Instant Crypto Payments

When you hear instant crypto payments, the ability to move digital money across a blockchain in seconds with barely any cost. Also known as real‑time crypto transactions, it connects senders and receivers without waiting for traditional banking clears. This concept instant crypto payments relies on three core pieces: crypto payment speed, how many transactions a network can process per second, transaction fee, the small amount paid to miners or validators for confirming a transfer, and the payment processor, software that routes the crypto transaction and may add user‑friendly features. Together they make a payment feel instant, just like buying a coffee with a card.

Why Speed and Fees Matter

Instant crypto payments encompass fast blockchain transaction speeds. A network that can handle 1,000 TPS (transactions per second) will settle a purchase in under a second, while slower chains might need minutes. Speed matters because merchants and users expect the same immediacy they get from credit cards. At the same time, low transaction fees keep the experience cheap; if fees rise to a few dollars, the appeal of using crypto for everyday buys disappears. Payment processors step in to bundle transactions, reduce fees, and offer fiat on‑ramps, making the whole process smoother for people new to crypto. The relationship is clear: the faster the blockchain network and the cheaper the fee, the more likely users will adopt instant crypto payments for daily spending.

Another key link is that payment processors enable instant crypto payments by handling the technical details—address validation, fee estimation, and compliance checks. Without a processor, a user would need to manage private keys, monitor network congestion, and manually set fees, which defeats the “instant” promise. Processors also provide APIs that let merchants embed crypto checkout buttons, turn crypto into loyalty points, or automatically convert to stablecoins to avoid volatility. This ecosystem makes it practical for small retailers, gig workers, and even large enterprises to accept crypto without a tech team.

Finally, the choice of blockchain network shapes the whole experience. Networks like Solana, Avalanche, or Polygon prioritize high throughput and low fees, while Bitcoin offers security but slower confirmation times. When you pick a network, you’re deciding how instant your payment truly feels and how much you pay for that speed. Understanding these trade‑offs helps you pick the right tool for the job, whether you’re building a checkout widget or simply sending money to a friend across the globe. Below you’ll find a curated set of articles that break down these topics, compare speeds, explain fee structures, and show real‑world examples of instant crypto payments in action.

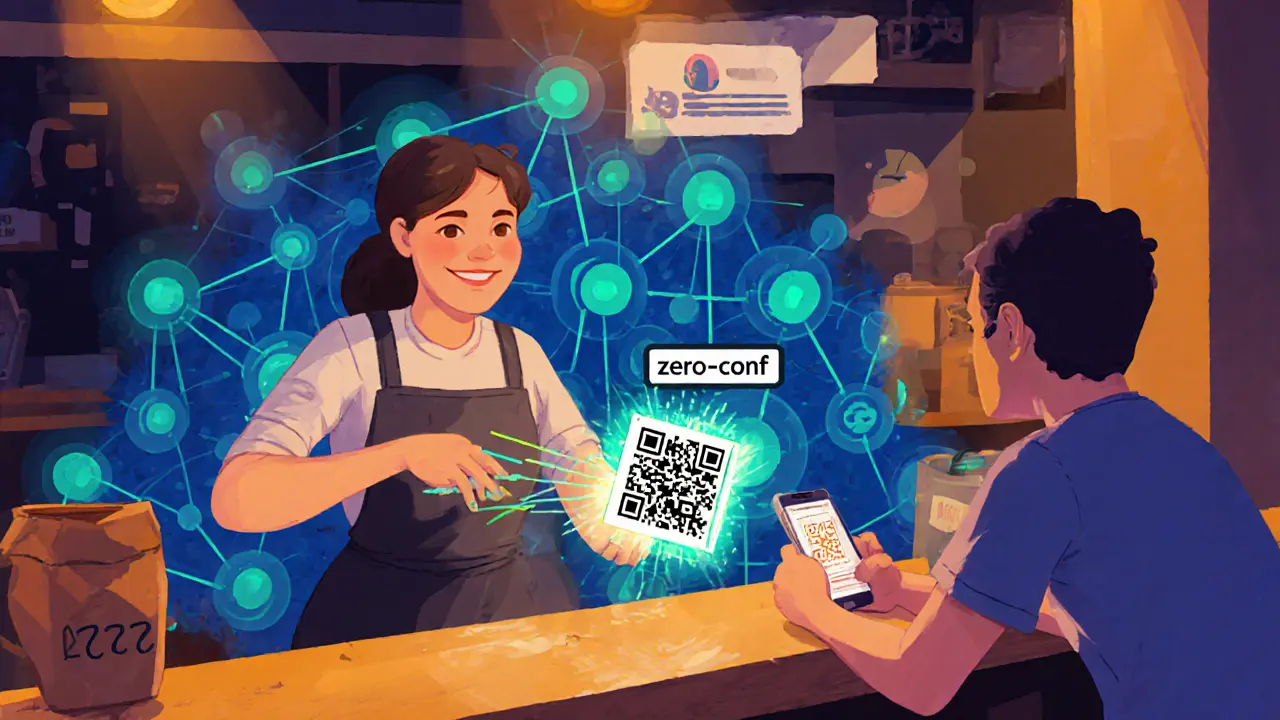

Zero-Confirmation Transaction Risks: What Merchants Need to Know

Learn the security pitfalls of zero-confirmation crypto payments, when they're safe, and how merchants can protect themselves from double-spending and other risks.