Nigeria Cryptocurrency Regulation: Rules, Licenses, and Compliance

When working with cryptocurrency regulation Nigeria, the collection of laws, licensing standards, and supervisory actions that govern digital assets in Nigeria. Also known as Nigerian crypto law, it determines what projects can launch, how investors protect themselves, and which activities the government permits.

One of the biggest forces behind cryptocurrency regulation Nigeria is the Central Bank of Nigeria, the nation’s primary monetary authority that issues the legal tender and oversees payment systems. The CBN’s policies directly shape licensing requirements for crypto businesses, dictate anti‑money‑laundering (AML) standards, and set the tone for stablecoin treatment. In practice, the bank’s circulars have pushed many local exchanges to register, adopt know‑your‑customer (KYC) checks, and report large transactions. This relationship creates a clear semantic triple: cryptocurrency regulation Nigeria is shaped by Central Bank of Nigeria.

Another key regulator is the Nigerian Securities and Exchange Commission, the agency responsible for overseeing securities markets and protecting investors. The SEC has started to view certain token sales as securities offerings, meaning token issuers must file prospectuses and meet disclosure standards. When the SEC classifies a token as a security, the same licensing rules that apply to traditional securities also apply to that crypto project. This forms a second semantic triple: cryptocurrency regulation Nigeria requires compliance with SEC guidelines for token offerings.

Crypto exchanges operating in Nigeria must navigate both CBN and SEC mandates. These platforms—from local startups to global players—need a formal operating license, robust AML/KYC processes, and transparent fee structures. They also have to monitor the Central Bank’s stance on stablecoins, as any shift can affect how they offer fiat‑crypto on‑ramps. The third semantic triple links the central entity to crypto exchanges: cryptocurrency regulation Nigeria imposes licensing and reporting duties on crypto exchanges.

Supporting Elements: Blockchain Tech and Emerging Trends

Blockchain technology itself is treated as an enabling infrastructure rather than a regulated product. However, the government’s approach to the tech influences how it regulates the surrounding ecosystem. For instance, when the CBN issued guidelines on digital payment tokens, it indirectly set standards for blockchain‑based payment solutions. This creates a fourth semantic triple: blockchain technology underpins cryptocurrency regulation Nigeria and drives policy adjustments.

Recent developments show the regulators focusing on decentralized finance (DeFi) and airdrop activities. DeFi protocols that allow lending, borrowing, or yield farming are now under scrutiny for potential AML risks, prompting the CBN to consider extending its AML framework to cover non‑custodial services. Meanwhile, airdrop campaigns must ensure they don’t violate securities laws, especially when they involve large distributions to Nigerian residents. These emerging areas illustrate how the regulatory landscape evolves, adding layers of compliance for innovators.

Overall, the mix of central bank oversight, securities regulation, exchange licensing, and blockchain adoption creates a dynamic environment for anyone interested in Nigeria’s crypto market. Below you’ll find a curated set of articles that break down each component, from the latest CBN circulars to practical guides on obtaining a crypto exchange license. Dive into the collection to see how each piece fits into the broader picture of cryptocurrency regulation Nigeria.

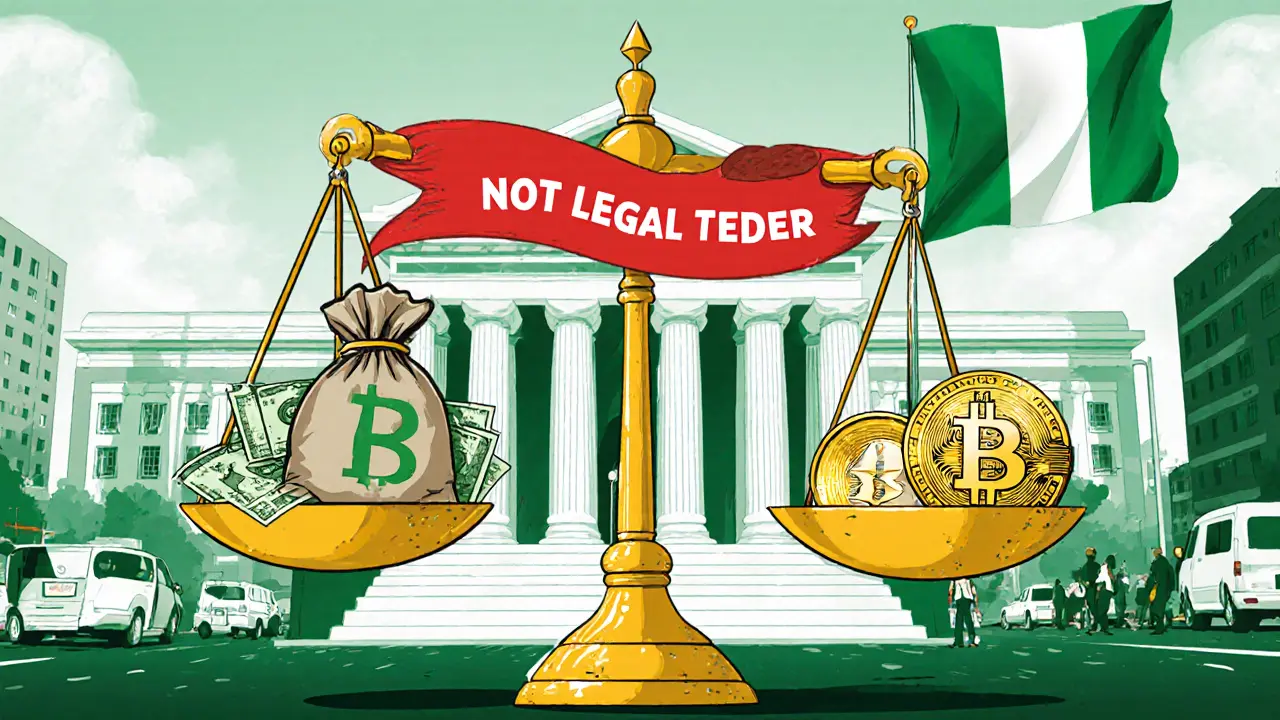

Crypto Payments in Nigeria: Legal Status, Regulations & How to Use Them Safely

Crypto payments are legal but not official tender in Nigeria. This guide explains the 2025 regulations, licensing steps, tax rules, and how to pay with crypto safely.