcements for a snapshot of upcoming airdrops, token launches, and governance votes. All of this means the articles you’ll find below are more than just isolated guides – they’re a curated mix of airdrop breakdowns, exchange reviews, and token deep‑dives that all live under the Arbitrum DeFi umbrella. Whether you’re hunting for the next high‑yield farm or trying to avoid a risky airdrop, the collection gives you practical insights to navigate the fast‑moving layer‑2 DeFi world.

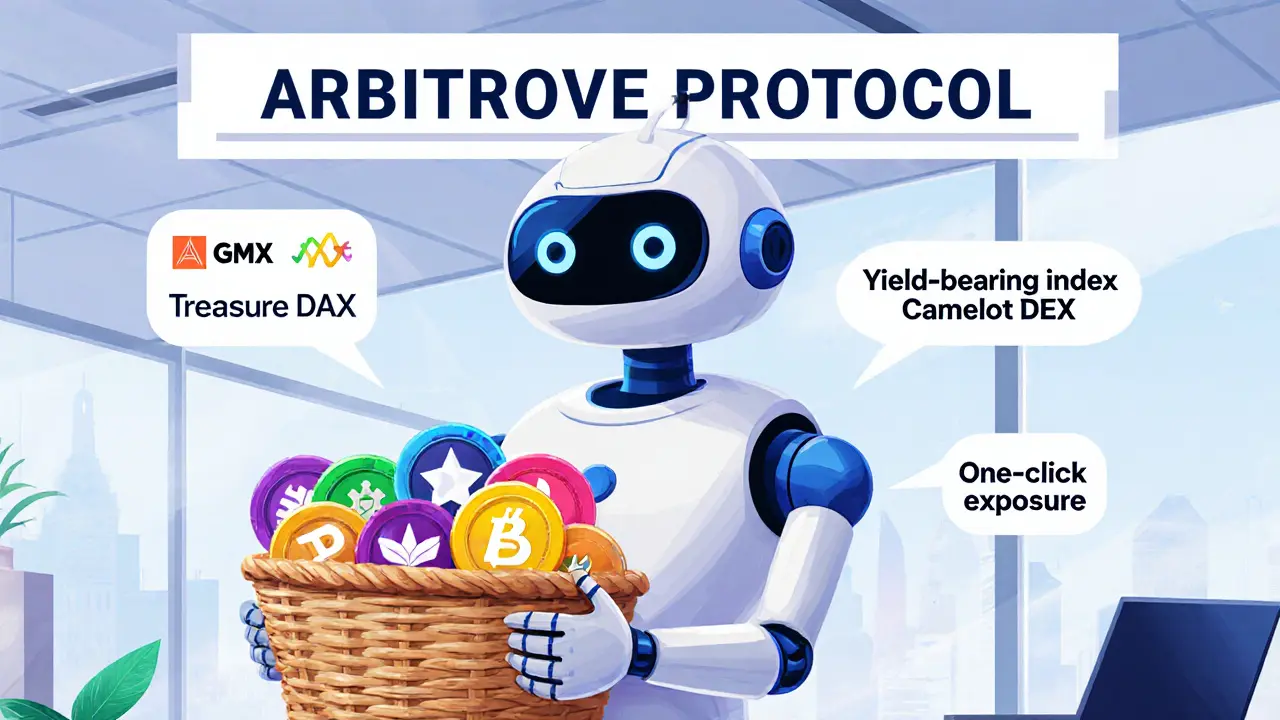

Arbitrove Protocol (TROVE) Explained: What It Is and How It Works

Discover what Arbitrove Protocol and its TROVE token are, how they function on Arbitrum, tokenomics, market performance, and key risks for investors.