Btcwinex: What It Is and Why It’s Not in Our Crypto Guides

When you search for Btcwinex, a crypto exchange that claims to offer low fees and fast trades. Also known as BTCWINEX, it appears in some obscure forums and spammy ads—but never in trusted crypto resources like ours. That’s not an accident. We’ve reviewed over 50 exchanges in the last two years, and Btcwinex never made the cut because it lacks transparency, verifiable licensing, and real trading volume. Unlike platforms like Binance or KuCoin, Btcwinex doesn’t publish its company address, regulatory status, or audit reports. That’s not just risky—it’s a classic red flag.

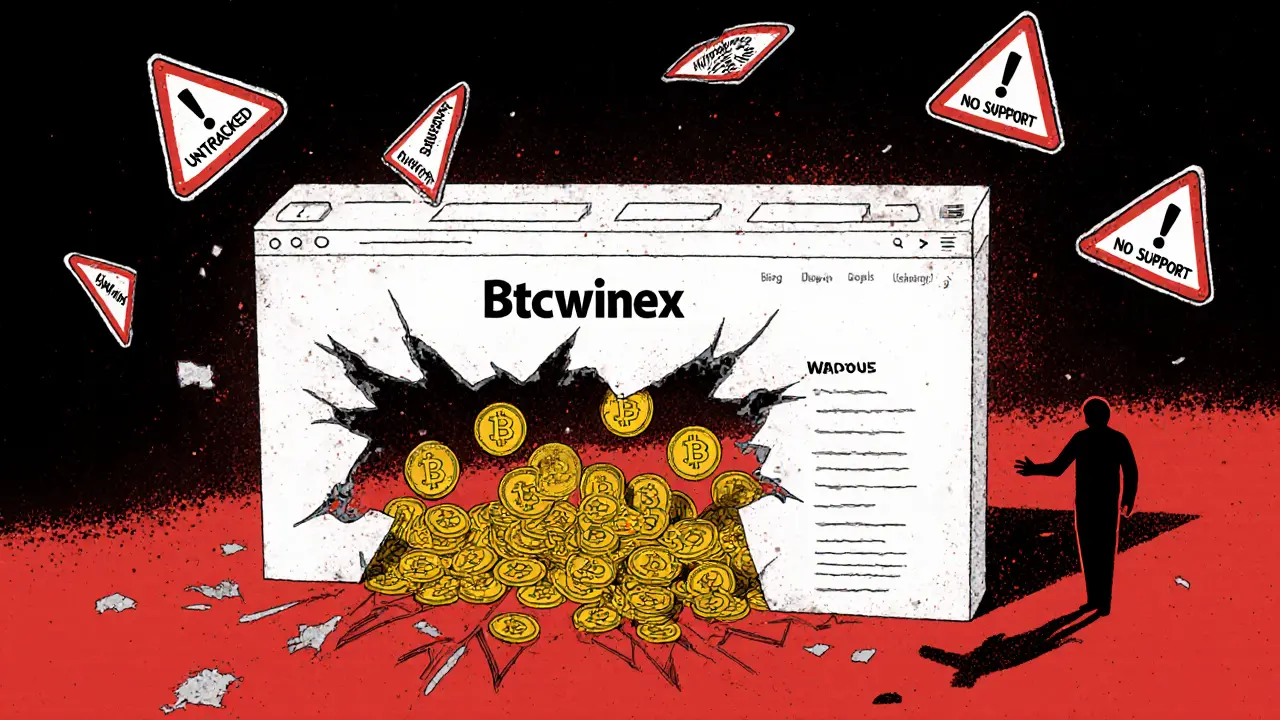

What makes Btcwinex dangerous isn’t just what it doesn’t do, but what it falsely claims. Some sites say it’s "EU-regulated," but no European financial authority lists it. Others promise zero fees, yet users report hidden withdrawal charges and locked accounts. It’s the same playbook used by JPEX, Qmall Exchange, and other platforms we’ve warned against. These platforms rely on hype, fake testimonials, and urgency tactics to pull in new users—then disappear when withdrawals spike. If you’ve seen a pop-up ad for Btcwinex offering free tokens or doubled returns, you’re being targeted by a scam funnel. Real crypto exchanges don’t chase you with ads—they earn trust through open records and community feedback.

There’s a reason our site doesn’t cover Btcwinex: we only report on platforms with verifiable activity. We’ve written deep dives on Jiamix, Qmall, and JPEX because they had enough user reports and data to analyze. Btcwinex has none. No real trading history. No public team. No blockchain activity tied to its token—if it even has one. It’s a ghost platform built to collect deposits, not provide services. The same goes for other obscure names you might stumble on: if it doesn’t show up in CoinGecko, CoinMarketCap, or official exchange lists, assume it’s not real. Protecting your crypto isn’t about chasing the next big thing—it’s about avoiding the next big loss.

Below, you’ll find real reviews of exchanges that actually work—platforms with tracked volume, clear security practices, and community accountability. You’ll also find guides on spotting fake airdrops, understanding exchange risks, and avoiding the traps that take down new investors. Skip the noise. Stick to what’s verified.

Btcwinex Crypto Exchange Review: A Defunct and Likely Scam Platform

Btcwinex is a defunct crypto exchange that vanished in 2022 after luring users with fake Bitcoin rewards. No trading, no support, no recovery - just a classic scam. Avoid it at all costs.