Crypto Tax Nigeria: What You Need to Know

When working with Crypto Tax Nigeria, the set of tax rules that apply to cryptocurrency transactions for individuals and businesses in Nigeria. Also known as Nigeria crypto tax, it determines how gains, income and payments in digital assets are treated by the tax authorities. The Federal Inland Revenue Service (FIRS), Nigeria’s tax authority responsible for collecting revenue and enforcing compliance oversees filing and payment, while Capital Gains Tax, a tax on the profit from selling or disposing of an asset forms the core of the crypto liability for most traders. Understanding the link between crypto tax Nigeria and the broader Cryptocurrency, digital assets that use blockchain technology for secure transactions is essential before you start trading or investing.

Key Elements of Crypto Tax in Nigeria

First, every crypto profit is treated as a taxable event unless it falls under a specific exemption, such as small‑scale peer‑to‑peer swaps that stay below the Naira threshold set by FIRS. The tax rate aligns with the standard capital gains rate of 10 % for individuals and 30 % for corporations, but the exact figure can shift if new regulations emerge. Second, the reporting requirement obliges you to disclose crypto transactions on your annual tax return using a detailed schedule that lists purchase dates, amounts, fair market values at the time of disposal, and any related fees. FIRS has begun issuing guidance notes that outline how to convert crypto values into Naira using the average market price from the day of each transaction. Third, compliance isn’t just about paying the right amount – it also involves keeping proper records for at least five years, as auditors may request transaction logs, wallet addresses and exchange statements during a tax audit.

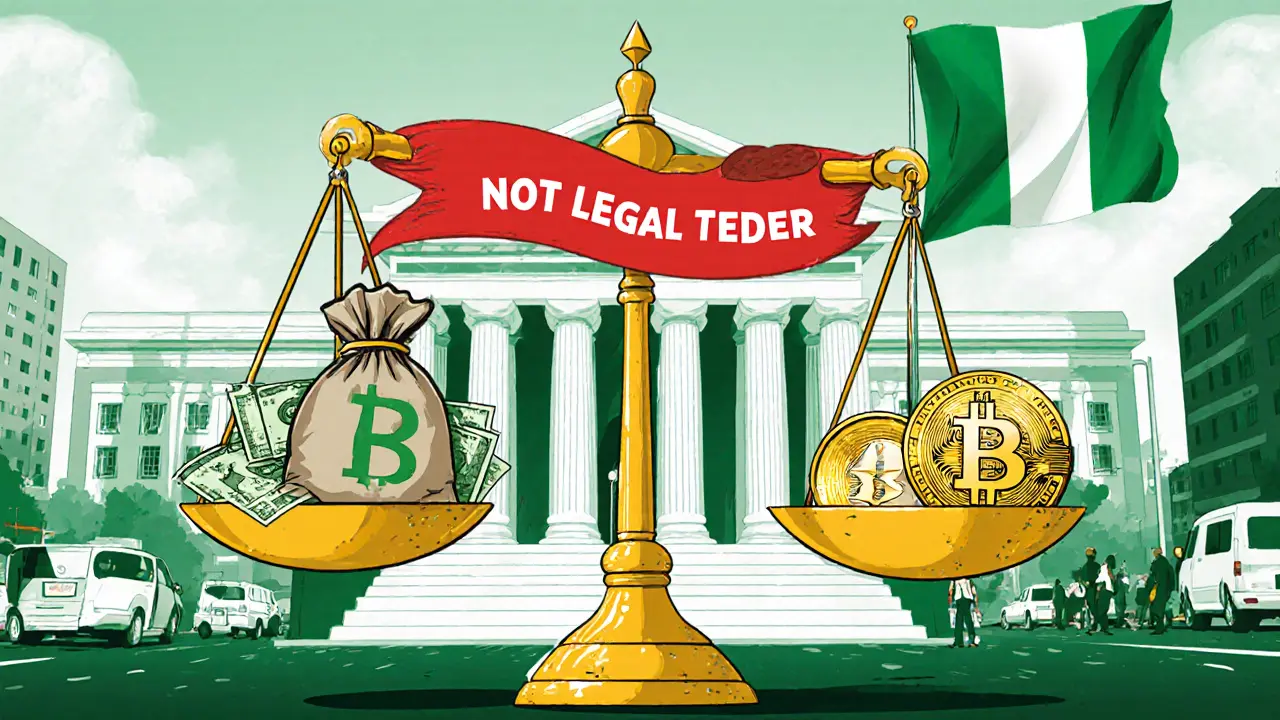

Finally, the regulatory landscape is evolving. The Central Bank of Nigeria (CBN) banned direct crypto payments in 2021, but the ban does not override tax obligations; it merely pushes trading onto compliant exchanges that still report to FIRS. New proposals suggest a dedicated crypto tax framework that could introduce a lower flat rate for long‑term holdings and clearer guidance on staking rewards. While you wait for those changes, the safe approach is to treat every crypto receipt – whether from mining, staking, airdrops or sales – as taxable income, calculate the Naira value at receipt, and file accordingly. Below you’ll find a curated collection of articles that break down each of these points, from step‑by‑step filing instructions to the latest updates on Nigerian crypto regulation.

Crypto Payments in Nigeria: Legal Status, Regulations & How to Use Them Safely

Crypto payments are legal but not official tender in Nigeria. This guide explains the 2025 regulations, licensing steps, tax rules, and how to pay with crypto safely.